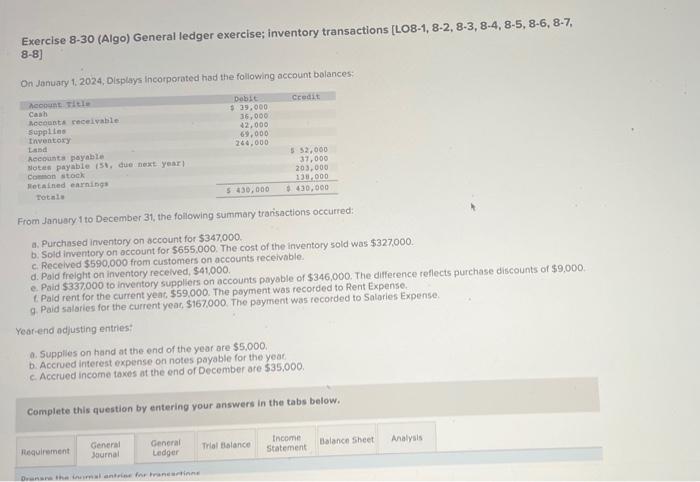

Question: Can I get help please Exercise 8-30 (Algo) General ledger exercise; inventory transactions [LO8-1, 8-2, 8-3, 8-4, 8-5, 8-6, 8-7, 88] On January 1, 2024,

![transactions [LO8-1, 8-2, 8-3, 8-4, 8-5, 8-6, 8-7, 88] On January 1,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671a29cd061b7_884671a29cc9943b.jpg)

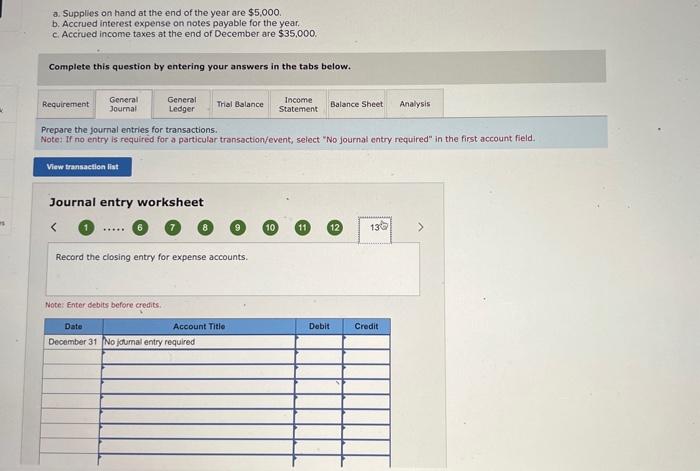

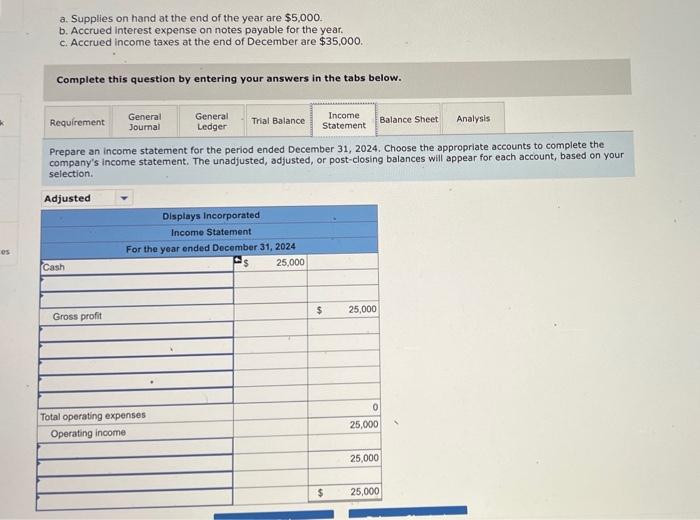

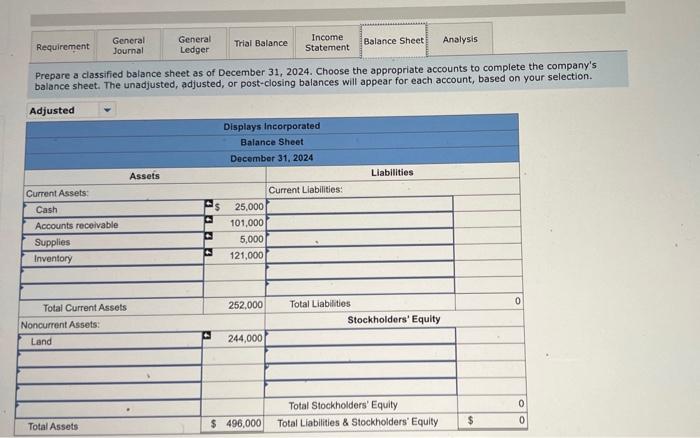

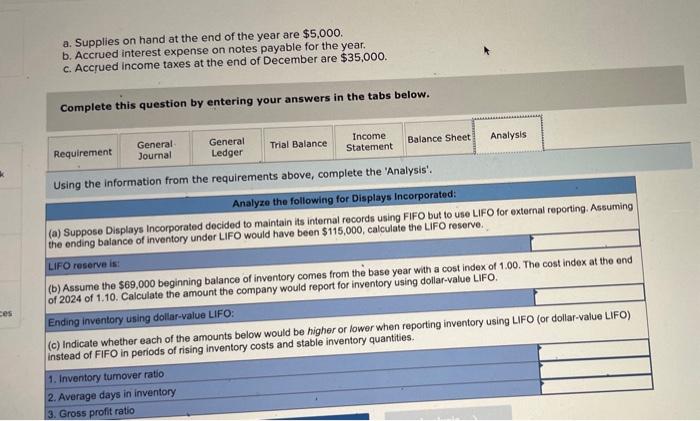

Exercise 8-30 (Algo) General ledger exercise; inventory transactions [LO8-1, 8-2, 8-3, 8-4, 8-5, 8-6, 8-7, 88] On January 1, 2024, Displays incorporated had the following account bolances: From January 1 to December 31 , the following summary tranisactions occurred: a. Purchased inventory on account for $347,000. b. Sold imentory on account for $655,000. The cost of the inventory sold was $327,000. c. Recelved $590,000 from customers on accounts recelvable. e. Paid $337,000 to inventory suppliers on accounts payable of $346,000. The difference reflects purchase discounts of $9,000 d. Paid freight on inventory received, $41,000. C. Paid rent for the curtent yeat, \$59,000. The poyment was recorded to Rent Expense. a. Paid salaries for the current yeat, $167.000. The poyment was recorded to Salaries Expense. Yearend odjusting entries: a. Suppiles on hand at the end of the year are $5,000 b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are 535.000 . Complete this question by entering your answers in the tabs below. a. Supplies on hand at the end of the year are $5,000. b. Accrued interest expense on notes payable for the year c. Acciued income taxes at the end of December are $35,000. Complete this question by entering your answers in the tabs below. Mrepare thejoumai entres for transamtions. Note: if no entry is required for a particular transaction/event, select "No journal entry requirnd" in the first account ileld. Prepare the joumal entries for transactions. a. Supplies on hand at the end of the year are $5,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $35,000. Complete this question by entering your answers in the tabs below. Prepare the journal entries for transactions. Note: If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field. a. Supplies on hand at the end of the year are $5,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $35,000. Complete this question by entering your answers in the tabs below. Prepare an income statement for the period ended December 31, 2024. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare a classified balance sheet as of December 31, 2024. Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. a. Supplies on hand at the end of the year are $5,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $35,000. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis'. Analyze the following for Displays incorporated: (a) Suppose Displays Incorporated decided to maintain its intemal records using FIFO but to use LIFO for external reporting. Assuming

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts