Question

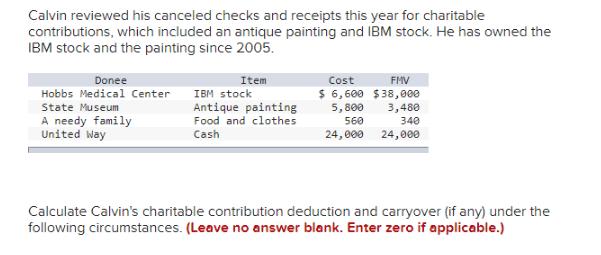

Calvin reviewed his canceled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the

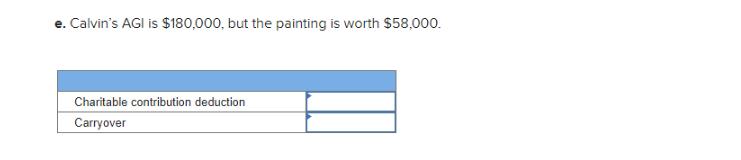

Calvin reviewed his canceled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Hobbs Medical Center State Museum A needy family United Way Item IBM stock Antique painting Food and clothes Cash Cost FMV $ 6,600 $38,000 5,800 3,480 560 340 24,000 24,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no answer blank. Enter zero if applicable.) e. Calvin's AGI is $180,000, but the painting is worth $58,000. Charitable contribution deduction Carryover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Calvins charitable contribution deduction and carryover we need to consider the limitat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2015

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

6th Edition

978-1259206955, 1259206955, 77862368, 978-0077862367

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App