can anyone help with these?

can anyone help with these?

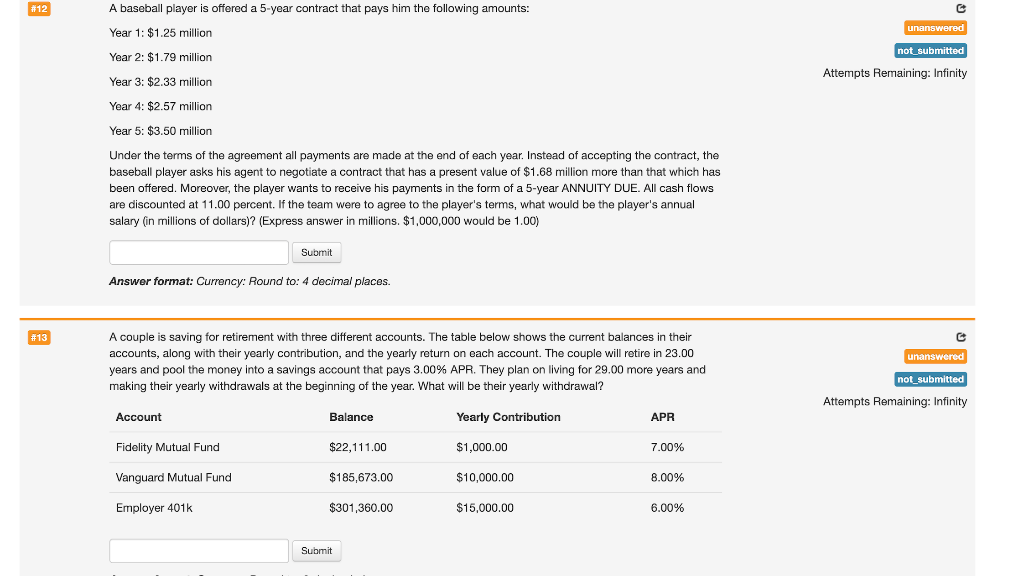

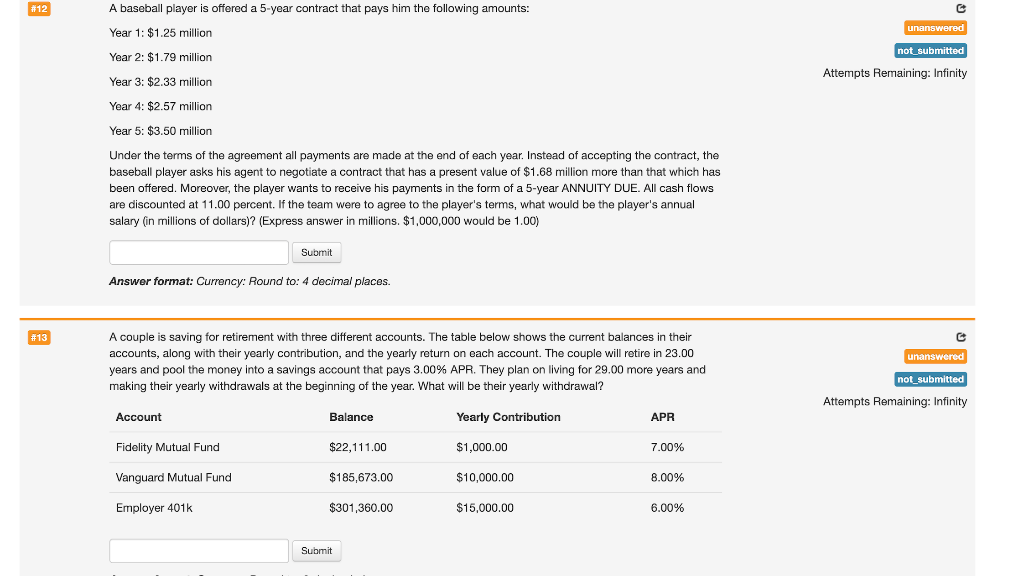

# #12 A baseball player is offered a 5-year contract that pays him the following amounts: Year 1: $1.25 million unanswered not_submitted Year 2: $1.79 million Attempts Remaining: Infinity Year 3: $2.33 million Year 4: $2.57 million 4 Year 5: $3.50 million 5 Under the terms of the agreement all payments are made at the end of each year. Instead of accepting the contract, the baseball player asks his agent to negotiate a contract that has a present value of $1.68 million more than that which has been offered. Moreover, the player wants to receive his payments in the form of a 5-year ANNUITY DUE. All cash flows are discounted at 11.00 percent. If the team were to agree to the player's terms, what would be the player's annual salary (in millions of dollars)? (Express answer in millions. $1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 4 decimal places. #13 A couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 23.00 years and pool the money into a savings account that pays 3.00% APR. They plan on living for 29.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal? unanswered not_submitted Attempts Remaining: Infinity Account Balance Yearly Contribution APR Fidelity Mutual Fund $22,111.00 $1,000.00 7.00% Vanguard Mutual Fund $185,673.00 $10,000.00 8.00% Employer 401k $301,360.00 $15,000.00 6.00% Submit # #12 A baseball player is offered a 5-year contract that pays him the following amounts: Year 1: $1.25 million unanswered not_submitted Year 2: $1.79 million Attempts Remaining: Infinity Year 3: $2.33 million Year 4: $2.57 million 4 Year 5: $3.50 million 5 Under the terms of the agreement all payments are made at the end of each year. Instead of accepting the contract, the baseball player asks his agent to negotiate a contract that has a present value of $1.68 million more than that which has been offered. Moreover, the player wants to receive his payments in the form of a 5-year ANNUITY DUE. All cash flows are discounted at 11.00 percent. If the team were to agree to the player's terms, what would be the player's annual salary (in millions of dollars)? (Express answer in millions. $1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 4 decimal places. #13 A couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 23.00 years and pool the money into a savings account that pays 3.00% APR. They plan on living for 29.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal? unanswered not_submitted Attempts Remaining: Infinity Account Balance Yearly Contribution APR Fidelity Mutual Fund $22,111.00 $1,000.00 7.00% Vanguard Mutual Fund $185,673.00 $10,000.00 8.00% Employer 401k $301,360.00 $15,000.00 6.00% Submit

can anyone help with these?

can anyone help with these?