Answered step by step

Verified Expert Solution

Question

1 Approved Answer

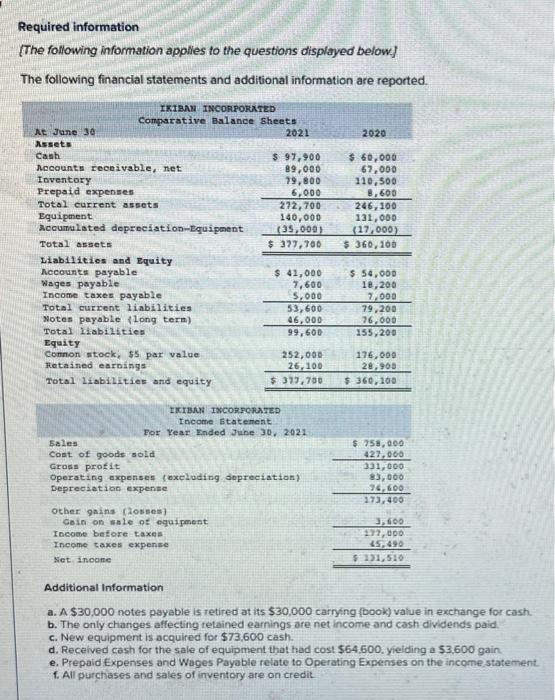

Can anyone solve this question pls? Required information [The following information applies to the questions displayed below.] The following financial statements and additional information are

Can anyone solve this question pls?

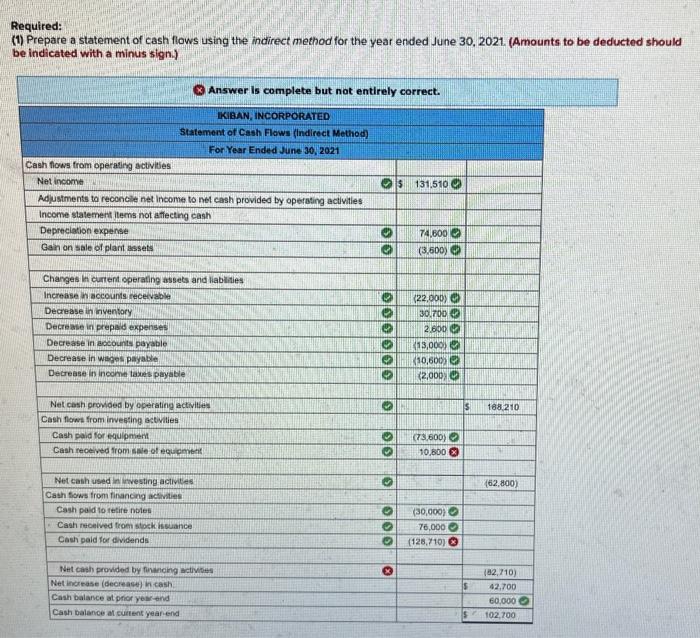

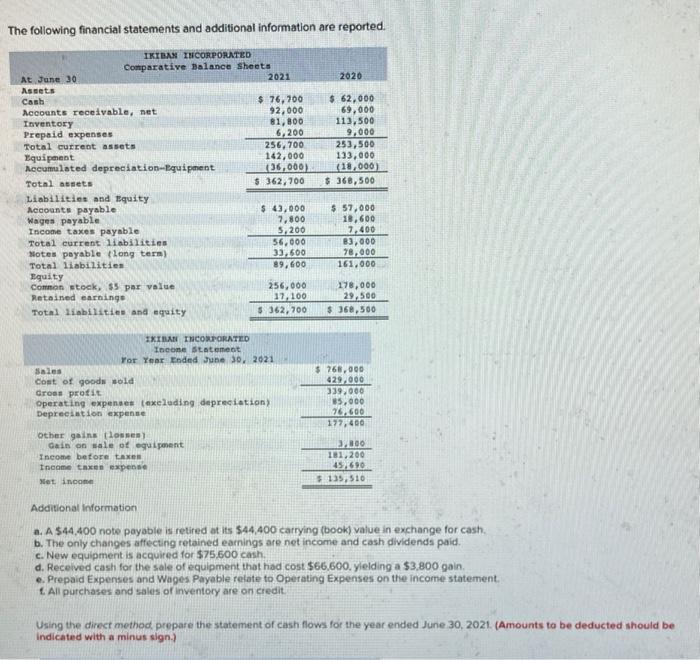

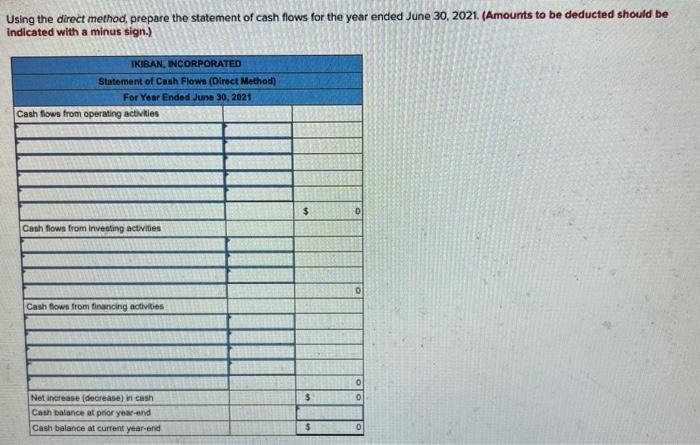

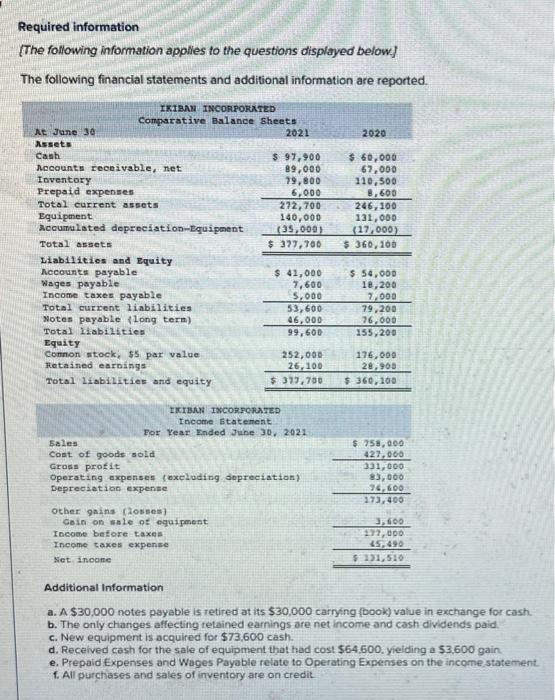

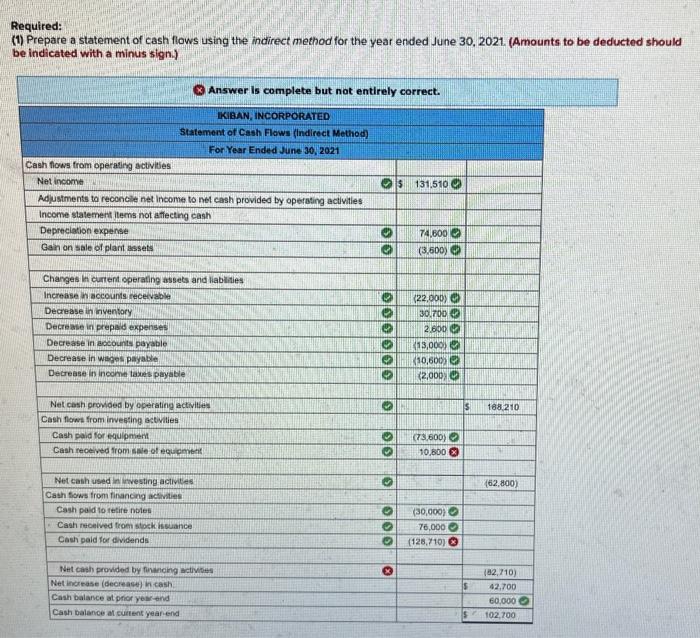

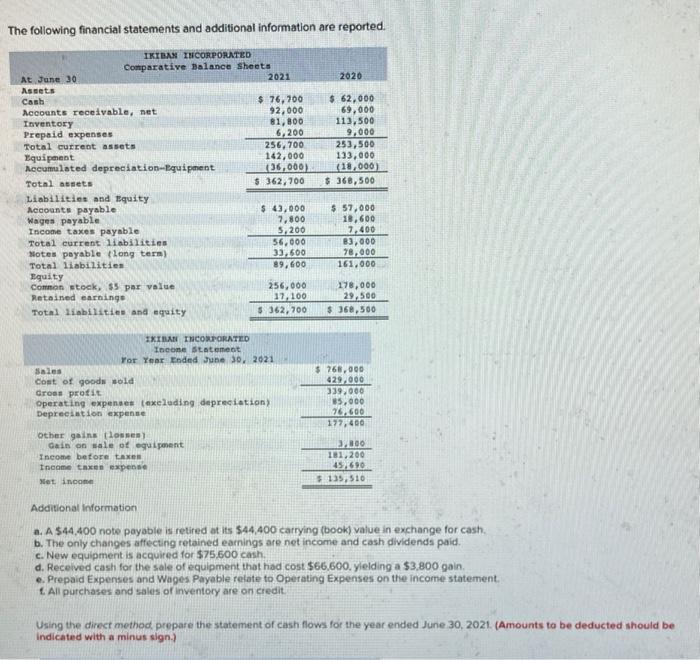

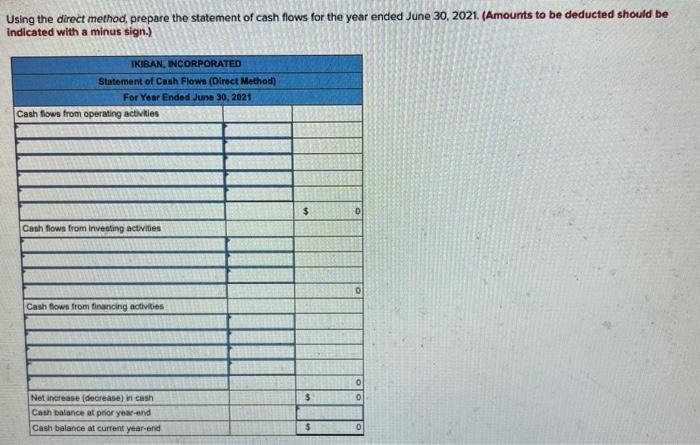

Required information [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. Additional Information a. A $30,000 notes payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting tetained eamings are net income and cash dividends paid. c. New equipment is acquired for $73,600 cash. d. Received cash for the sale of equipment that had cost $64,600, yieiding a $3,600 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement. f. All purchases and sales of inventory are on credit Required: (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2021. (Amounts to be deducted should be indicated with a minus sign.) The following financial statements and additional information are reported. Additional information a. A $44,400 note payable is retired at its $44,400 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $75,600cash. d. Received cash for the sale of equipment that had cost $66,600. ylelding a $3,800 gain. e. Prepaid Expenses and Wages Payable retate to Operating Expenses on the income statement. t. All purchases and sales of inventory are on credit. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2021. (Amounts to be deducted should be indicated with a minus sign.) Using the direct method, prepare the statement of cash flows for the year ended June 30,2021 . (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started