Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can I get help computing the net book value? The Ste Marie Division of Pacific Media Corporation just started operations. It purchased depreciable assets costing

can I get help computing the net book value?

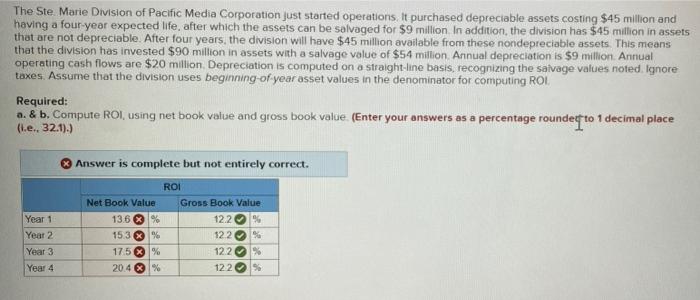

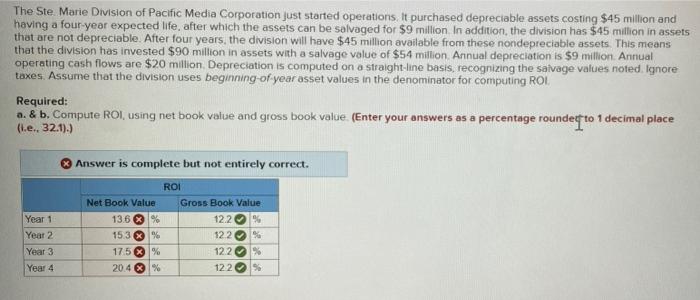

The Ste Marie Division of Pacific Media Corporation just started operations. It purchased depreciable assets costing $45 million and having a four-year expected life, after which the assets can be salvaged for $9 million. In addition, the division has $45 million in assets that are not depreciable. After four years, the division will have $45 million available from these nondepreciable assets. This means that the division has invested $90 million in assets with a salvage value of $54 million Annual depreciation is $9 million Annual operating cash flows are $20 million Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Assume that the division uses beginning of year asset values in the denominator for computing ROL Required: a. & b. Compute ROI, using net book value and gross book value. (Enter your answers as a percentage roundef to 1 decimal place (l... 32.1).) Answer is complete but not entirely correct. Year 1 Year 2 Year 3 Year 4 Net Book Value 13.6 % 15 3 X % 17.5 % % 20.4 % ROI Gross Book Value 12.2% 122 % 12.2% 122

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started