caluclations needed and work shown:

assuming the bond pays out 1000

what is the future value of the bond?

what is the yeild to maturity?

what is the cost of equity?

what is the weighted cost of capital?

calculations needed and work shown:

what is the yeild to maturity?

what is the cost of equity?

what is the weighted cost of captial?

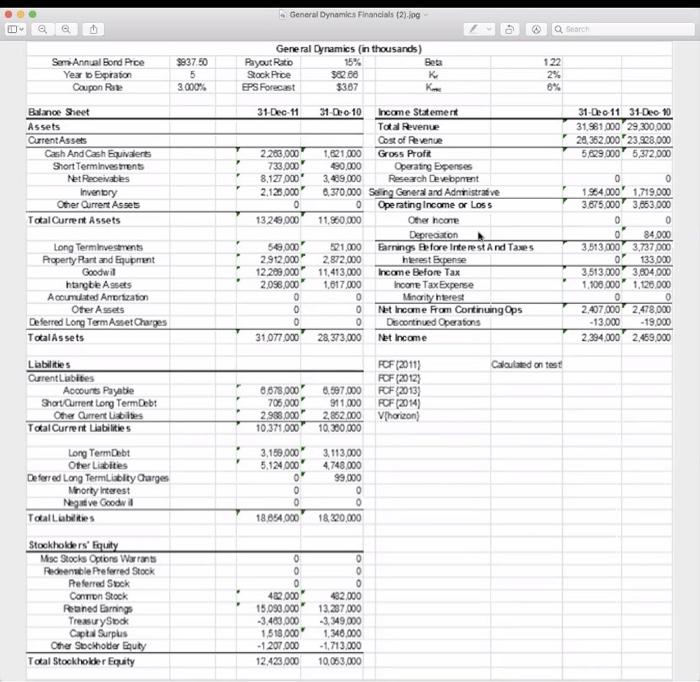

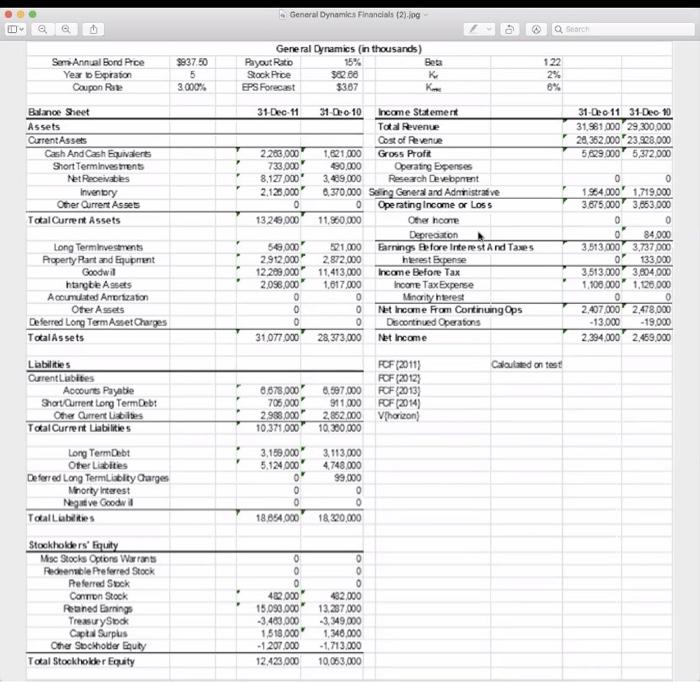

General Dynamic Financials (2) Jog Q General Dynamics (in thousands) Payout Ratio 15% Beta Sock Price $82.60 K EPS Forecast $387 122 2% 8% 31 Dec 11 31-Deo 11 31-Dec 10 31.981 000 29 300.000 29,362.000 23.928,000 5.629.000 5,372.000 2.263.000 733.000 8,127 000 2.125.000 0 13249.000 31 Dec 10 Income Statement Total Revenue Cost of Revenue 1.821.000 Gross Profit 490,000 Operating Expenses 349,000 Research Developnent 8,370,000 Seling General and Administrave 0 Operating income or LOSS 11.500.000 Other hoone Depresston 521,000 Earnings Before Interest And Taxes 2.872,000 herest Expense 11,413,000 Income Before Tax 1,617 000 Incone Tax Experse 0 Minority herest 0 Net Income From Continuing Ops 0 Decortinued Operators 28.373.000 Net Income 549.000 2.912.000 12.200.000 2.096.000 0 0 0 31,077 000 0 0 1964.000 1.719.000 3.675.000 3.863.000 0 0 84.000 3,513 000 3,737.000 0 133,000 3,513,000 3,804.000 1.106.000 1.126.000 0 0 2.407.000 2.478.000 -13.000 -19.000 2,394,000 2,469,000 Ser Annual Bond Price $93750 Year Epration 5 Coupon Rae 3000% Balance Sheet Assets Current Assets Cash And Cash Equivalent Short Terminverents NetReceivables Inventory Other Current Asses Total Current Assets Long Terminvestments Property Rart and Equipment Goodwil hangbe Annet Acumulated Anortization Other Assets Deferred Long Term Amet Charges Total Assets Labilities Current liabides Accounts Payable Short Current Long Term Debt Other Current Listes Total Current Liabilities Long Term Debt Oter Lubites Deferred Long TermLisbity Garges Morty interest Negaid ve Goodwill Totallubilities Stockholders' Equity Misc Stocks Options Warran's Redenle Preferred Stock Preferred Sook Conton Stock Reaned Earning TreasuryStock Capta Surplus Other Stockholler Equity Total Stockholder Equity Calculated on test 6,678,000 705 000 2 988 000 10.371.000 6.597,000 911000 2,852.000 10.300.000 FCF (2011) POF (2012) FCF (2013) FCF (2014) Vhorizon) 3,159.000 5.124 000 o' 0 0 18.654,000 3,113,000 4748,000 99.000 0 0 18.320,000 0 0 402.000 15.090.000 -3.400.000 1,519.000 -1 207.000 12,423,000 0 0 0 482.000 13.287 000 -3.349.000 1.346.000 -1,713.000 10,053,000 General Dynamic Financials (2) Jog Q General Dynamics (in thousands) Payout Ratio 15% Beta Sock Price $82.60 K EPS Forecast $387 122 2% 8% 31 Dec 11 31-Deo 11 31-Dec 10 31.981 000 29 300.000 29,362.000 23.928,000 5.629.000 5,372.000 2.263.000 733.000 8,127 000 2.125.000 0 13249.000 31 Dec 10 Income Statement Total Revenue Cost of Revenue 1.821.000 Gross Profit 490,000 Operating Expenses 349,000 Research Developnent 8,370,000 Seling General and Administrave 0 Operating income or LOSS 11.500.000 Other hoone Depresston 521,000 Earnings Before Interest And Taxes 2.872,000 herest Expense 11,413,000 Income Before Tax 1,617 000 Incone Tax Experse 0 Minority herest 0 Net Income From Continuing Ops 0 Decortinued Operators 28.373.000 Net Income 549.000 2.912.000 12.200.000 2.096.000 0 0 0 31,077 000 0 0 1964.000 1.719.000 3.675.000 3.863.000 0 0 84.000 3,513 000 3,737.000 0 133,000 3,513,000 3,804.000 1.106.000 1.126.000 0 0 2.407.000 2.478.000 -13.000 -19.000 2,394,000 2,469,000 Ser Annual Bond Price $93750 Year Epration 5 Coupon Rae 3000% Balance Sheet Assets Current Assets Cash And Cash Equivalent Short Terminverents NetReceivables Inventory Other Current Asses Total Current Assets Long Terminvestments Property Rart and Equipment Goodwil hangbe Annet Acumulated Anortization Other Assets Deferred Long Term Amet Charges Total Assets Labilities Current liabides Accounts Payable Short Current Long Term Debt Other Current Listes Total Current Liabilities Long Term Debt Oter Lubites Deferred Long TermLisbity Garges Morty interest Negaid ve Goodwill Totallubilities Stockholders' Equity Misc Stocks Options Warran's Redenle Preferred Stock Preferred Sook Conton Stock Reaned Earning TreasuryStock Capta Surplus Other Stockholler Equity Total Stockholder Equity Calculated on test 6,678,000 705 000 2 988 000 10.371.000 6.597,000 911000 2,852.000 10.300.000 FCF (2011) POF (2012) FCF (2013) FCF (2014) Vhorizon) 3,159.000 5.124 000 o' 0 0 18.654,000 3,113,000 4748,000 99.000 0 0 18.320,000 0 0 402.000 15.090.000 -3.400.000 1,519.000 -1 207.000 12,423,000 0 0 0 482.000 13.287 000 -3.349.000 1.346.000 -1,713.000 10,053,000