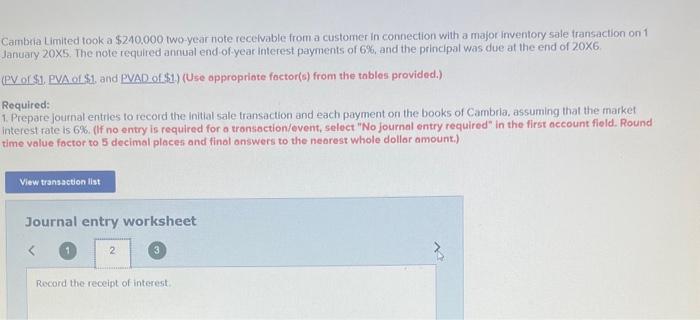

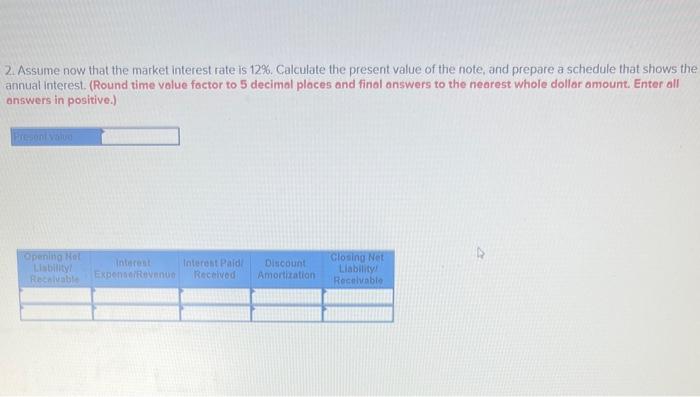

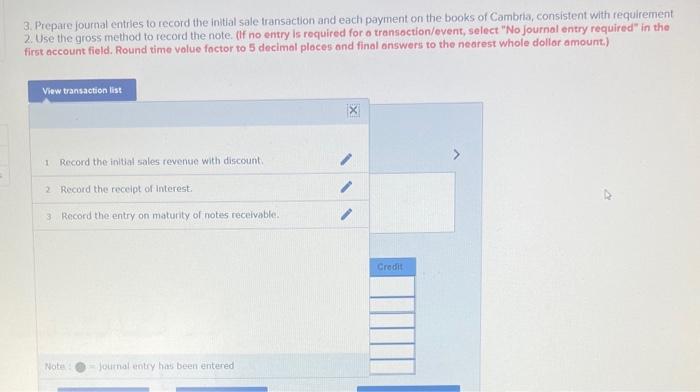

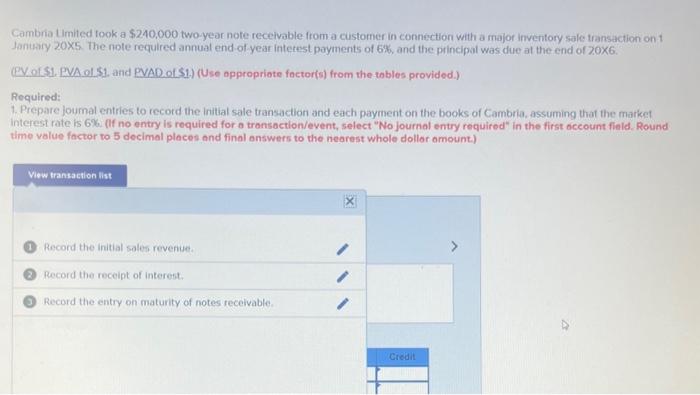

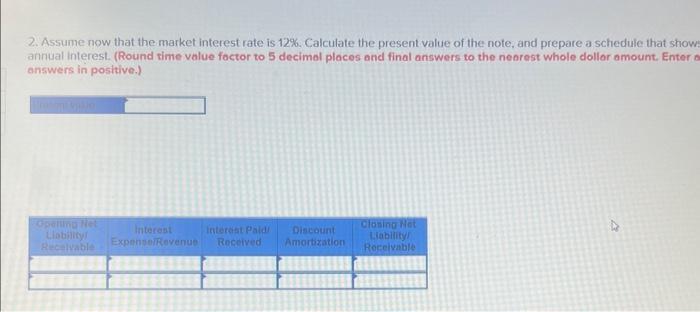

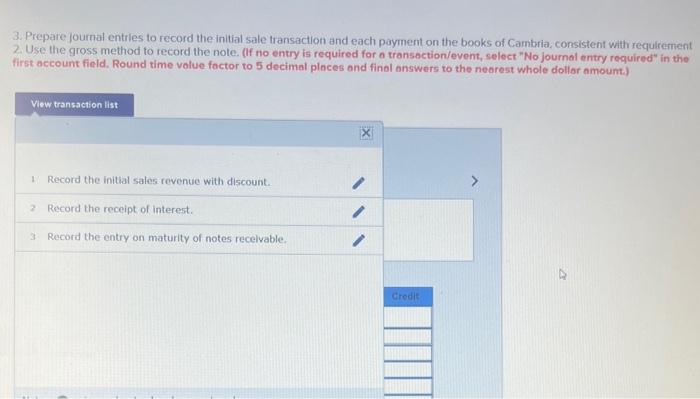

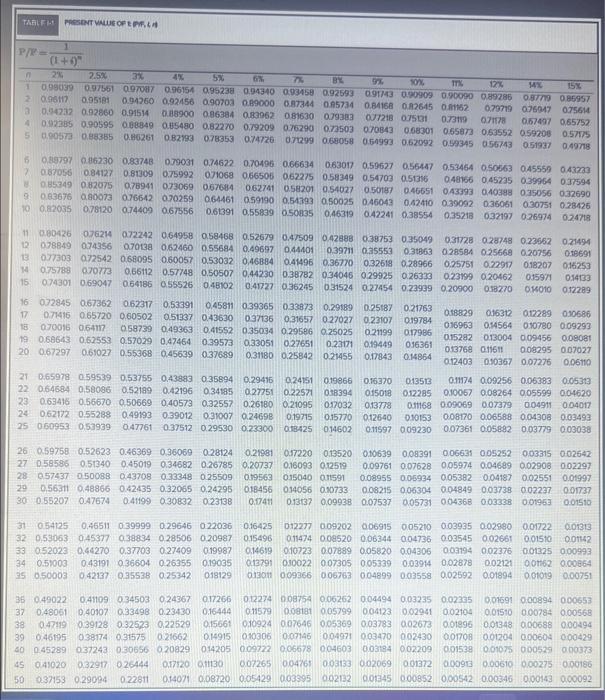

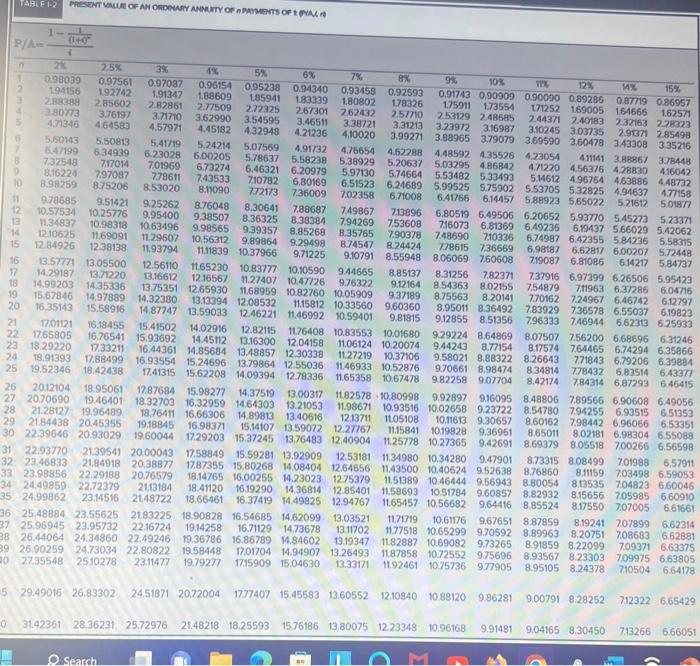

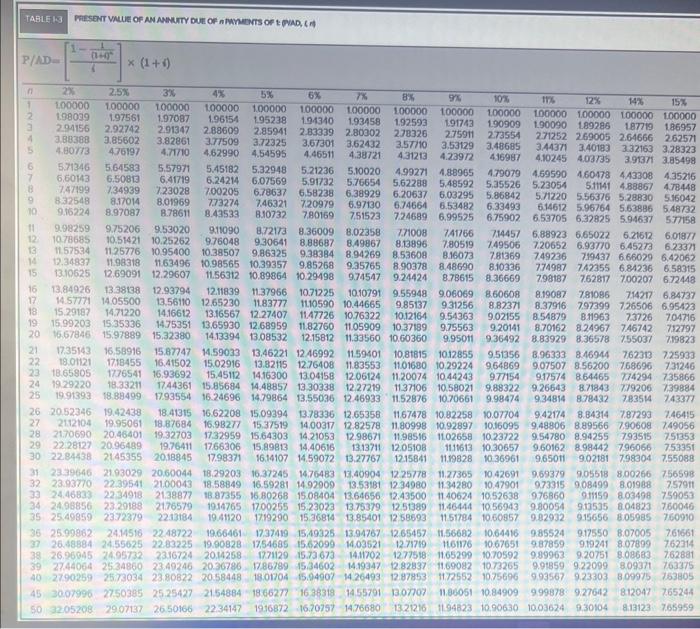

Cambria Limited took a $240.000 two-year note recelvable from a customer in connection with a major inventory sale transaction on 1 January 205. The note required annual end-of-year interest payments of 6%, and the principal was due at the end of 206. (PV of \$1. PVA of $1, and PVAD of \$1.) (Use appropriote foctor(s) from the tables provided.) Required: 1. Prepare journal entries to record the initial sale fransaction and each payment on the books of Cambria, assuming that the market interest rate is 6%. (If no entry is required for a tronsoction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final onswers to the nearest whole dollor amount.) 2. Assume now that the market interest rate is 12%. Calculate the present value of the note, and prepare a schedule that shows the annual interest. (Round time volue factor to 5 decimal ploces and final answers to the nearest whole dollar amount. Enter all onswers in positive.) 3. Prepare journal entries to record the inithal sale transaction and each payment on the books of Cambria, consistent with requirement 2. Use the gross method to record the note. (If no entry Is required for o transoction/event, select "No journal entry required" in the first occount field. Round time value factor to 5 decimal ploces and final answers to the nearest whole dollor amount.) Cambria Limited took a $240.000 two year note receivable from a customer in connection with a major inventory sale transaction on 1 Jantary 205. The note required annual end of year intetest payments of 6%, and the principal was due at the end of 206. (PY of S1. RVA ol 51, and PVAD of S1) (Use appropriate foctor(s) from the tables provided.) Required: 1. Prepare joumal entries to record the initial sale transaction and each payment on the books of Cambria, assuming that the market interest rate is 6%. (If no entry is required for a transaction/event, select "No journal entry required" in the first occount fiald. Round time value factor to 5 decimal places and final answers to the nearest whole dollor amount.) 2. Assume now that the market interest rate is 12%. Calculate the present value of the note, and prepare a schedule that show annual interest. (Round time value factor to 5 decimal places and final answers to the nearest whole dollor amount. Enter a answers in positive.) 3. Prepare journal entries to record the initial sale transaction and each payment on the books of Cambria, consistent with requirement 2. Use the gross method to record the note. (If no entry is required for a transoction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and finol answers to the nearest whole dollar amount.) P/AD=[41(t+961](1+1)