Question

Cam, who was single, died in 2022 and has a gross estate valued at $7.5 million. Six months after his death, the gross assets

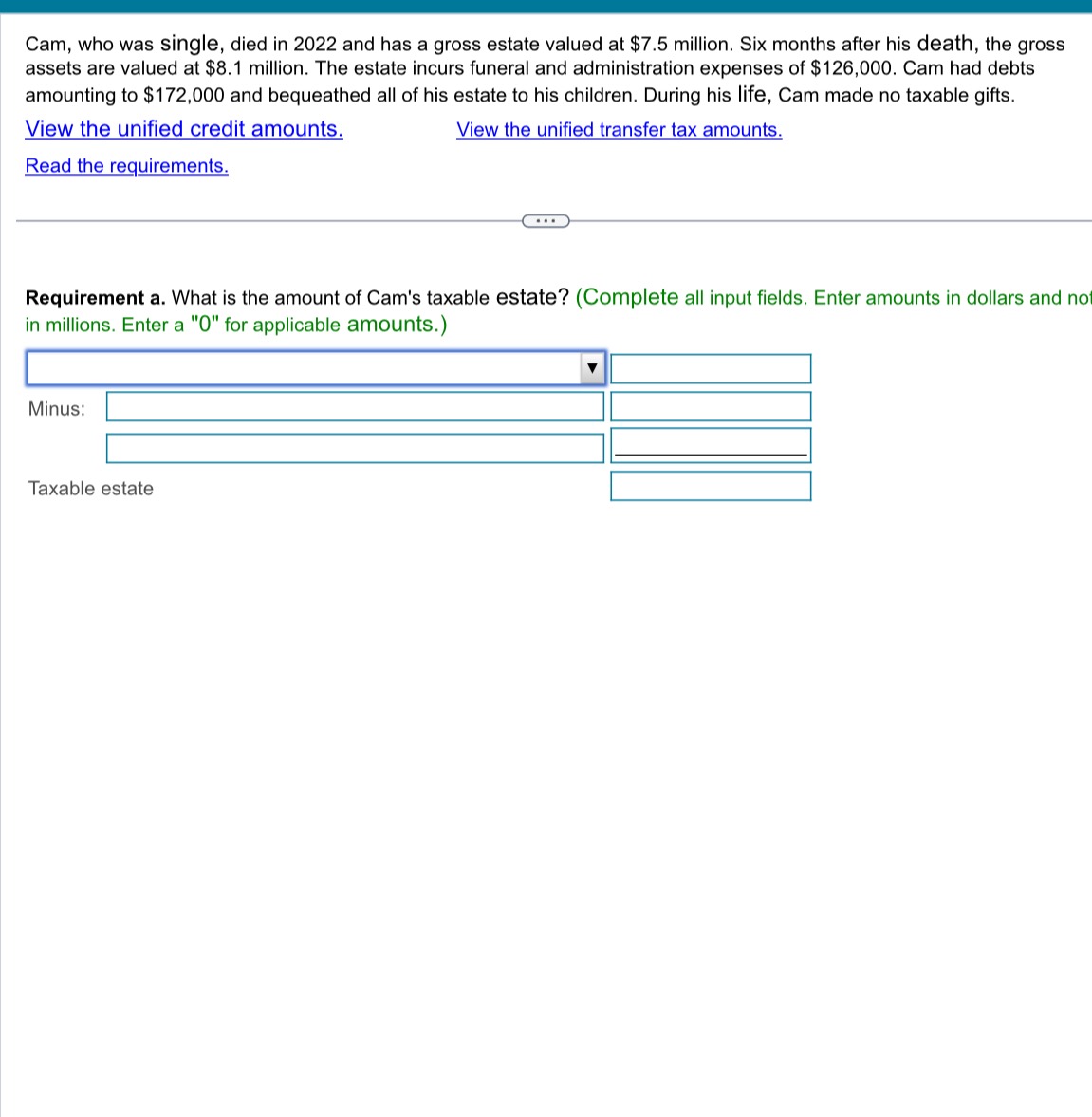

Cam, who was single, died in 2022 and has a gross estate valued at $7.5 million. Six months after his death, the gross assets are valued at $8.1 million. The estate incurs funeral and administration expenses of $126,000. Cam had debts amounting to $172,000 and bequeathed all of his estate to his children. During his life, Cam made no taxable gifts. View the unified credit amounts. View the unified transfer tax amounts. Read the requirements. Requirement a. What is the amount of Cam's taxable estate? (Complete all input fields. Enter amounts in dollars and not in millions. Enter a "O" for applicable amounts.) Minus: Taxable estate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Pearsons Federal Taxation 2023 Comprehensive

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

36th Edition

9780137840656

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App