Question

Call options with an exercise price of $46 and one year to expiration are available. The market price of the underlying stock is currently

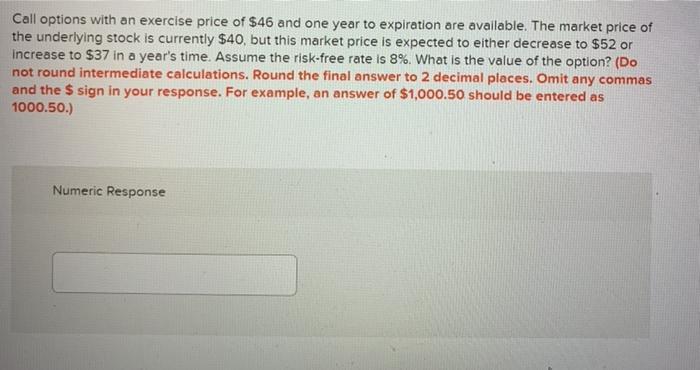

Call options with an exercise price of $46 and one year to expiration are available. The market price of the underlying stock is currently $40, but this market price is expected to either decrease to $52 or increase to $37 in a year's time. Assume the risk-free rate is 8%. What is the value of the option? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) Numeric Response

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Given the information we can use the Binomial Option Pricing Model to calculate the value of the cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

4th edition

77862201, 978-0077760298, 77760298, 978-0077862206

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App