Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can any one help me with 9C-15 which I posted in my last question? Thank you 9-12. Mahjong, Inc. has identified the following two mutually

Can any one help me with 9C-15 which I posted in my last question?

Can any one help me with 9C-15 which I posted in my last question?

Thank you

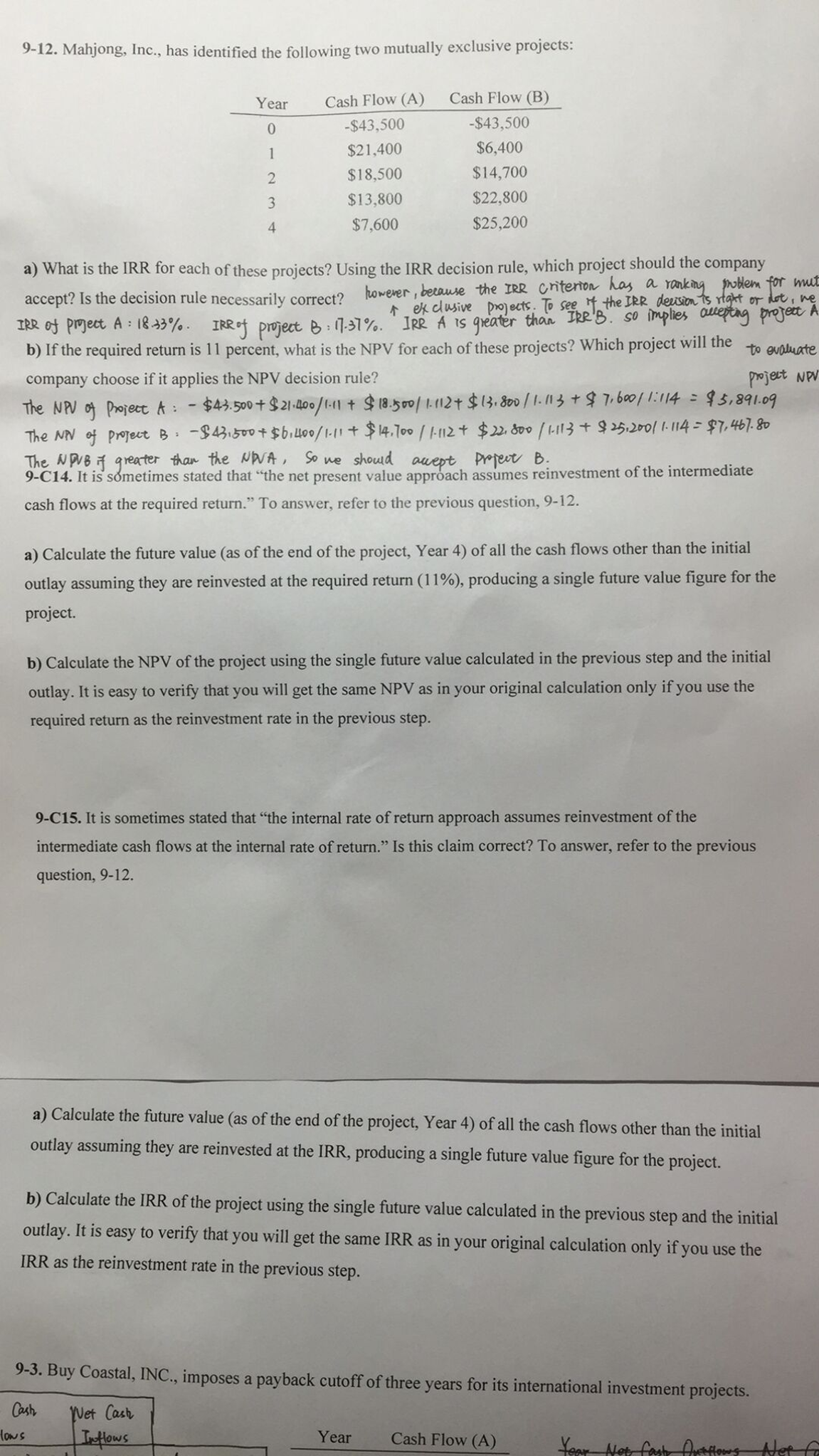

9-12. Mahjong, Inc. has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) $43,500 -$43,500 $21,400 $6,400 $18,500 $14,700 $13,800 $22,800 $7,600 $25,200 a) What is the IRR for each of these projects? Using the IRR decision rule, which project should the company has a ranking problem for accept? Is the decision necessarily correct? rule forever, because the IRR criterion mut Nek clusive projects. To see the IRR devision The 'B. p! IRR of Prmject A : 1 & 3% . IRR of project B 1. Jke A greater than Is so b) If the required return is 11 percent, what is the NPV for each of these projects? Which project will the , ple company choose if it applies the NPV decision rule? prject NPW The Nn a project A : - $43.50 +$21400/1and + $ 18spot at $ 13, Boro / MI3 + $ 7boLN4509 The NN of project 1-4 vot sbroof 11 + $47oo I-M2+ $ Boo hM3+ 25, of 1-4 $7,457So B The NPB greater than the NRA, So we shoud aucept Prjet net Reinvestment of the intermediate cash flows at the required return. To answer, refer to he previous question, 9-12. a) Calculate the future value (as of the end of the project, Year 4) of all the cash flows other than the initial outlay assuming they are reinvested at the required return (11%, producing a single future value figure for the project. b) Calculate the NPV of the project using the single future value calculated in the previous step and the initial outlay. It is easy to verify that you will get the same NPV as in your original calculation only if you use the required return as the reinvestment rate in the previous step. 9-C15. It is sometimes stated that the internal rate of return approach assumes reinvestment of the intermediate cash flows at the internal rate of return. Is this claim correct? To answer, refer to the previous question, 9-12. a) Calculate the future value (as of the end of the project, Year 4) of all the cash flows other than the initial outlay assuming they are reinvested at the IRR, producing a single future value figure for the project, b) Calculate the IRR of the project using the single future value calculated in the previous step and the initial itlay. It is easy to verify that you will get the same IRR as in your original calculation only if you use the IRR as the reinvestment rate in the previous step. 9-3. Buy Coastal, INC, imposes a payback cutoff of three years for its international investment projects. Bash let Cash los Year Cash Flow (A)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started