Can anyone help me and show me how to do the last two charts? (Also help tell me if the ones ive done so far are correct...?)

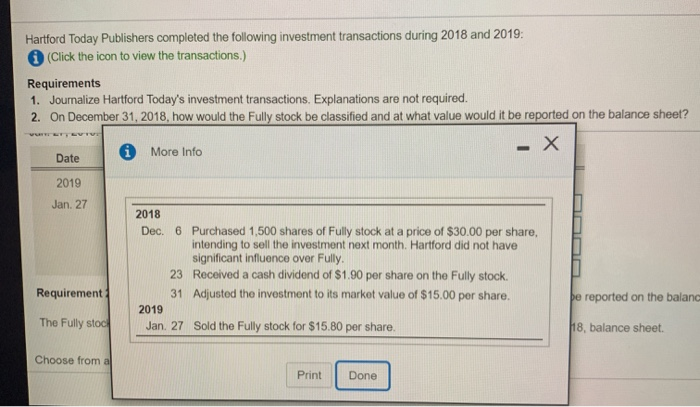

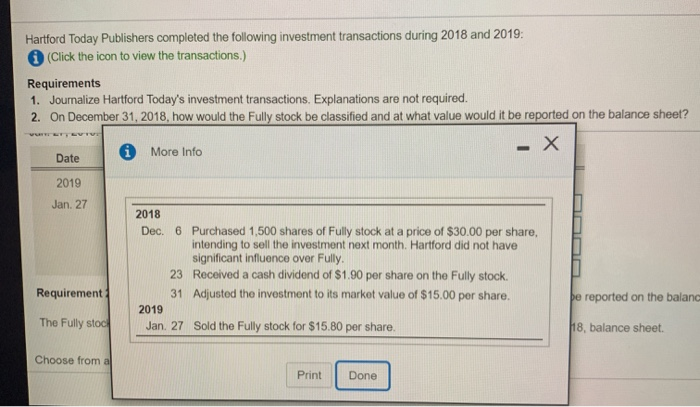

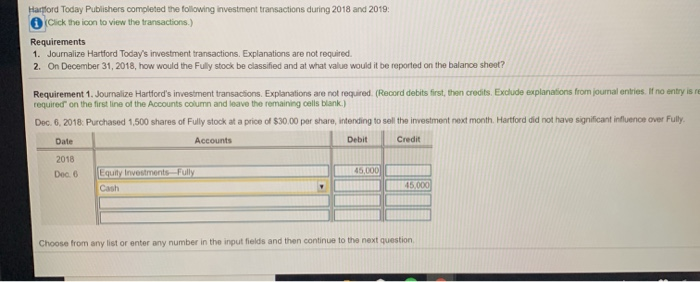

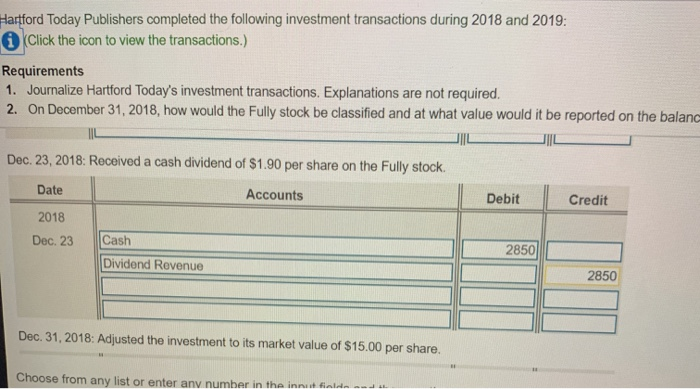

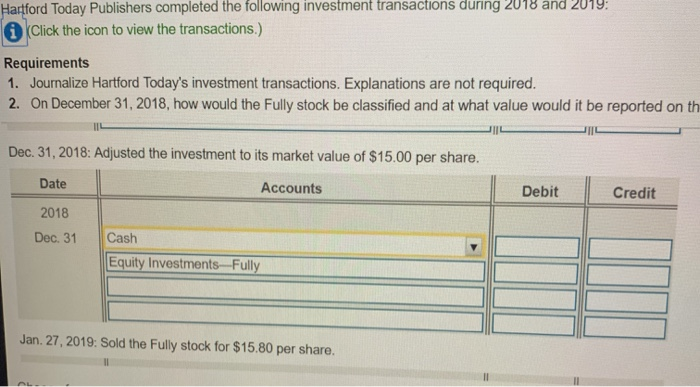

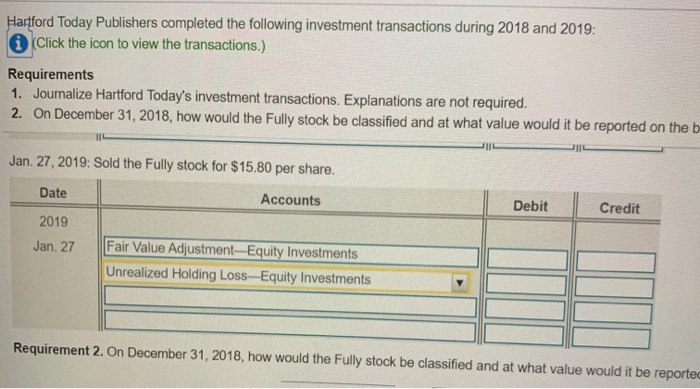

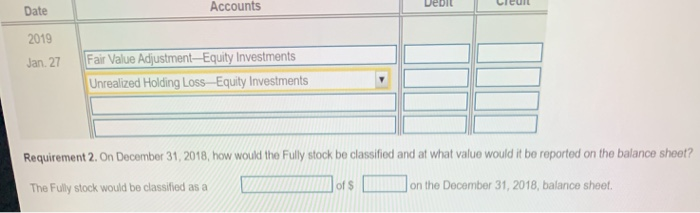

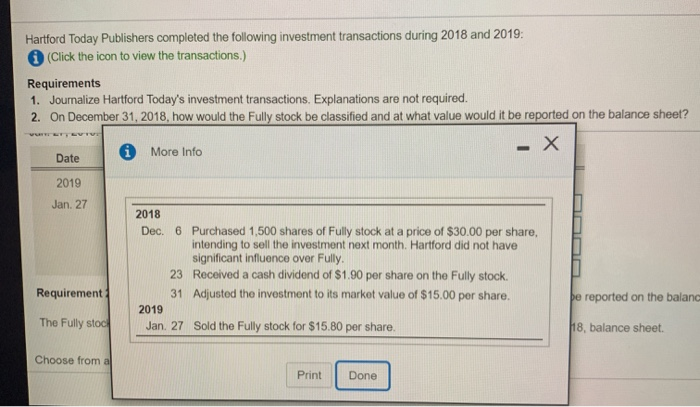

Hartford Today Publishers completed the following investment transactions during 2018 and 2019: (Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2018, how would the Fully stock be classified and at what value would it be reported on the balance sheet? Date * More Info 2019 Jan. 27 2018 Dec. 6 Purchased 1,500 shares of Fully stock at a price of $30.00 per share, intending to sell the investment next month. Hartford did not have significant influence over Fully. 23 Received a cash dividend of $1.90 per share on the Fully stock. 31 Adjusted the investment to its market value of $15.00 per share. 2019 Jan. 27 Sold the Fully stock for $15.80 per share. Requirement be reported on the baland The Fully stod 118, balance sheet Choose from a Print Done Hartford Today Publishers completed the following investment transactions during 2018 and 2019: Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2018, how would the Fully stock be classified and at what value would it be reported on the balanc Dec. 23, 2018: Received a cash dividend of $1.90 per share on the Fully stock. Date Accounts 2018 Dec. 23 Cash Debit Credit 2850 Dividend Revenue 2850 Dec 31, 2018: Adjusted the investment to its market value of $15.00 per share. Choose from any list or enter any number in the initialde --- Hartford Today Publishers completed the following investment transactions during 2018 and 2014: A Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2018, how would the Fully stock be classified and at what value would it be reported on th Dec 31, 2018: Adjusted the investment to its market value of $15.00 per share. Date Accounts Debit Credit 2018 Dec. 31 Cash Equity Investments-Fully Jan 27, 2019: Sold the Fully stock for $15.80 per share. Hartford Today Publishers completed the following investment transactions during 2018 and 2019: (Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2018, how would the Fully stock be classified and at what value would it be reported on the b Jan 27, 2019: Sold the Fully stock for $15.80 per share. Date Accounts Debit Credit 2019 Jan. 27 Fair Value Adjustment-Equity Investments Unrealized Holding Loss-Equity Investments Requirement 2. On December 31, 2018, how would the Fully stock be classified and at what value would it be reporte Accounts Webil Lleure Date 2019 Jan. 27 Fair Value Adjustment-Equity Investments Unrealized Holding Loss - Equity Investments Requirement 2. On December 31, 2018, how would the Fully stock be classified and at what value would it be reported on the balance sheet? The Fully stock would be classified as a of $ on the December 31, 2018, balance sheet