Answered step by step

Verified Expert Solution

Question

1 Approved Answer

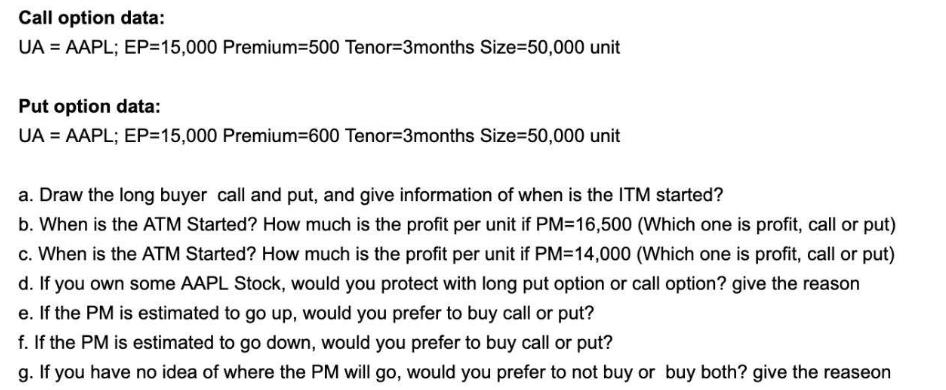

Call option data: UA = AAPL; EP=15,000 Premium-500 Tenor-3months Size=50,000 unit Put option data: UA = AAPL; EP=15,000 Premium-600 Tenor-3months Size=50,000 unit a. Draw

Call option data: UA = AAPL; EP=15,000 Premium-500 Tenor-3months Size=50,000 unit Put option data: UA = AAPL; EP=15,000 Premium-600 Tenor-3months Size=50,000 unit a. Draw the long buyer call and put, and give information of when is the ITM started? b. When is the ATM Started? How much is the profit per unit if PM=16,500 (Which one is profit, call or put) c. When is the ATM Started? How much is the profit per unit if PM=14,000 (Which one is profit, call or put) d. If you own some AAPL Stock, would you protect with long put option or call option? give the reason e. If the PM is estimated to go up, would you prefer to buy call or put? f. If the PM is estimated to go down, would you prefer to buy call or put? g. If you have no idea of where the PM will go, would you prefer to not buy or buy both? give the reaseon

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a A long call option is when the buyer of the option has the right but not the obligation to buy the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started