Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can anyone help me solve this question? Thank you! Question 4 (25 marks) John Xu established Happy John Company in late 2018. He targets to

Can anyone help me solve this question? Thank you!

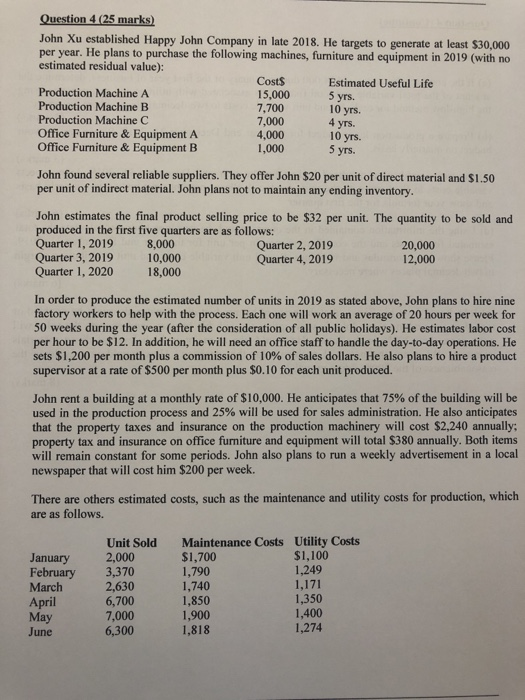

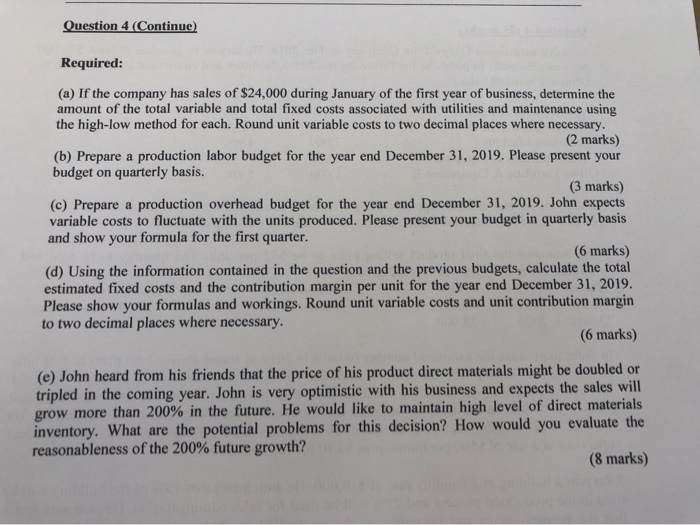

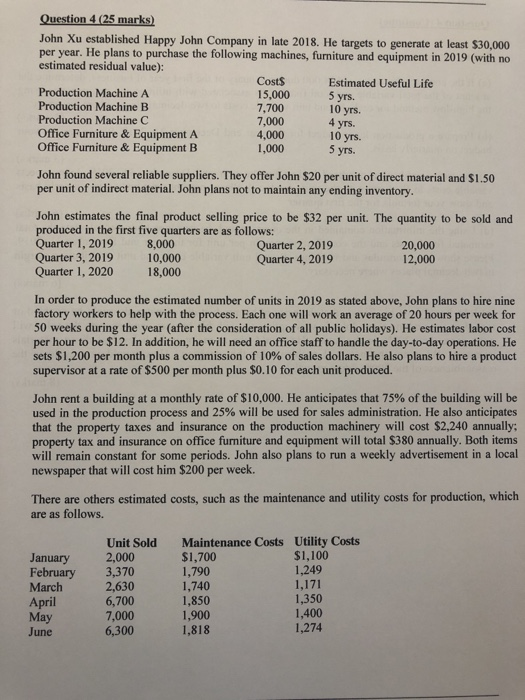

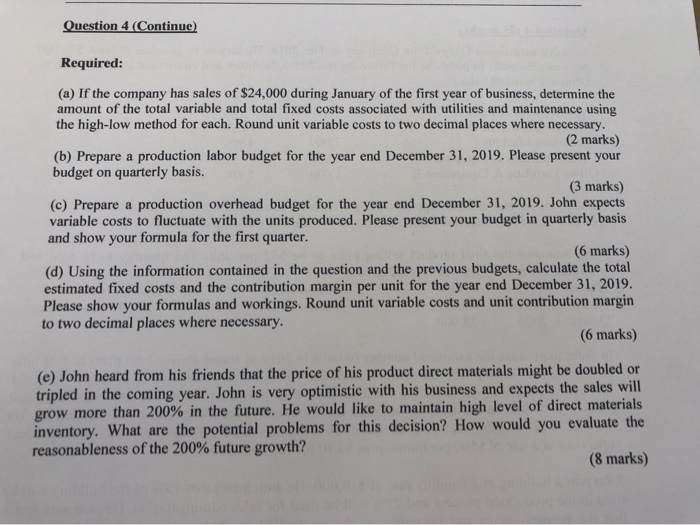

Question 4 (25 marks) John Xu established Happy John Company in late 2018. He targets to generate at least $30,000 per year. He plans to purchase the following machines, furniture and equipment in 2019 (with no estimated residual value): Cost$ Estimated Useful Life Production Machine A 15,000 5 yrs. Production Machine B 7,700 10 yrs. Production Machine C 7,000 4 yrs. Office Furniture & Equipment A 4,000 10 yrs. Office Furniture & Equipment B 1,000 5 yrs. John found several reliable suppliers. They offer John $20 per unit of direct material and $1.50 per unit of indirect material. John plans not to maintain any ending inventory. John estimates the final product selling price to be $32 per unit. The quantity to be sold and produced in the first five quarters are as follows: Quarter 1, 2019 8.000 Quarter 2, 2019 20,000 Quarter 3, 2019 10,000 Quarter 4, 2019 12,000 Quarter 1, 2020 18.000 In order to produce the estimated number of units in 2019 as stated above, John plans to hire ning factory workers to help with the process. Each one will work an average of 20 hours per week for 50 weeks during the year after the consideration of all public holidays). He estimates labor cost per hour to be $12. In addition, he will need an office staff to handle the day-to-day operations. He sets $1,200 per month plus a commission of 10% of sales dollars. He also plans to hire a product supervisor at a rate of $500 per month plus $0.10 for each unit produced. John rent a building at a monthly rate of $10,000. He anticipates that 75% of the building will be used in the production process and 25% will be used for sales administration. He also anticipates that the property taxes and insurance on the production machinery will cost $2.240 annually: property tax and insurance on office furniture and equipment will total $380 annually. Both items will remain constant for some periods. John also plans to run a weekly advertisement in a local newspaper that will cost him $200 per week. There are others estimated costs, such as the maintenance and utility costs for production, which are as follows. January February March Unit Sold 2,000 3,370 2,630 6,700 7,000 6,300 Maintenance Costs Utility Costs $1,700 $1,100 1,790 1,249 1,740 1,171 1,850 1,350 1,900 1,400 1,818 1,274 April May June Question 4 (Continue) Required: (a) If the company has sales of $24,000 during January of the first year of business, determine the amount of the total variable and total fixed costs associated with utilities and maintenance using the high-low method for each. Round unit variable costs to two decimal places where necessary. (2 marks) (b) Prepare a production labor budget for the year end December 31, 2019. Please present your budget on quarterly basis. (3 marks) (c) Prepare a production overhead budget for the year end December 31, 2019. John expects variable costs to fluctuate with the units produced. Please present your budget in quarterly basis and show your formula for the first quarter. (6 marks) (d) Using the information contained in the question and the previous budgets, calculate the total estimated fixed costs and the contribution margin per unit for the year end December 31, 2019. Please show your formulas and workings. Round unit variable costs and unit contribution margin to two decimal places where necessary. (6 marks) (e) John heard from his friends that the price of his product direct materials might be doubled or tripled in the coming year. John is very optimistic with his business and expects the sales will grow more than 200% in the future. He would like to maintain high level of direct materials inventory. What are the potential problems for this decision? How would you evaluate the reasonableness of the 200% future growth? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started