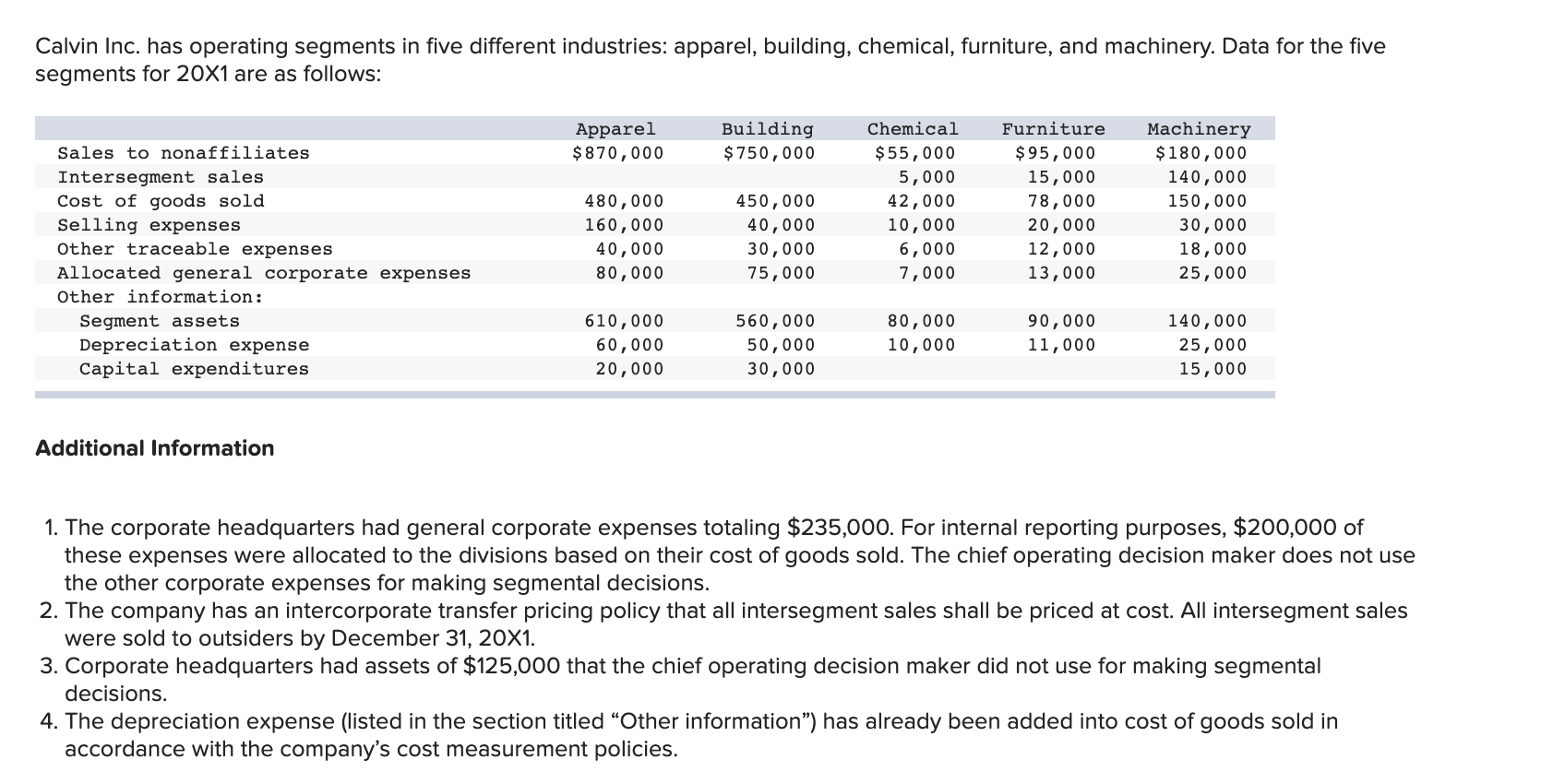

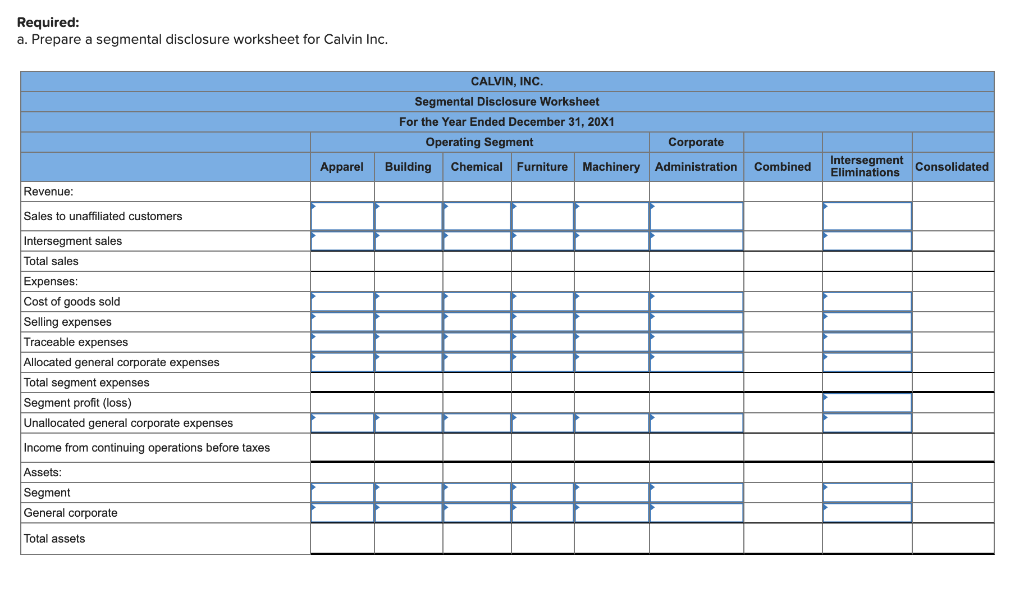

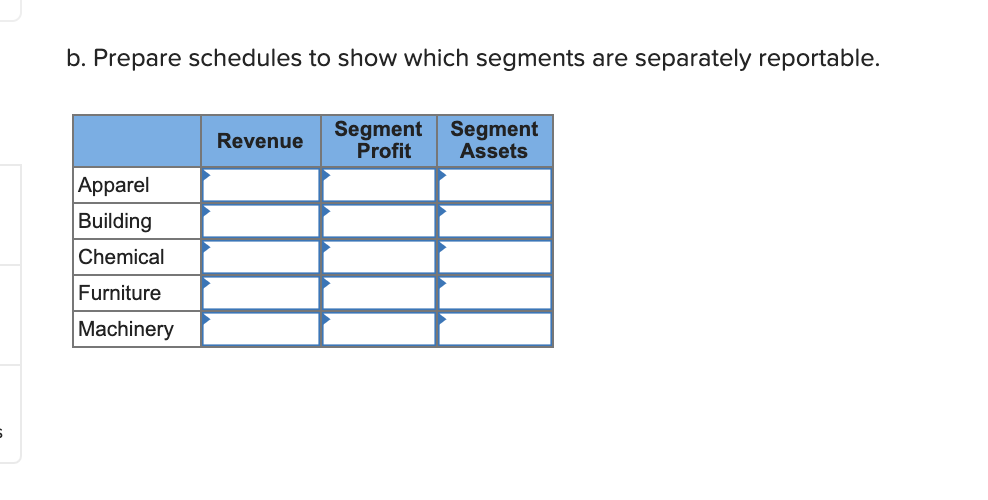

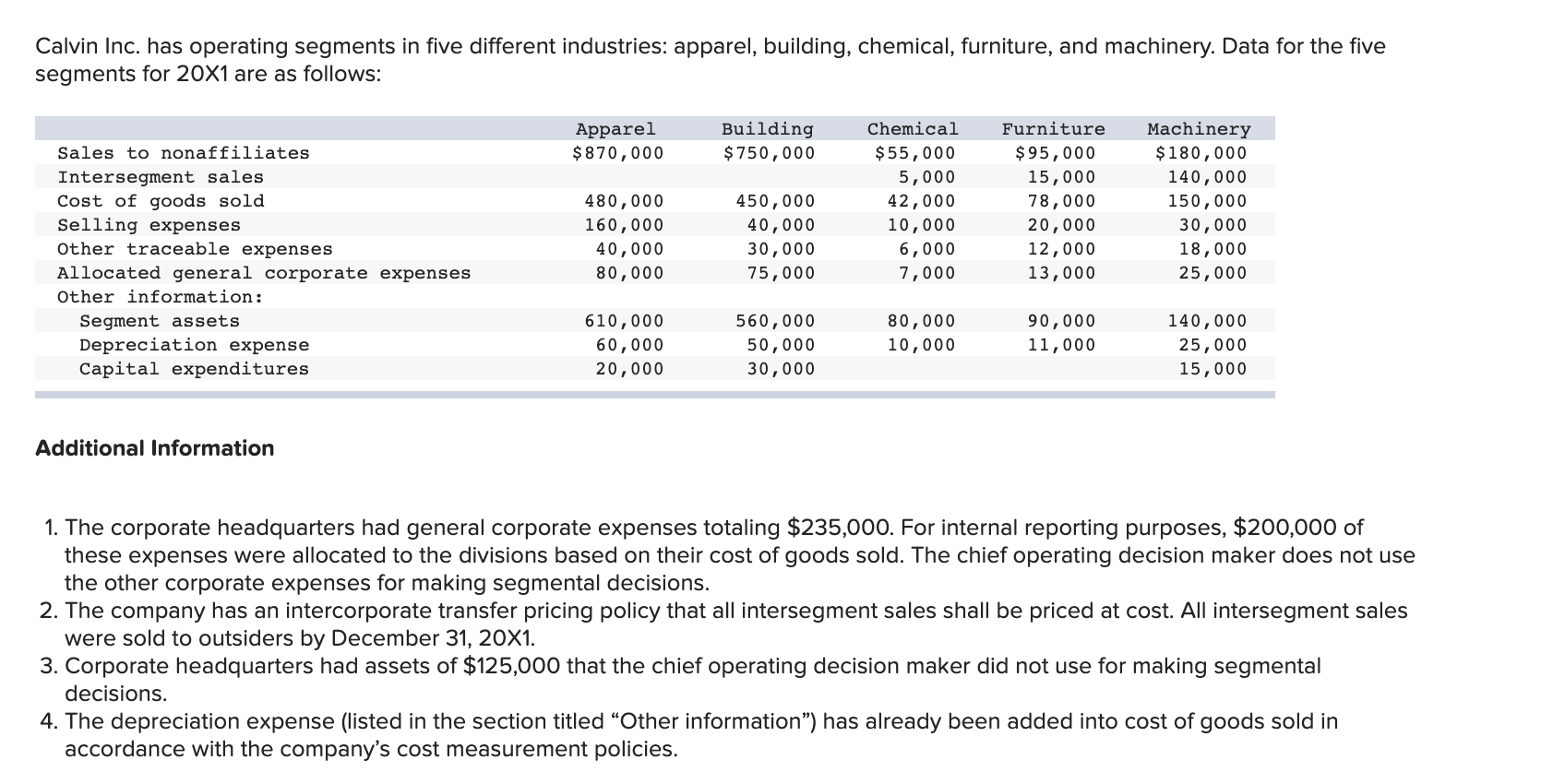

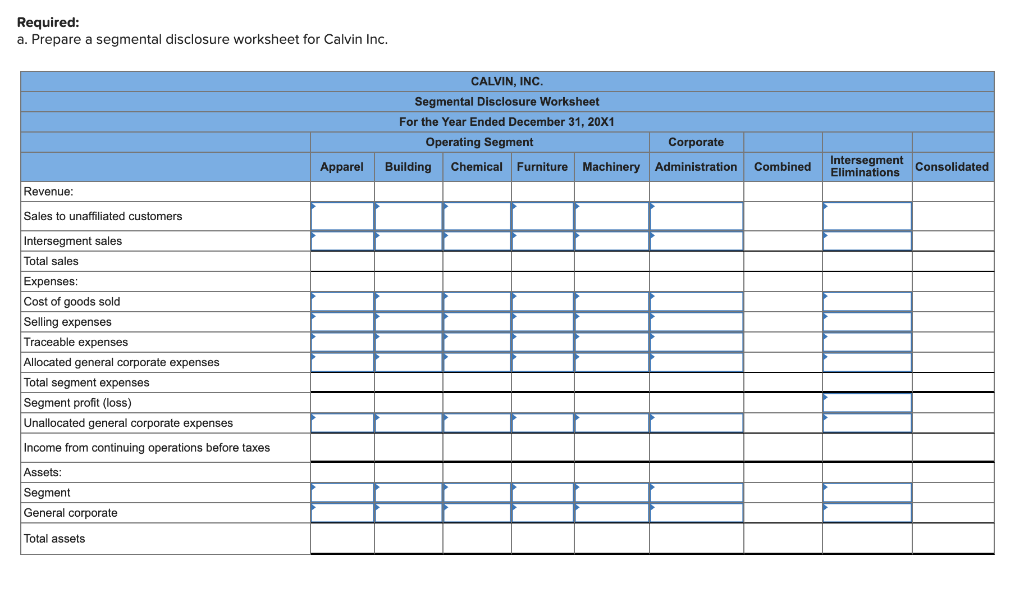

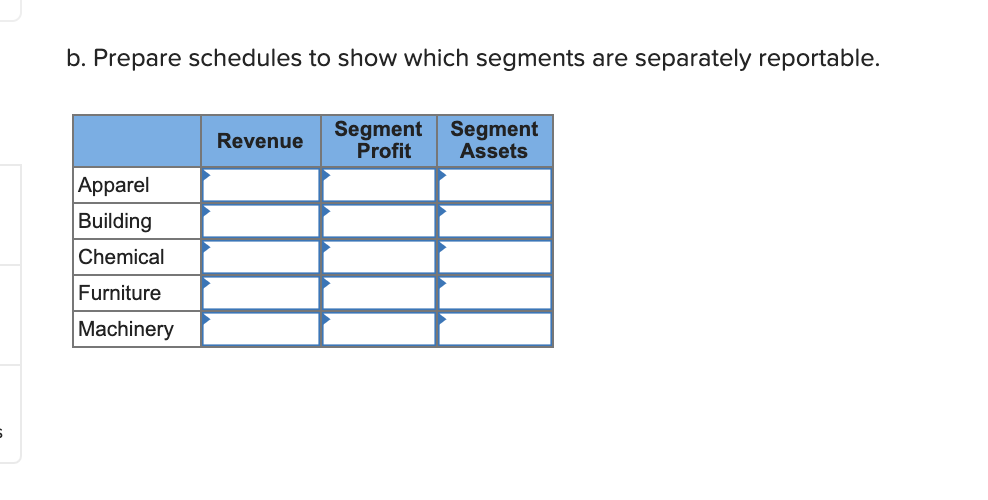

Calvin Inc. has operating segments in five different industries: apparel, building, chemical, furniture, and machinery. Data for the five segments for 20X1 are as follows: Apparel $ 870,000 Building $750,000 Sales to nonaffiliates Intersegment sales Cost of goods sold Selling expenses Other traceable expenses Allocated general corporate expenses Other information: Segment assets Depreciation expense Capital expenditures 480,000 160,000 40,000 80,000 450,000 40,000 30,000 75,000 Chemical $55,000 5,000 42,000 10,000 6,000 7,000 Furniture $ 95,000 15,000 78,000 20,000 12,000 13,000 Machinery $180,000 140,000 150,000 30,000 18,000 25,000 610,000 60,000 20,000 560,000 50,000 30,000 80,000 10,000 90,000 11,000 140,000 25,000 15,000 Additional Information 1. The corporate headquarters had general corporate expenses totaling $235,000. For internal reporting purposes, $200,000 of these expenses were allocated to the divisions based on their cost of goods sold. The chief operating decision maker does not use the other corporate expenses for making segmental decisions. 2. The company has an intercorporate transfer pricing policy that all intersegment sales shall be priced at cost. All intersegment sales were sold to outsiders by December 31, 20X1. 3. Corporate headquarters had assets of $125,000 that the chief operating decision maker did not use for making segmental decisions. 4. The depreciation expense (listed in the section titled Other information") has already been added into cost of goods sold in accordance with the company's cost measurement policies. Required: a. Prepare a segmental disclosure worksheet for Calvin Inc. CALVIN, INC. Segmental Disclosure Worksheet For the Year Ended December 31, 20X1 Operating Segment Corporate Building Chemical Furniture Machinery Administration Apparel Combined Intersegment Eliminations Consolidated Revenue: Sales to unaffiliated customers Intersegment sales Total sales Expenses: Cost of goods sold Selling expenses Traceable expenses Allocated general corporate expenses Total segment expenses Segment profit (loss) Unallocated general corporate expenses Income from continuing operations before taxes Assets: Segment General corporate Total assets b. Prepare schedules to show which segments are separately reportable. Revenue Segment Profit Segment Assets Apparel Building Chemical Furniture Machinery