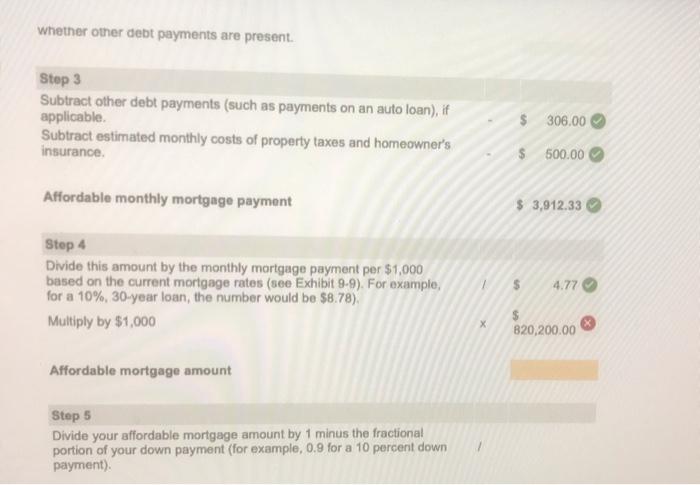

can anyone help me out i been soo confused by step 4

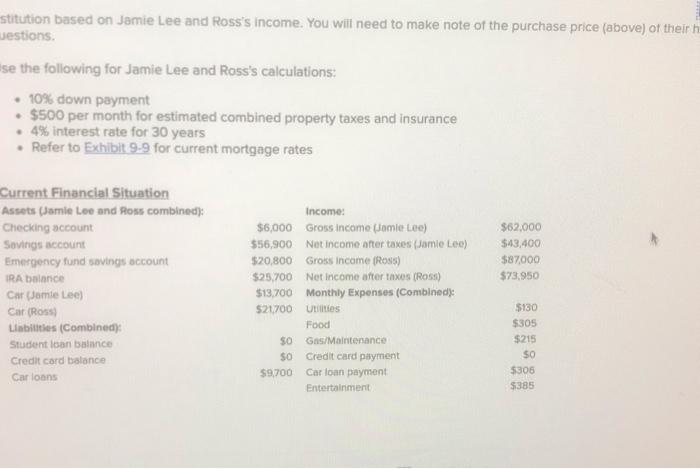

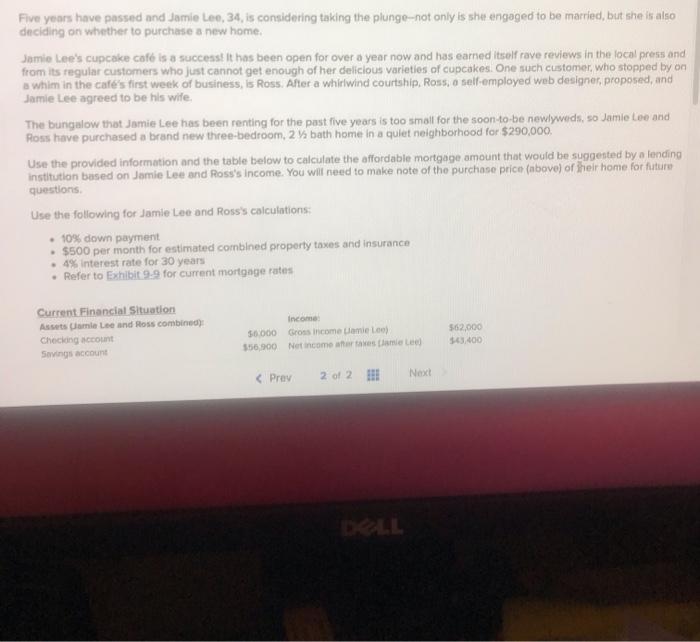

stitution based on Jamie Lee and Ross's income. You will need to make note of the purchase price (above) of their h Jestions. se the following for Jamie Lee and Ross's calculations: 10% down payment $500 per month for estimated combined property taxes and insurance .4% interest rate for 30 years Refer to Exhibit 9-9 for current mortgage rates Current Financial Situation Assets Jamie Lee and Ross combined): Checking account Savings account Emergency fund savings account IRA balance Car Jamie Lee Car (Ross Liabilities (Combined): Student loan balance Credit card balance $62,000 $43,400 587000 $73,950 Income: $6,000 Gross income (Jamie Lee) $56,900 Net Income after taxes (Jamie Lee) $20,800 Gross income (Ross) $25.700 Net Income after taxes (Ross) $13,700 Monthly Expenses (Combined): $21700 Utilities Food $0 Gas/Maintenance $0 Credit card payment $9.700 Car loan payment Entertainment $130 $305 $215 $0 5306 $385 Car loans Five years have passed and Jamie Lee, 34, is considering taking the plunge-not only is she engaged to be married, but she is also deciding on whether to purchase a new home. Jamie Lee's cupcake caf is a success it has been open for over a year now and has earned itself rave reviews in the local press and from its regular customers who just cannot get enough of her delicious varieties of cupcakes. One such customer who stopped by on a whim in the cafe's first week of business, is Ross. After a whirlwind courtship. Ross, a self-employed web designer, proposed, and Jamie Lee agreed to be his wife, The bungalow that Jamie Lee has been renting for the past five years is too small for the soon-to-be newlyweds, so Jamie Lee and Ross have purchased a brand new three bedroom, 2 bath home in a quiet neighborhood for $290,000 Use the provided information and the table below to calculate the affordable mortgage amount that would be suggested by a lending institution based on Jamie Lee and Ross's Income. You will need to make note of the purchase price (above) or their home for future questions Use the following for Jamie Lee and Ross's calculations 10% down payment $500 per month for estimated combined property taxes and insurance .4% interest rate for 30 years Refer to Exhibit 9.9 for current mortgage rates Current Financial Situation Assets amie Lee and Ross combined) Checking account Savings account Income 50.000 Gross income Lamie Lee) $56.900 Net income taxes (lamele $62,000 543400 Next