Question

Cameron Tucker recently joined the Bank of MF as a profitability analyst. Tucker was asked to review the operating profitability of the 5M Co., an

Cameron Tucker recently joined the Bank of MF as a profitability analyst. Tucker was asked to review the operating profitability of the 5M Co., an American multinational conglomerate corporation operating in the fields of industry, worker safety, US health care, and consumer goods.

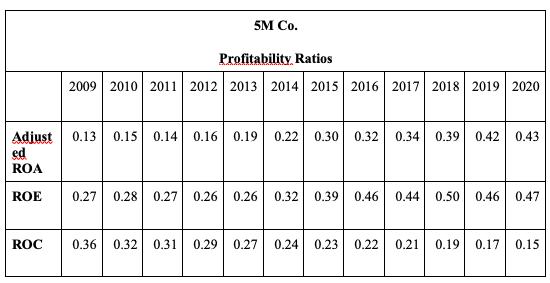

In order to assess the company's profitability, Tucker collects the company's returns on equity, adjusted return on asset, and return on capital. The information that Tucker collects is shown in the table below. After reviewing the data, Tucker suggests that the company's operating profitability has been deteriorating over time, and the company has been generating more earnings from investing activities.

Is Tucker's recommendation on the 5M Co.'s profitability justifiable? Why?

Manny Delgado is interviewing with the Bank of MF for a financial analyst position. The interviewer is interested in knowing whether he understands the EV-to-EBITDA multiple. Delgado explains that the enterprise value is determined by the market value of equity, total debt, cash, and short-term investment. He also points out an alternative measure of the enterprise value which considers the free cash flow to the firm.

Delgado suggests that we need to subtract the investments on working capital and PPE when calculating the free cash flow to the firm. He further explains the reason we do so is due to the interest tax shield that the investments on working capital and PPE would create. Therefore, by excluding the investments on working capital and PPE, the EV-to-EBITDA ratio is not affected by the interest tax shield and is a consistently-defined ratio.

Is Delgado's suggestion on the reason that the investment on working capital and PPE are excluded justifiable? Why?

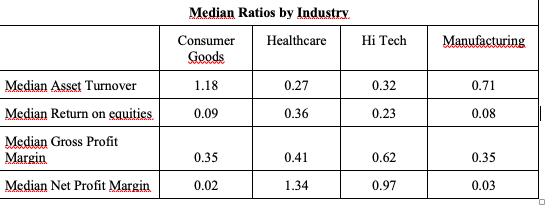

Paulie Gualtieri is a financial analyst in the industrial-trend research team in the research department of IFA. Gualtieri is assigned to examine the sensitivity of each industry's operational performance on the changes in monetary policy. He collects the median asset turnover, return on equities, net profit margin, and gross profit margin of four industries from the most recent annual accounting reports and tabulates the data in the table shown below.

Today, one of Gualtieri's colleagues, Silvio Dante, reports his prediction on the future Federal Funds Rate in the U.S. in the coming months. Dante suggests an increasing Federal Funds Rate in the coming months. According to Dante's report and the data he collects, Gualtieri suggests that the Earnings Per Share (EPS) of healthcare and high-tech companies would be less affected by the increasing interest rate in the next year than consumer goods companies and manufacturing companies.

Is Gualtieri's suggestion on the healthcare and high-tech companies' future EPS justifiable? Why?

5M Co. Profitability Ratios 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Adjust 0.13 0.15 0.14 0.16 0.19 0.22 0.30 0.32 0.34 0.39 0.42 0.43 ed ROA ROE 0.27 0.28 0.27 0.26 0.26 0.32 0.39 0.46 0.44 0.50 0.46 0.47 ROC 0.36 0.32 0.31 0.29 0.27 0.24 0.23 0.22 0.21 0.19 0.17 0.15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Yes Cameron Tuckers recommendation on 5M Cos profitability is justifiable Heres why DecliningReturn on Assets ROA ROA measures how efficiently a company uses its assets to generate profits A decreasin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started