Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Camera King is a retail store that sells cameras and photography supplies. The firm's credit purchases and purchases returns and allowances transactions for June

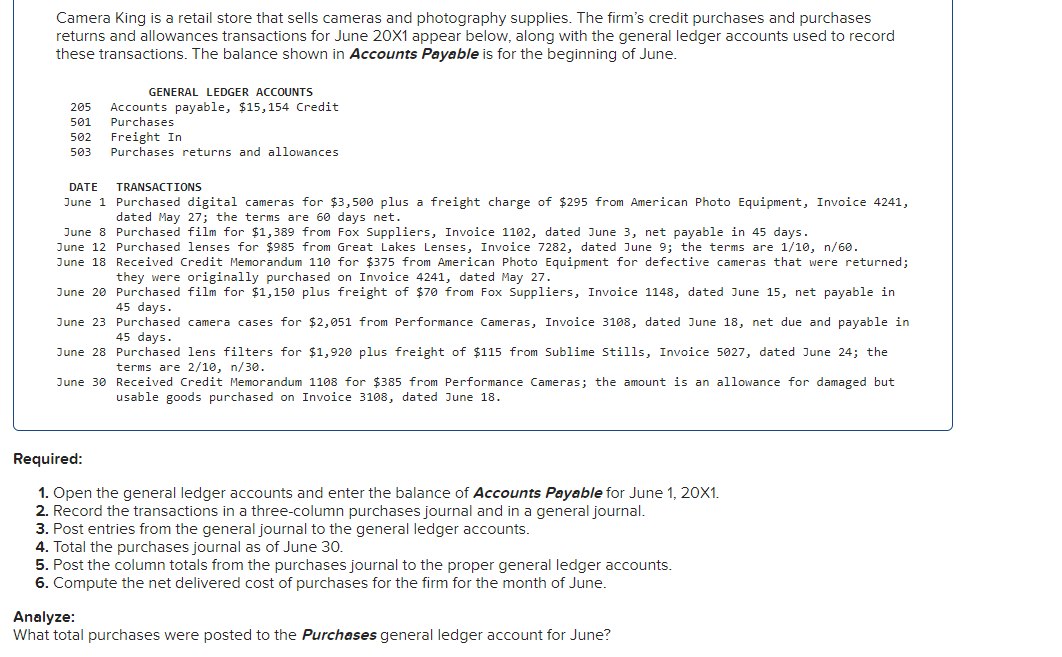

Camera King is a retail store that sells cameras and photography supplies. The firm's credit purchases and purchases returns and allowances transactions for June 20X1 appear below, along with the general ledger accounts used to record these transactions. The balance shown in Accounts Payable is for the beginning of June. GENERAL LEDGER ACCOUNTS 205 Accounts payable, $15,154 Credit 501 502 503 Purchases Freight In DATE Purchases returns and allowances TRANSACTIONS June 1 Purchased digital cameras for $3,500 plus a freight charge of $295 from American Photo Equipment, Invoice 4241, dated May 27; the terms are 60 days net. June 8 Purchased film for $1,389 from Fox Suppliers, Invoice 1102, dated June 3, net payable in 45 days. June 12 Purchased lenses for $985 from Great Lakes Lenses, Invoice 7282, dated June 9; the terms are 1/10, n/60. June 18 Received Credit Memorandum 110 for $375 from American Photo Equipment for defective cameras that were returned; they were originally purchased on Invoice 4241, dated May 27. June 20 Purchased film for $1,150 plus freight of $70 from Fox Suppliers, Invoice 1148, dated June 15, net payable in 45 days. June 23 Purchased camera cases for $2,051 from Performance Cameras, Invoice 3108, dated June 18, net due and payable in 45 days. June 28 Purchased lens filters for $1,920 plus freight of $115 from Sublime Stills, Invoice 5027, dated June 24; the terms are 2/10, n/30. June 30 Received Credit Memorandum 1108 for $385 from Performance Cameras; the amount is an allowance for damaged but usable goods purchased on Invoice 3108, dated June 18. Required: 1. Open the general ledger accounts and enter the balance of Accounts Payable for June 1, 20X1. 2. Record the transactions in a three-column purchases journal and in a general journal. 3. Post entries from the general journal to the general ledger accounts. 4. Total the purchases journal as of June 30. 5. Post the column totals from the purchases journal to the proper general ledger accounts. 6. Compute the net delivered cost of purchases for the firm for the month of June. Analyze: What total purchases were posted to the Purchases general ledger account for June?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started