Answered step by step

Verified Expert Solution

Question

1 Approved Answer

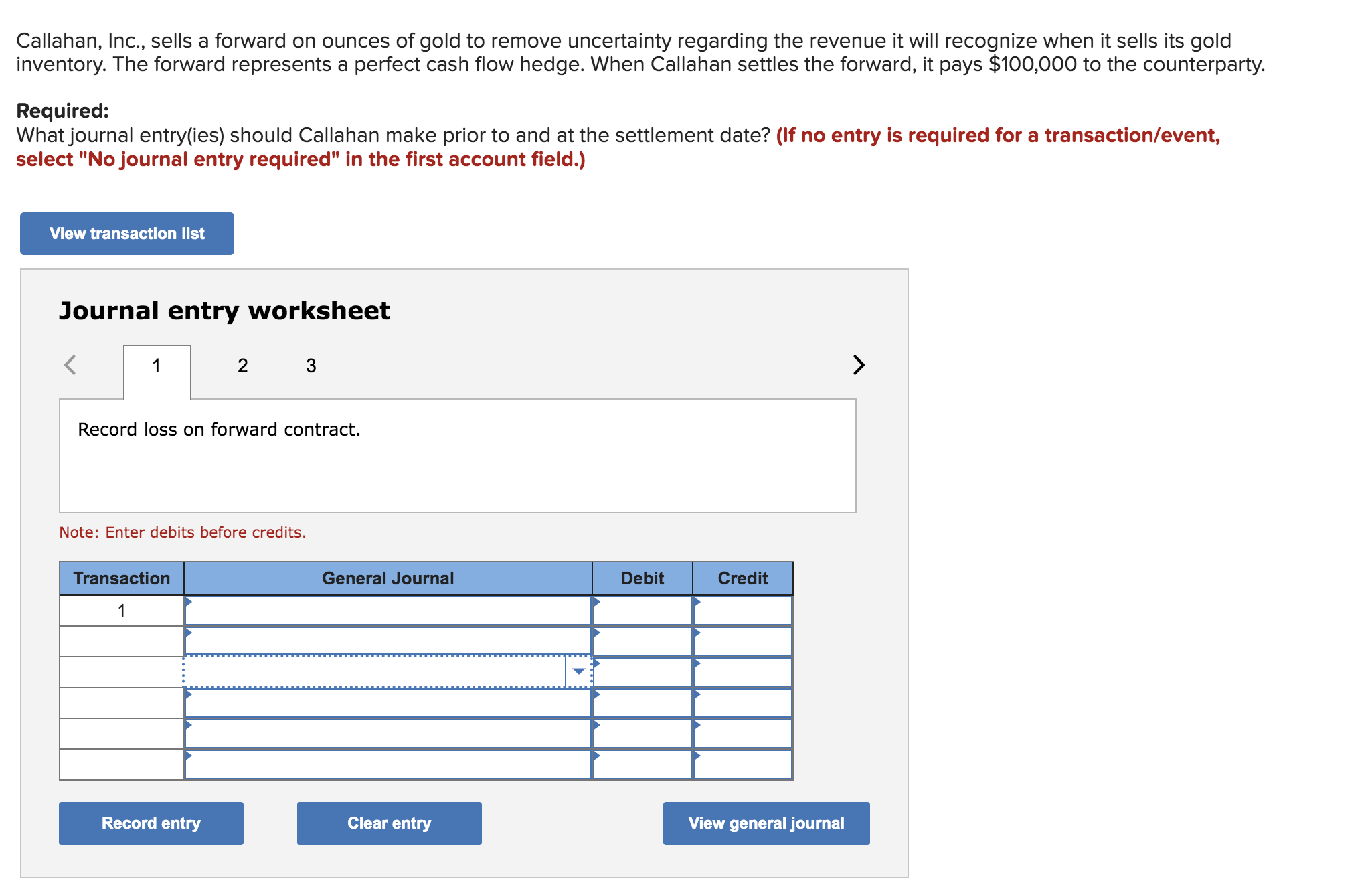

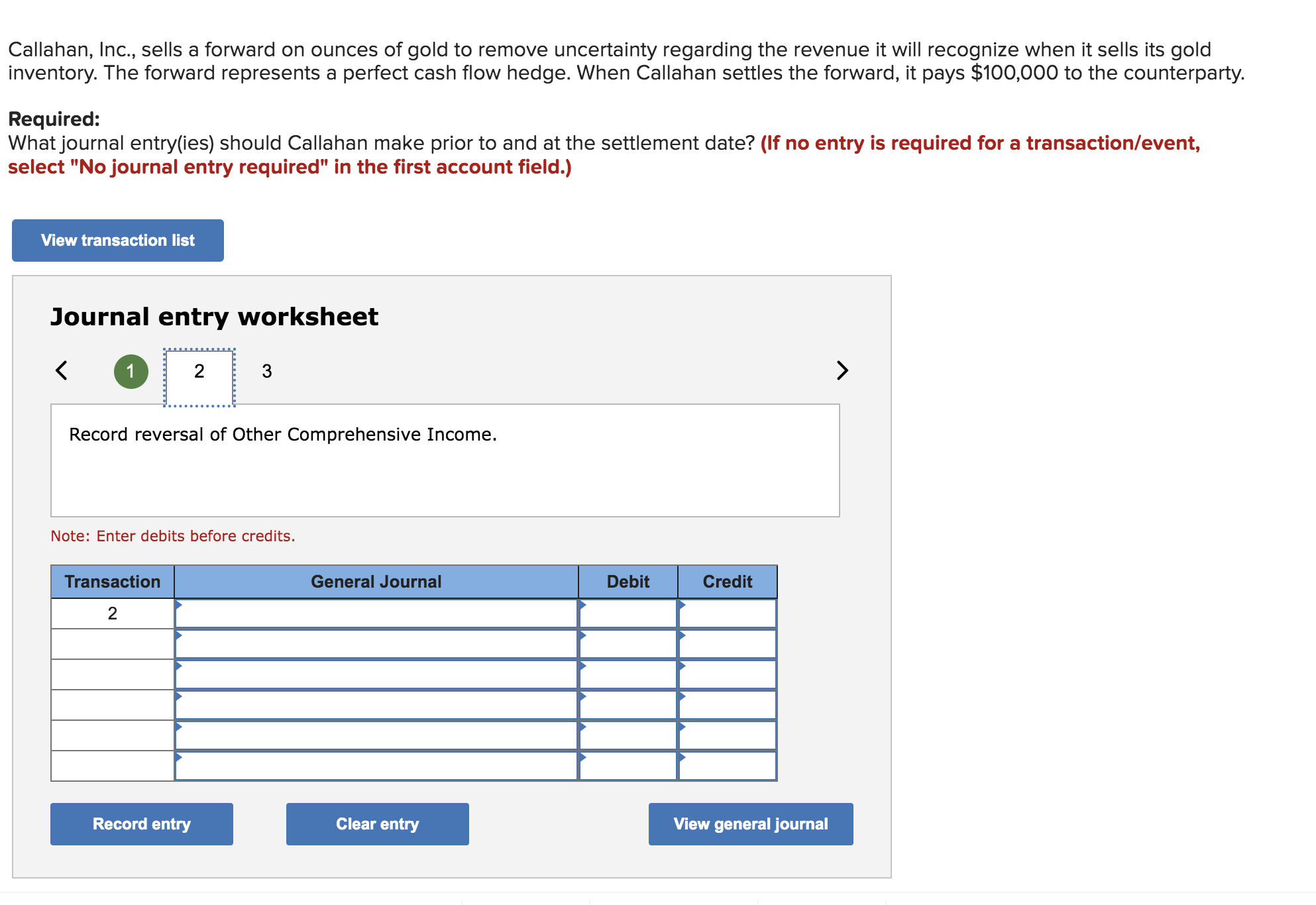

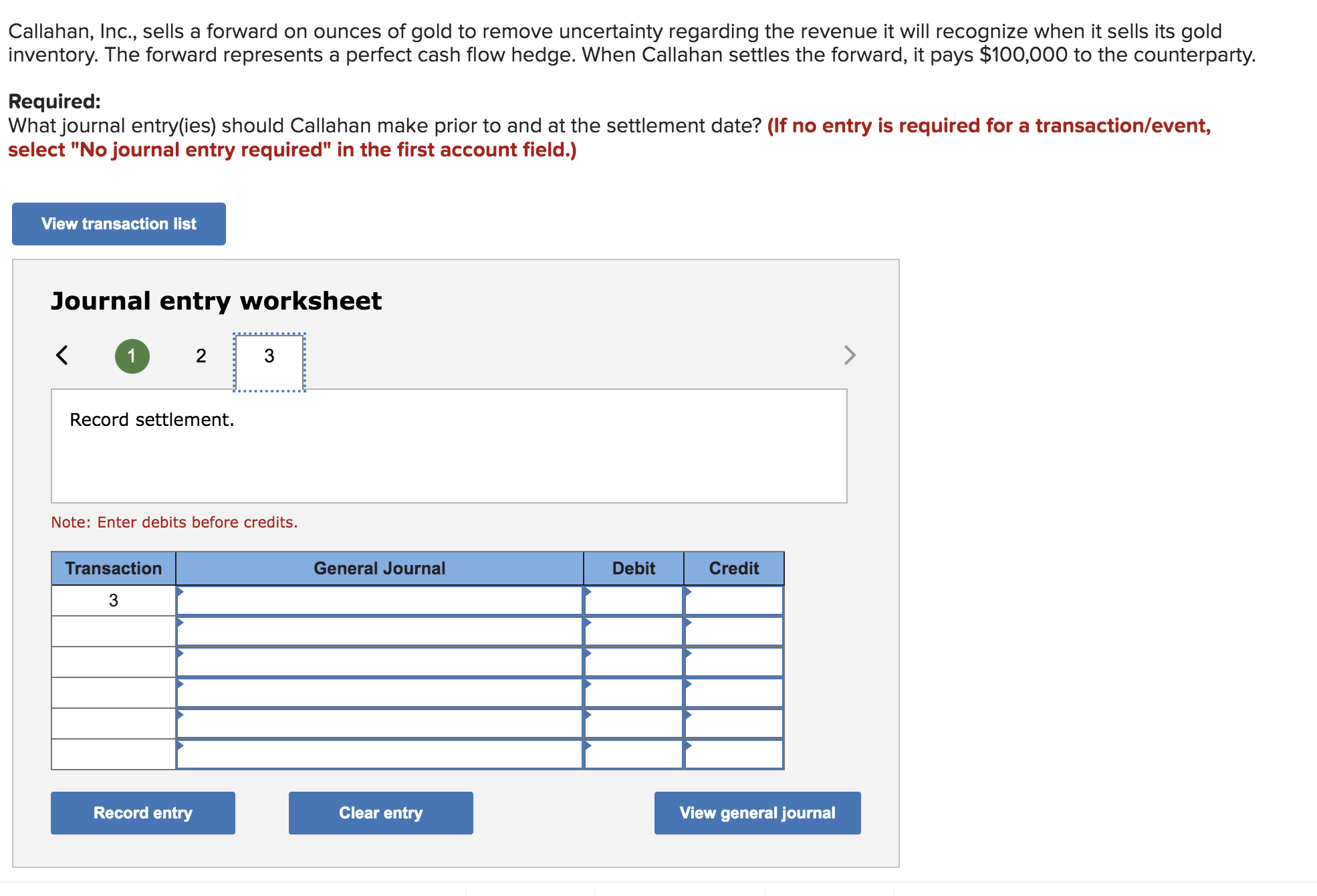

Callahan, Inc., sells a forward on ounces of gold to remove uncertainty regarding the revenue it will recognize when it sells its gold inventory. The

Callahan, Inc., sells a forward on ounces of gold to remove uncertainty regarding the revenue it will recognize when it sells its gold inventory. The forward represents a perfect cash flow hedge. When Callahan settles the forward, it pays $100,000 to the counterparty. Required: What journal entry(ies) should Callahan make prior to and at the settlement date? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 3 Record loss on forward contract. Note: Enter debits before credits. Callahan, Inc., sells a forward on ounces of gold to remove uncertainty regarding the revenue it will recognize when it sells its gold nventory. The forward represents a perfect cash flow hedge. When Callahan settles the forward, it pays $100,000 to the counterparty. Required: What journal entry(ies) should Callahan make prior to and at the settlement date? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Callahan, Inc., sells a forward on ounces of gold to remove uncertainty regarding the revenue it will recognize when it sells its gold inventory. The forward represents a perfect cash flow hedge. When Callahan settles the forward, it pays $100,000 to the counterparty. Required: What journal entry(ies) should Callahan make prior to and at the settlement date? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record reversal of Other Comprehensive Income. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started