Answered step by step

Verified Expert Solution

Question

1 Approved Answer

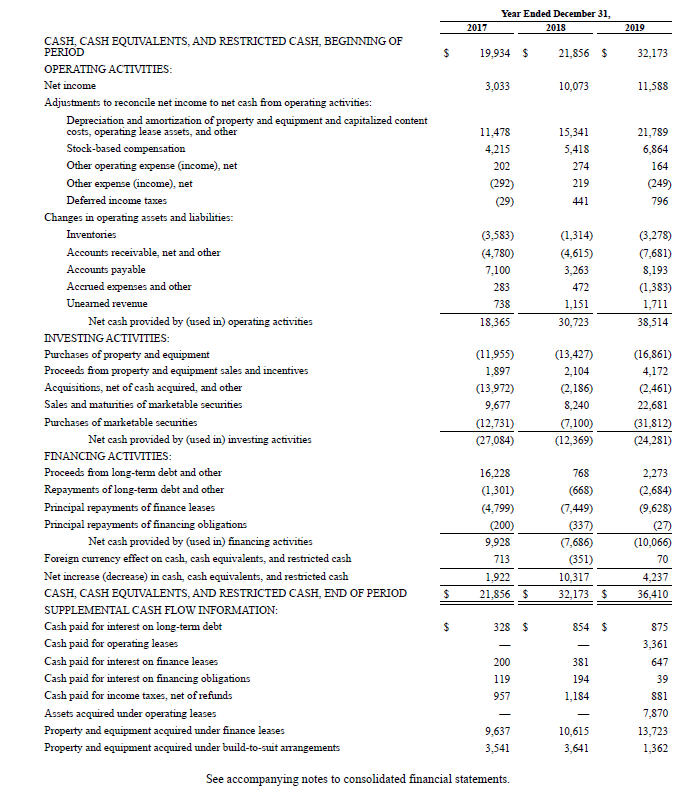

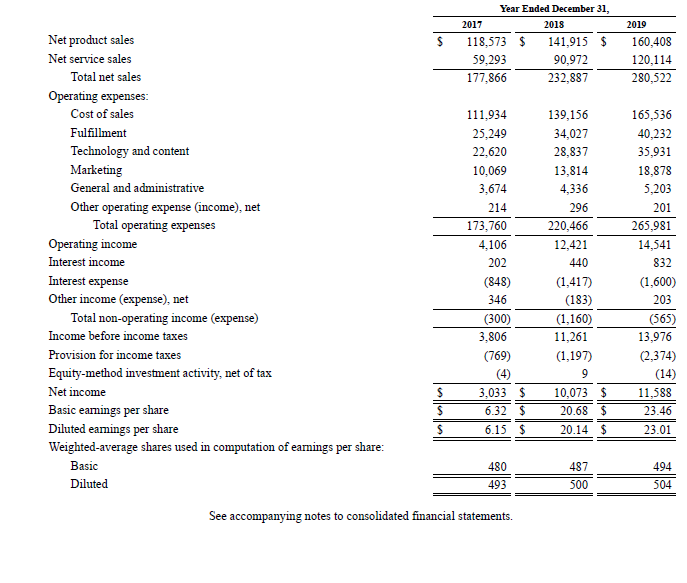

calulate the following ratios Debt service, profitability Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property

calulate the following ratios

Debt service, profitability

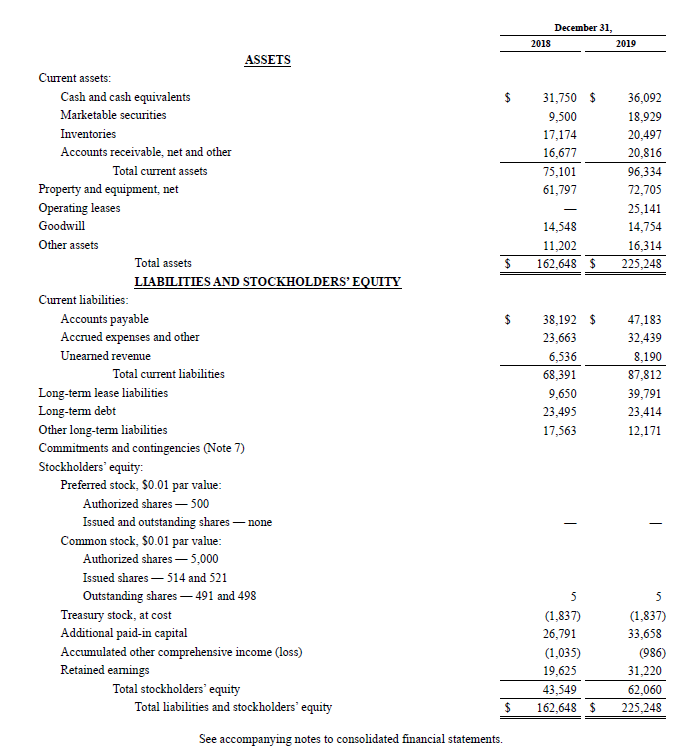

Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Current liabilities: Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities ASSETS Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares - 500 Issued and outstanding shares - none Common stock, $0.01 par value: Authorized shares - 5,000 Issued shares - 514 and 521 Outstanding shares - 491 and 498 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ $ See accompanying notes to consolidated financial statements. $ $ 2018 December 31, 31,750 $ 9,500 17,174 16,677 75,101 61,797 14,548 11,202 162,648 $ 38,192 $ 23,663 6,536 68,391 9,650 23,495 17,563 2019 36,092 18,929 20,497 20,816 96,334 72,705 25,141 14,754 16,314 225,248 47,183 32,439 8,190 87,812 39,791 23,414 12,171 5 (1,837) 26,791 (1,035) 19,625 31,220 43,549 62,060 162,648 $ 225,248 (1,837) 33,658 (986)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Debt service ratio Interest expense Total Debt 2019 Interest expense 1600000 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started