Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can I get help with 31 and 32 please Answer Save Question 31 (1 point) d Clarion Enterprises is considering investment in a new product

can I get help with 31 and 32 please

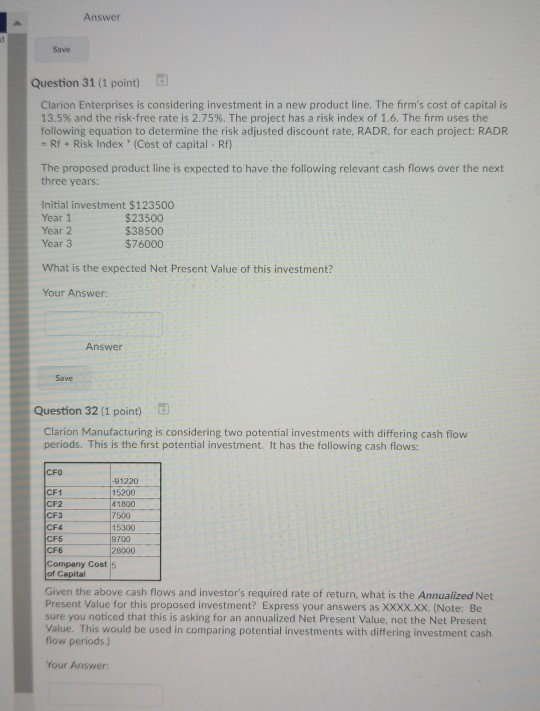

Answer Save Question 31 (1 point) d Clarion Enterprises is considering investment in a new product line. The firm's cost of capital is 13.5% and the risk-free rate is 2.75%. The project has a risk index of 1.6. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR Rf + Risk Index" (Cost of capital-Rf) The proposed product line is expected to have the following relevant cash flows over the next three years: Initial investment $123500 Year 1 Year 2 Year 3 $23500 $38500 $76000 What is the expected Net Present Value of this investment? Your Answer: Answer Save Question 32 (1 point) Clarion Manufacturing is considering two potential investments with differing cash flow periods. This is the first potential investment. It has the following cash flows: CFO CF1 CF2 CF3 CF4 CF5 CF6 Company Cost 5 of Capital 91220 15200 41800 7500 15300 9700 28000 Given the above cash flows and investor's required rate of return, what is the Annualized Net Present Value for this proposed investment? Express your answers as XXXX.XX. (Note: Be sure you noticed that this is asking for an annualized Net Present Value, not the Net Present Value. This would be used in comparing potential investments with differing investment cash flow periods.) YourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started