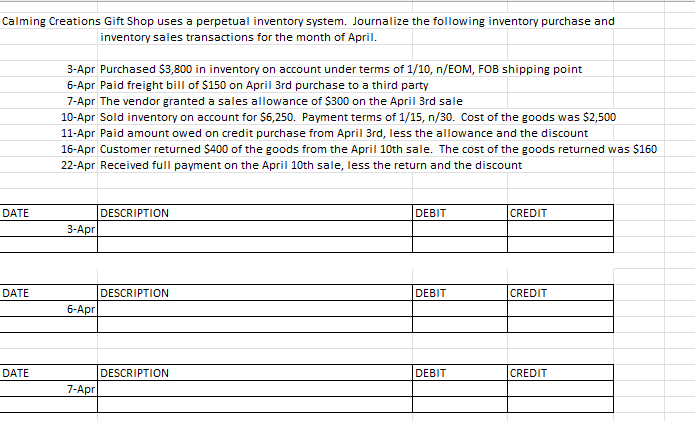

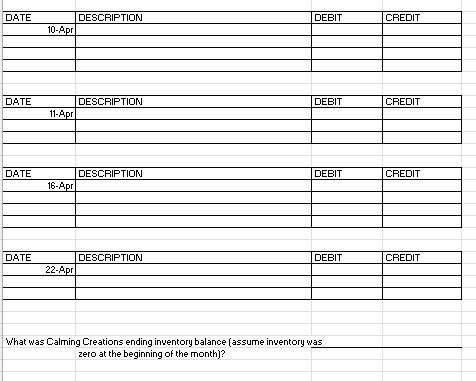

Calming Creations Gift Shop uses a perpetual inventory system. Journalize the following inventory purchase and inventory sales transactions for the month of April. 3-Apr Purchased $3,800 in inventory on account under terms of 1/10, n/EOM, FOB shipping point 6-Apr Paid freight bill of $150 on April 3rd purchase to a third party 7-Apr The vendor granted a sales allowance of $300 on the April 3rd sale 10-Apr Sold inventory on account for $6,250. Payment terms of 1/15,n/30. Cost of the goods was $2,500 11-Apr Paid amount owed on credit purchase from April 3rd, less the allowance and the discount 16-Apr Customer returned $400 of the goods from the April 10th sale. The cost of the goods returned was $160 22-Apr Received full payment on the April 10th sale, less the return and the discount \begin{tabular}{|l|l|l|l|} \hline DATE & DESCRIPTION & DEBIT & CREDIT \\ \hline 3-Apr & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DATE & DESCRIPTION & DEBIT & CREDIT \\ \hline 6Apr & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline DATE & DESCRIPTION & DEBIT & CREDIT \\ \hline 7-Apr & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DAATE & DESCFIPTION & DEEIT & CREDIT \\ \hline 10A P & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DATE & DESCFIPTION & DEEIT & CREDIT \\ \hline 11-A.Pr & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DAATE & DESCFIPTION & DEBIT & CREDIT \\ \hline 16A.PF & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DA.TE & DESCFIPTION & DEEIT & CREDIT \\ \hline 22A.PP & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} What was Calming Creations ending inventory balance (assume inventory was zero at the beginning of the month)? Calming Creations Gift Shop uses a perpetual inventory system. Journalize the following inventory purchase and inventory sales transactions for the month of April. 3-Apr Purchased $3,800 in inventory on account under terms of 1/10, n/EOM, FOB shipping point 6-Apr Paid freight bill of $150 on April 3rd purchase to a third party 7-Apr The vendor granted a sales allowance of $300 on the April 3rd sale 10-Apr Sold inventory on account for $6,250. Payment terms of 1/15,n/30. Cost of the goods was $2,500 11-Apr Paid amount owed on credit purchase from April 3rd, less the allowance and the discount 16-Apr Customer returned $400 of the goods from the April 10th sale. The cost of the goods returned was $160 22-Apr Received full payment on the April 10th sale, less the return and the discount \begin{tabular}{|l|l|l|l|} \hline DATE & DESCRIPTION & DEBIT & CREDIT \\ \hline 3-Apr & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DATE & DESCRIPTION & DEBIT & CREDIT \\ \hline 6Apr & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline DATE & DESCRIPTION & DEBIT & CREDIT \\ \hline 7-Apr & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DAATE & DESCFIPTION & DEEIT & CREDIT \\ \hline 10A P & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DATE & DESCFIPTION & DEEIT & CREDIT \\ \hline 11-A.Pr & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DAATE & DESCFIPTION & DEBIT & CREDIT \\ \hline 16A.PF & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|l|} \hline DA.TE & DESCFIPTION & DEEIT & CREDIT \\ \hline 22A.PP & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} What was Calming Creations ending inventory balance (assume inventory was zero at the beginning of the month)