Answered step by step

Verified Expert Solution

Question

1 Approved Answer

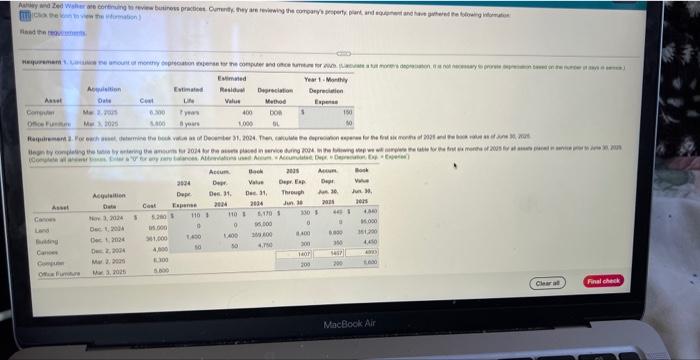

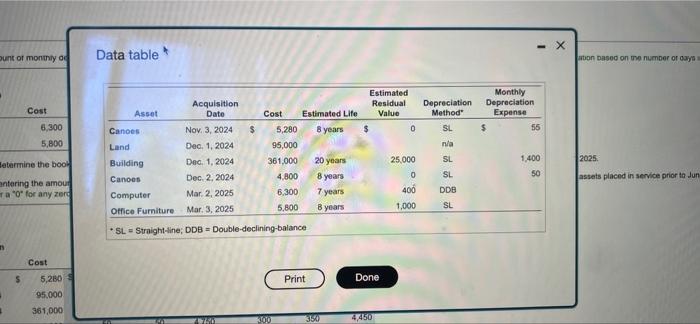

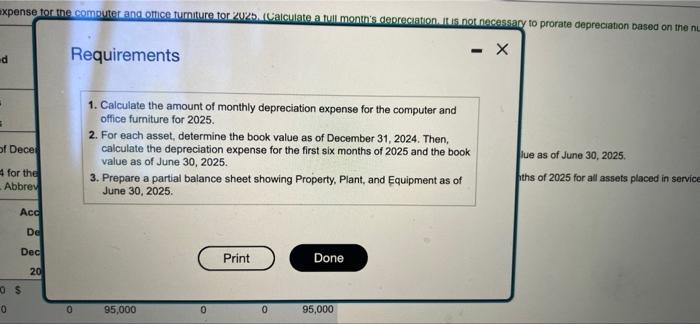

can comeone please show how to get the answers Ay and Zed Water are continuing to review business practices. Cumenty they are reviewing the company's

can comeone please show how to get the answers

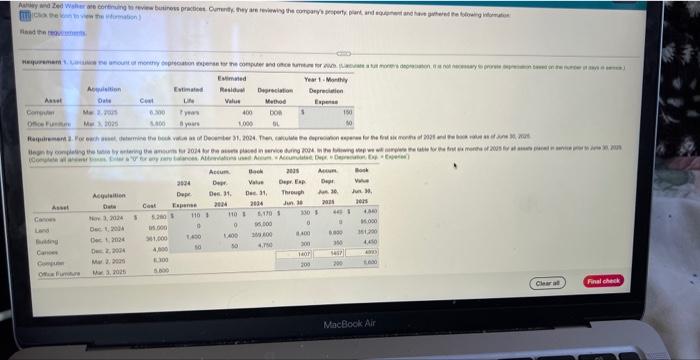

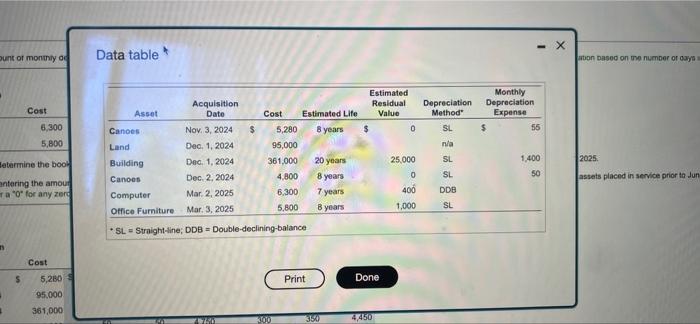

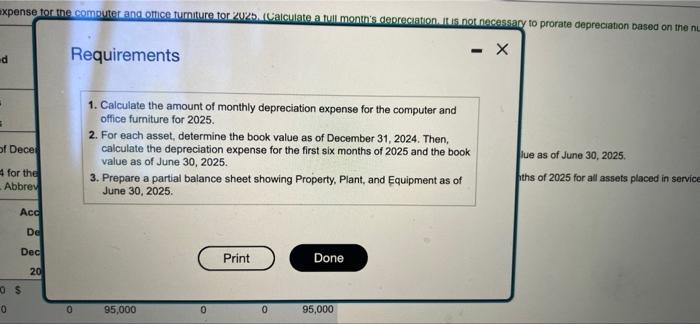

Ay and Zed Water are continuing to review business practices. Cumenty they are reviewing the company's property, plant, and equpment and have gathered the flowing in Chak view the formation) Read the rements. Requirement. Le me amount of money depreciation pense for the computer and once tumeure for at moederation is not necessary to proste pont) Estimated Year 1 Monthly Acquisition Date Residual Depreciation Method Depreciation Asset Estimated Life yeas Cont Expense Computer Ma 2.2005 6.300 400 DOB M32025 1.800 1,000 OL Requirement For each asset determine the book value as of December 31, 2024. Then, calculate the depreciation expens for the first six months of 2025 and the book value as of Jun Begn by completing the late by entering the amous for 2024 for the assets placed in service during 2004 in the (Complete ar for any ry balances Altreviations used AccumAccumulate Depe www.x200 wing step we womplete the table for the first six months of 2005 for at a cle Depo Exp Exp Book 2024 Depe Expense Accum Depr Des 31. 2024 Book Value Dec 31, 2024 2035 Au Depr. Exp Depr Through A 30. Jun 36 2025 Jun 30, 2025 Asset Cost 110 130 1 Nov 3, 2024 $ 5,170 95,000 0 Dec 1, 2014 350.00 8,400 Dec 12024 4,750 300 D2.2004 1407 Mar 2.200 200 Mar 3, 2025 Clear Final check Conos Land Boldog Canes Conque Off Future 5.200 05.000 361,000 4,000 1.300 6.800 0 1,400 10 110 $ 6 1,400 440 1 4340 $5,000 6.000 361,200 300 4,410 4900 200 MacBook Air B ount of monthly od Cost 6,300 5,800 letermine the book antering the amour ra "0" for any zero n Cost 1 $ 5,280 95,000 361,000 Data table Asset Acquisition Date Cost Estimated Life Canoes Nov. 3, 2024 8 years Land Dec. 1, 2024 5,280 95,000 361,000 4,800 Building Dec. 1, 2024 20 years Canoes Dec. 2, 2024 8 years Computer Mar. 2, 2025 6,300 7 years Office Furniture Mar. 3, 2025 5,800 8 years SL = traight-line; DDB Double-declining-balance Print 1.750 $ 300 350 Estimated Residual Value $ Done 4,450 0 25,000 0 400 1,000 Depreciation Method SL n/a SL SL DDB SL Monthly Depreciation Expense $ - X 55 1,400 50 ation based on the number of days 2025. assets placed in service prior to Jun expense for the computer and office furniture for 2025. (Calculate a full month's depreciation. It is not necessary to prorate depreciation based on the nu X Requirements d 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025. 2. For each asset, determine the book value as of December 31, 2024. Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30, 2025. lue as of June 30, 2025. ths of 2025 for all assets placed in service 3. Prepare a partial balance sheet showing Property, Plant, and Equipment as of June 30, 2025. Print Done 95,000 } = of Dece 4 for the Abbrev Acc De Dec 20 0 $ 0 0 0 0 95,000 Ay and Zed Water are continuing to review business practices. Cumenty they are reviewing the company's property, plant, and equpment and have gathered the flowing in Chak view the formation) Read the rements. Requirement. Le me amount of money depreciation pense for the computer and once tumeure for at moederation is not necessary to proste pont) Estimated Year 1 Monthly Acquisition Date Residual Depreciation Method Depreciation Asset Estimated Life yeas Cont Expense Computer Ma 2.2005 6.300 400 DOB M32025 1.800 1,000 OL Requirement For each asset determine the book value as of December 31, 2024. Then, calculate the depreciation expens for the first six months of 2025 and the book value as of Jun Begn by completing the late by entering the amous for 2024 for the assets placed in service during 2004 in the (Complete ar for any ry balances Altreviations used AccumAccumulate Depe www.x200 wing step we womplete the table for the first six months of 2005 for at a cle Depo Exp Exp Book 2024 Depe Expense Accum Depr Des 31. 2024 Book Value Dec 31, 2024 2035 Au Depr. Exp Depr Through A 30. Jun 36 2025 Jun 30, 2025 Asset Cost 110 130 1 Nov 3, 2024 $ 5,170 95,000 0 Dec 1, 2014 350.00 8,400 Dec 12024 4,750 300 D2.2004 1407 Mar 2.200 200 Mar 3, 2025 Clear Final check Conos Land Boldog Canes Conque Off Future 5.200 05.000 361,000 4,000 1.300 6.800 0 1,400 10 110 $ 6 1,400 440 1 4340 $5,000 6.000 361,200 300 4,410 4900 200 MacBook Air B ount of monthly od Cost 6,300 5,800 letermine the book antering the amour ra "0" for any zero n Cost 1 $ 5,280 95,000 361,000 Data table Asset Acquisition Date Cost Estimated Life Canoes Nov. 3, 2024 8 years Land Dec. 1, 2024 5,280 95,000 361,000 4,800 Building Dec. 1, 2024 20 years Canoes Dec. 2, 2024 8 years Computer Mar. 2, 2025 6,300 7 years Office Furniture Mar. 3, 2025 5,800 8 years SL = traight-line; DDB Double-declining-balance Print 1.750 $ 300 350 Estimated Residual Value $ Done 4,450 0 25,000 0 400 1,000 Depreciation Method SL n/a SL SL DDB SL Monthly Depreciation Expense $ - X 55 1,400 50 ation based on the number of days 2025. assets placed in service prior to Jun expense for the computer and office furniture for 2025. (Calculate a full month's depreciation. It is not necessary to prorate depreciation based on the nu X Requirements d 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025. 2. For each asset, determine the book value as of December 31, 2024. Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30, 2025. lue as of June 30, 2025. ths of 2025 for all assets placed in service 3. Prepare a partial balance sheet showing Property, Plant, and Equipment as of June 30, 2025. Print Done 95,000 } = of Dece 4 for the Abbrev Acc De Dec 20 0 $ 0 0 0 0 95,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started