Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Caliper Ltd. has market values of debt, preference shares and common equity of $170 million, $90 million, and $ 425 million, respectively. The yield

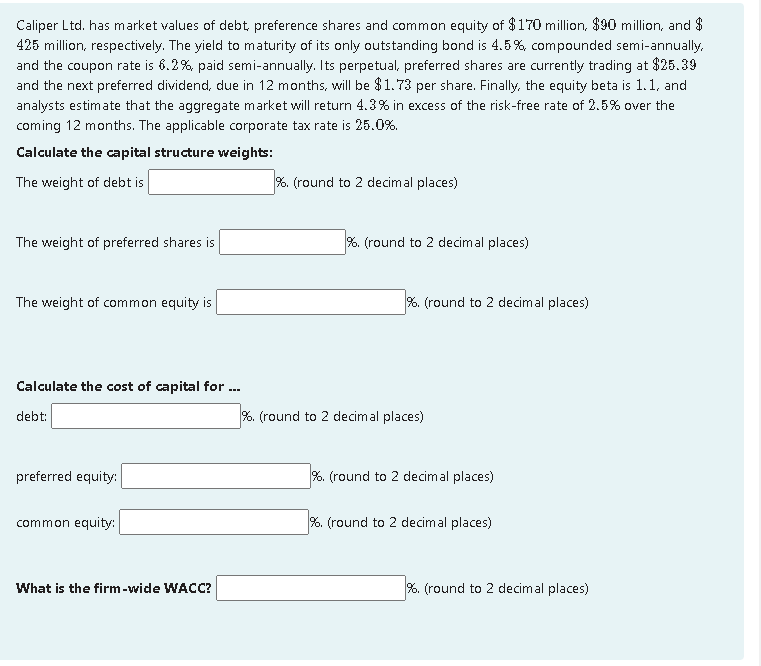

Caliper Ltd. has market values of debt, preference shares and common equity of $170 million, $90 million, and $ 425 million, respectively. The yield to maturity of its only outstanding bond is 4.5%, compounded semi-annually. and the coupon rate is 6.2% paid semi-annually. Its perpetual, preferred shares are currently trading at $25.39 and the next preferred dividend, due in 12 months, will be $1.73 per share. Finally, the equity beta is 1.1, and analysts estimate that the aggregate market will return 4.3% in excess of the risk-free rate of 2.5% over the coming 12 months. The applicable corporate tax rate is 25.0%. Calculate the capital structure weights: The weight of debt is The weight of preferred shares is The weight of common equity is Calculate the cost of capital for ... debt: preferred equity: common equity: What is the firm-wide WACC? %. (round to 2 decimal places) %. (round to 2 decimal places) %. (round to 2 decimal places) %. (round to 2 decimal places) %. (round to 2 decimal places) %. (round to 2 decimal places) %. (round to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Capital Structure Weights Weight of Debt Calculate the market value of all securitiesMarket Value 17...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started