Question

Calla Company produces skateboards that sell for $69 per unit. The company currently has the capacity to produce 100,000 skateboards per year, but is selling

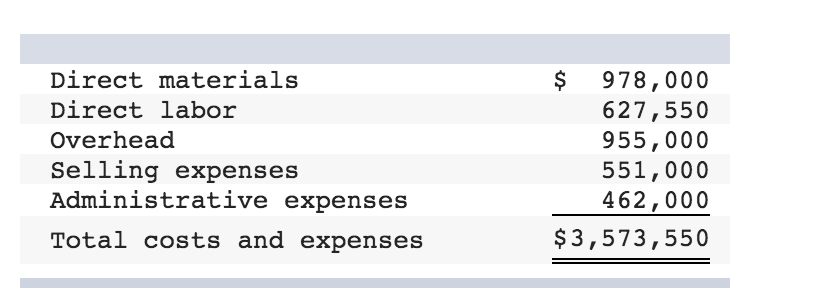

Calla Company produces skateboards that sell for $69 per unit. The company currently has the capacity to produce 100,000 skateboards per year, but is selling 81,500 skateboards per year. Annual costs for 81,500 skateboards follow.

A new retail store has offered to buy 18,500 of its skateboards for $64 per unit. The store is in a different market from Calla's regular customers and would not affect regular sales. A study of its costs in anticipation of this additional business reveals the following:

- Direct materials and direct labor are 100% variable.

- 50 percent of overhead is fixed at any production level from 81,500 units to 100,000 units; the remaining 50% of annual overhead costs are variable with respect to volume.

- Selling expenses are 80% variable with respect to number of units sold, and the other 20% of selling expenses are fixed.

- There will be an additional $2.80 per unit selling expense for this order.

- Administrative expenses would increase by a $950 fixed amount.

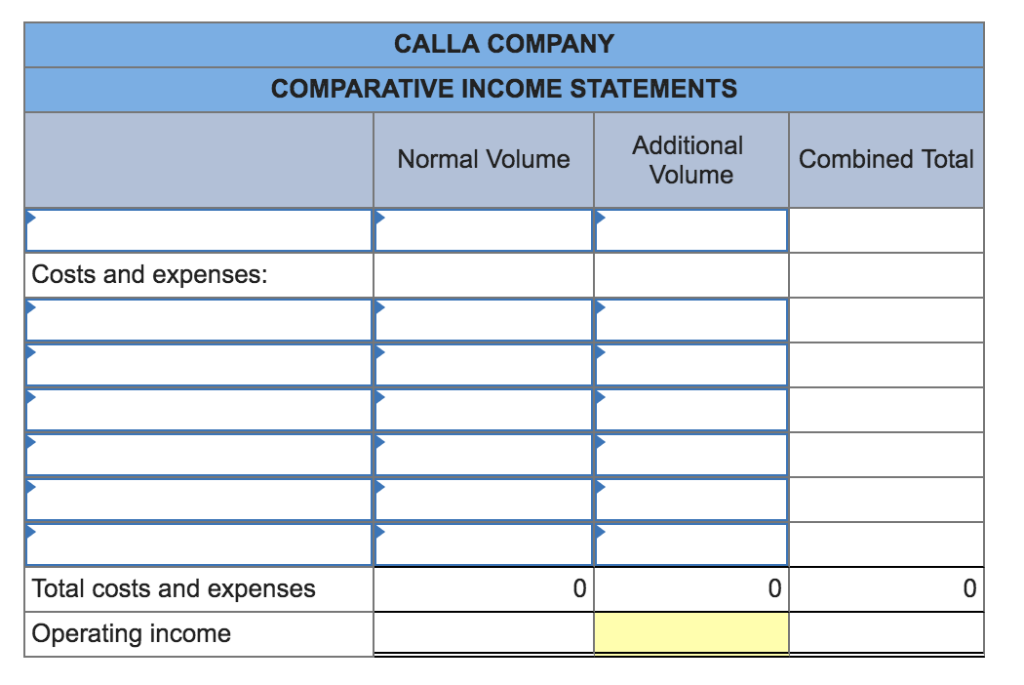

Required: Prepare a three-column comparative income statement that reports the following: a. Annual income without the special order. b. Annual income from the special order. c. Combined annual income from normal business and the new business (round to nearest whole #)

Direct materials $ 978,000 627,550 955,000 551,000 462,000 Direct labor Overhead Selling expenses Administrative expenses $3,573,550 Total costs and expenses CALLA COMPANY COMPARATIVE INCOME STATEMENTS Additional Normal Volume Combined Total Volume Costs and expenses: Total costs and expenses 0 0 0 Operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started