Question

Can anyone help with this in Excel format plz? I will rate if the answer is correct! Thanks! The Contribution Margin (Variable Costing Income Statement

Can anyone help with this in Excel format plz? I will rate if the answer is correct! Thanks!

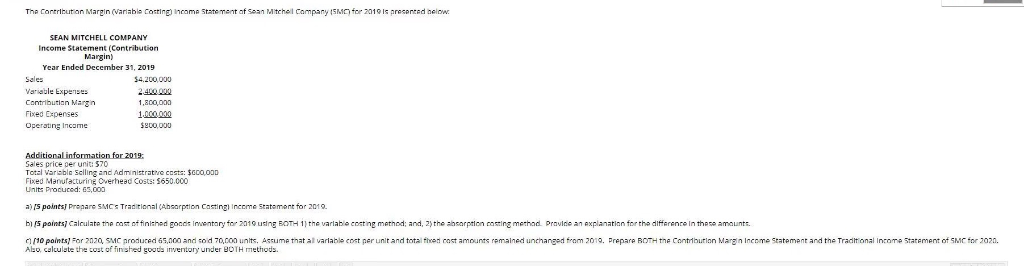

The Contribution Margin (Variable Costing Income Statement of San Mitchel Company (SM) for 2019 is presented below.

SEAN MITCHELL COMPANY

Income Statement (Contribution Margin)

Year Ended December 31, 2019

Sales $4.200.000

Variable expenses Contribution Margin 1,800,000

Fixed expenses 1.000.000

Operating Income $800.000

Additional information for 2019:

Sales price per unit: 570

Total Variable Selling and Administrative costs: $600,000

Fixed Manufacturing Overhead Costs: 5650.000

Units Produced: 65,000

a)Prepare SMCS Traditional (Absorption Casting income Statement for 2010

b)Calculate the cast of finished goods Inventory for 2016 using BOTH 1) the variable costing method; and, 2. the absorption casting method Dravide an explanation for the difference in these amounts.

c) for 2020, SMC produced 65.000 and sod 70,000 units. Assume that al variable cost per unit and total the cast amounts remained unchanged from 2010. Prepare BOTH the Contribution Margin Income Statement and the Traditional Income Statement of SMC for 2020. Also, calculate the cost of finished goods inventory under BOTH methods.

The Contribution Margin (Variable Costing income Statement of San Mitchel Company (SM) for 2019 is presented below. SEAN MITCHELL COMPANY Income Statement (Contribution Margin) Year Ended December 31, 2019 Sales $4.200.000 Variable expenses Contribution Margin 1,800,000 Fixed expenses 1.000.000 Operating Income $800.000 Additional information for 2019: Sales price per unit: 570 Total Variable Selling and Administrative costs: $600,000 Fixed Manufacturing Overhead Costs: 5650.000 Units Produced: 65,000 a) s points Prepare SMCS Traditional (Absorption Casting income Statement for 2010 b15 points Calculate the cast of finished goods Inventory for 2016 using BOTH 1) the variable costing method; and, 2the shorption casting method Dravide an explanation for the difference in these amounts. 1/10 points for 2020, SMC produced 65.000 and sod 70,000 units. Assume that al variable cost per unit and total the cast amounts remained unchanged from 2010. Prepare BOTH the Contribution Margin Income Statement and the Traditional Income Statement of SMC for 2020. Also calculate the cost of hished you inventory under BOTH methodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started