Answered step by step

Verified Expert Solution

Question

1 Approved Answer

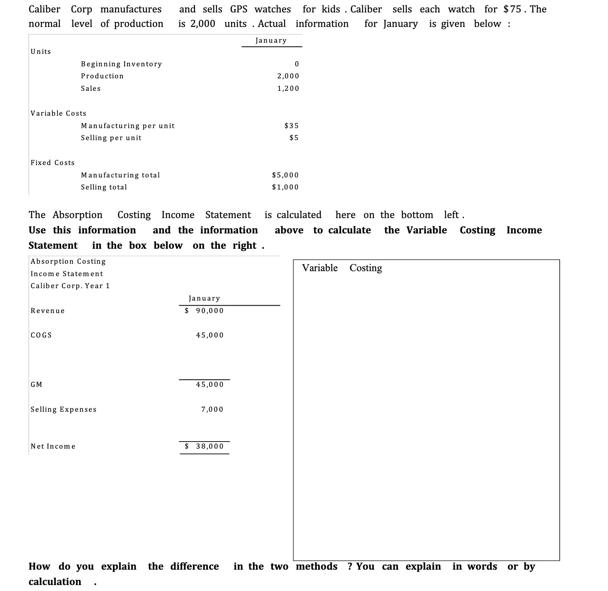

Caliber Corp manufactures normal level of production Units Variable Costs Fixed Costs Revenue Beginning Inventory Production Sales COGS Absorption Costing Income Statement Caliber Corp.

Caliber Corp manufactures normal level of production Units Variable Costs Fixed Costs Revenue Beginning Inventory Production Sales COGS Absorption Costing Income Statement Caliber Corp. Year I GM Manufacturing per unit Selling per unit Manufacturing total Selling total Net Income The Absorption Costing Income Statement is calculated here on the bottom left. Use this information and the information above to calculate the Variable Costing Income Statement in the box below on the right. Selling Expenses and sells GPS watches for kids. Caliber sells each watch for $75. The is 2,000 units. Actual information for January is given below : January January $ 90,000 45,000 45,000 7,000 0 2,000 1,200 $ 38,000 $35 $5 $5,000 $1,000 Variable Costing How do you explain the difference in the two methods ? You can explain in words or by calculation

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep explanation Contribution Income Statement To arrive at a contribution margin an income st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started