Question: Can anyone look at this case study. I am lost. You are consulting an apartment complex owner on how to renovate a 30 unit apartment

Can anyone look at this case study. I am lost.

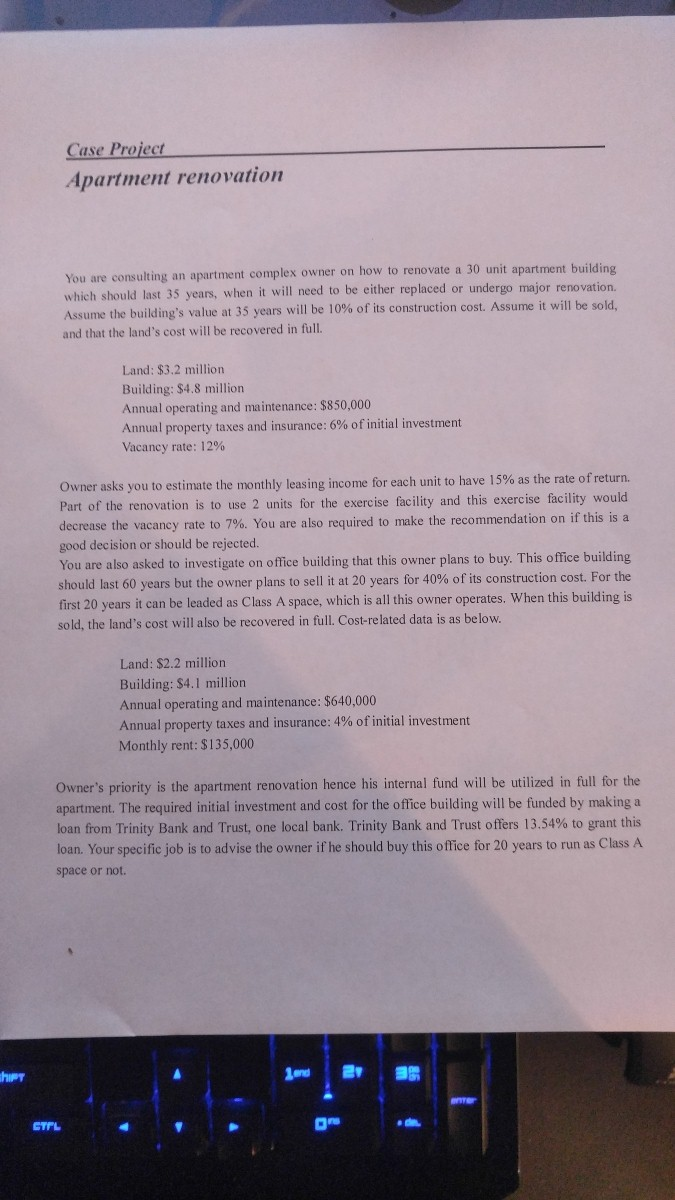

You are consulting an apartment complex owner on how to renovate a 30 unit apartment building which should last 35 years, when it will need to be either replaced or undergo major renovation. Assume the building's value at 35 years will be 10% of its construction cost. Assume it will be sold, and that the land's cost will be recovered in full. Land: $3.2 million Building: $4.8 million Annual operating and maintenance: $850,000 Annual property taxes and insurance: 6% of initial investment Vacancy rate: 12% Owner asks you to estimate the monthly leasing income for each unit to have 15% as the rate of return. Part of the renovation is to use 2 units for the exercise facility and this exercise facility would decrease the vacancy rate to 7%. You are also required to make the recommendation on if this is a good decision or should be rejected. You are also asked to investigate on office building that this owner plans to buy. This office building should last 60 years but the owner plans to sell it at 20 years for 40% of its construction cost. For the first 20 years it can be leaded as Class A space, which is all this owner operates. When this building is sold, the land's cost will also be recovered in full. Cost-related data is as below. Land: $2.2 million Building: $4.1 million Annual operating and maintenance: $640,000 Annual property taxes and insurance: 4% of initial investment Monthly rent: $135,000 Owner's priority is the apartment renovation hence his internal fund will be utilized in full for the apartment. The required initial investment and cost for the office building will be funded by making a loan from Trinity Bank and Trust, one local bank. Trinity Bank and Trust offers 13.54% to grant this loan. Your specific job is to advise the owner if he should buy this office for 20 years to run as Class A space or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts