Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calendar year Corp. A purchases and places in service only two items of tangible personal property during 2020 - - a machine (7 yr.)

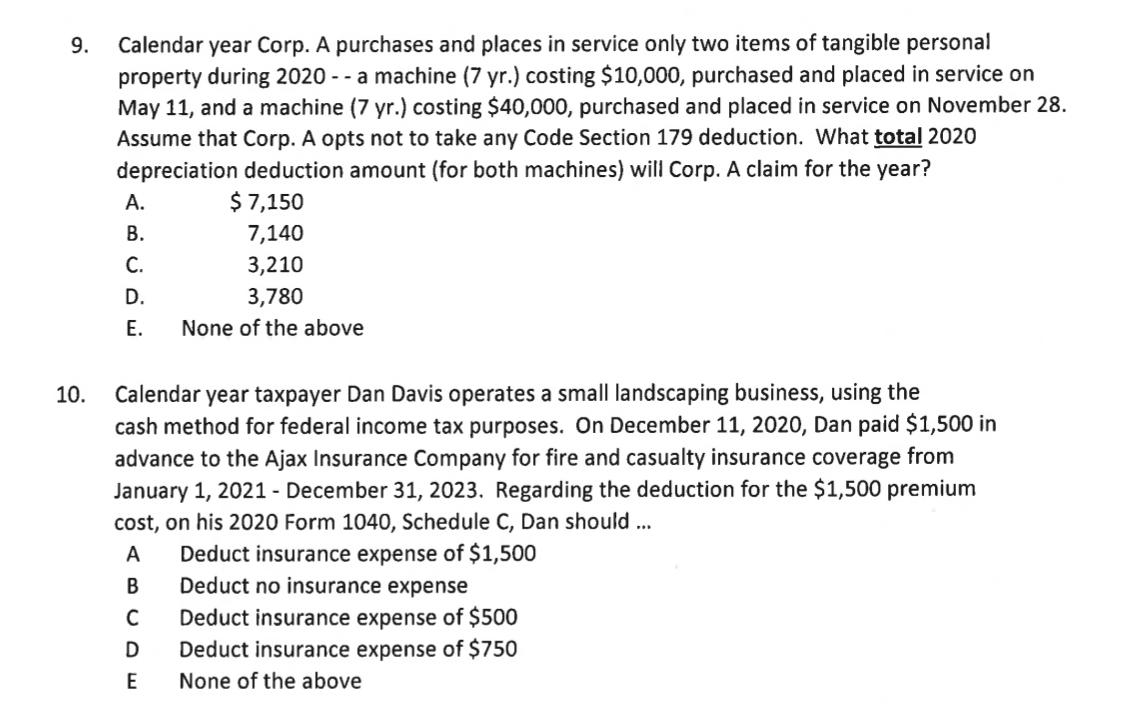

Calendar year Corp. A purchases and places in service only two items of tangible personal property during 2020 - - a machine (7 yr.) costing $10,000, purchased and placed in service on May 11, and a machine (7 yr.) costing $40,000, purchased and placed in service on November 28. Assume that Corp. A opts not to take any Code Section 179 deduction. What total 2020 depreciation deduction amount (for both machines) will Corp. A claim for the year? . 9. $ 7,150 . 7,140 C. 3,210 D. 3,780 E. None of the above Calendar year taxpayer Dan Davis operates a small landscaping business, using the cash method for federal income tax purposes. On December 11, 2020, Dan paid $1,500 in advance to the Ajax Insurance Company for fire and casualty insurance coverage from January 1, 2021 - December 31, 2023. Regarding the deduction for the $1,500 premium cost, on his 2020 Form 1040, Schedule C, Dan should... Deduct insurance expense of $1,500 10. A Deduct no insurance expense Deduct insurance expense of $500 Deduct insurance expense of $750 D E None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

9 Option B 7140 100007400007 14285714 7142 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started