Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can I get help answer this year 12 Accounting question about budget simple answer Post's Pillows Austin Post is about to start his own business

can I get help answer this year 12 Accounting question about budget

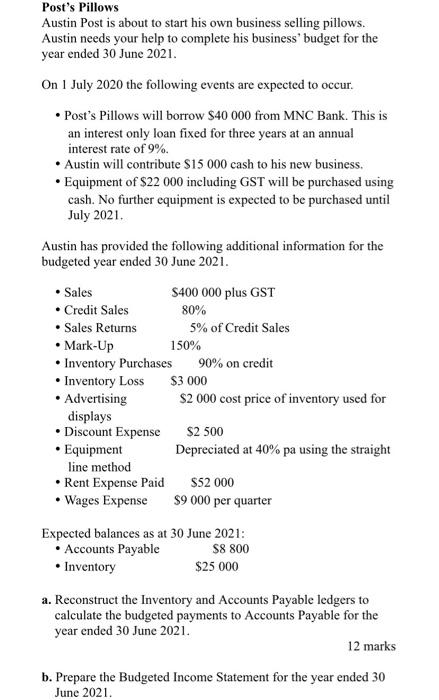

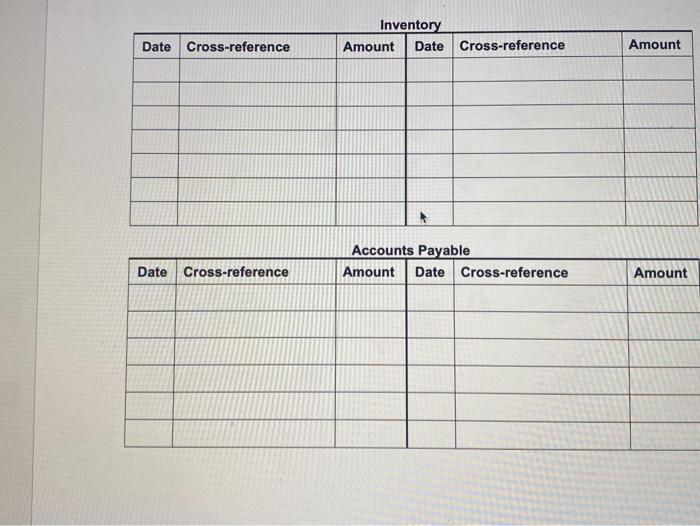

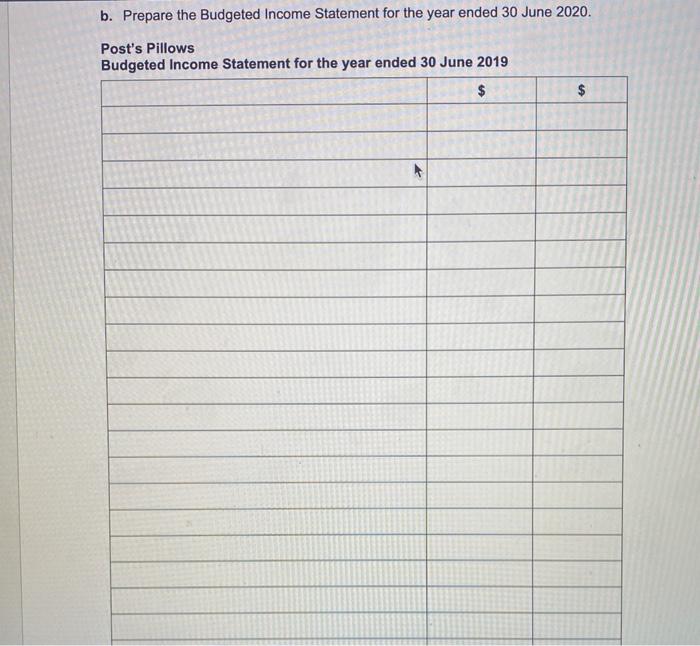

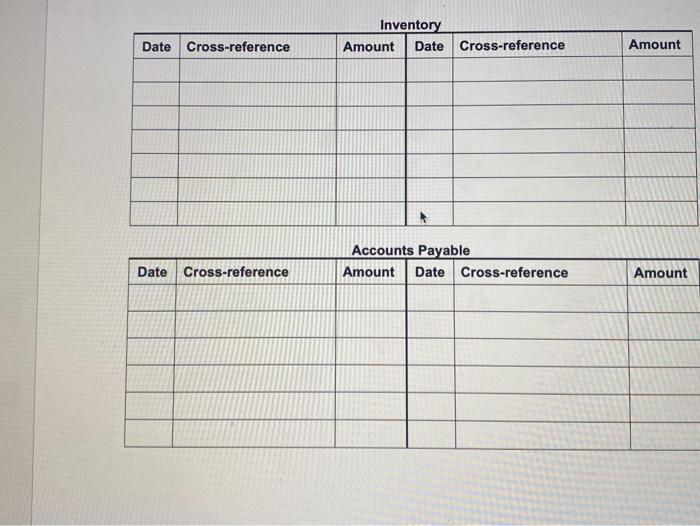

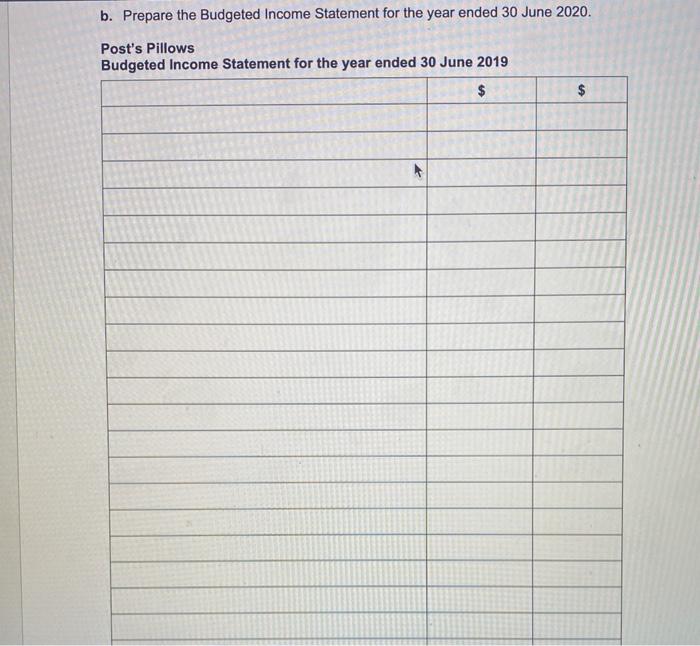

Post's Pillows Austin Post is about to start his own business selling pillows. Austin needs your help to complete his business" budget for the year ended 30 June 2021. On 1 July 2020 the following events are expected to occur. Post's Pillows will borrow $40 000 from MNC Bank. This is an interest only loan fixed for three years at an annual interest rate of 9%. Austin will contribute S15 000 cash to his new business, Equipment of $22 000 including GST will be purchased using cash. No further equipment is expected to be purchased until July 2021. Austin has provided the following additional information for the budgeted year ended 30 June 2021. Sales S400 000 plus GST Credit Sales 80% Sales Returns 5% of Credit Sales Mark-Up 150% Inventory Purchases 90% on credit Inventory Loss $3000 Advertising $2 000 cost price of inventory used for displays Discount Expense $2 500 Equipment Depreciated at 40% pa using the straight line method Rent Expense Paid S52 000 Wages Expense $9 000 per quarter Expected balances as at 30 June 2021: Accounts Payable $8 800 Inventory $25 000 a. Reconstruct the Inventory and Accounts Payable ledgers to calculate the budgeted payments to Accounts Payable for the year ended 30 June 2021. 12 marks b. Prepare the Budgeted Income Statement for the year ended 30 June 2021 Inventory Amount Date Date Cross-reference Cross-reference Amount Accounts Payable Amount Date Cross-reference Date Cross-reference Amount b. Prepare the Budgeted Income Statement for the year ended 30 June 2020. Post's Pillows Budgeted Income Statement for the year ended 30 June 2019 $ $ simple answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started