can i have answer with reason

can i have answer with reason

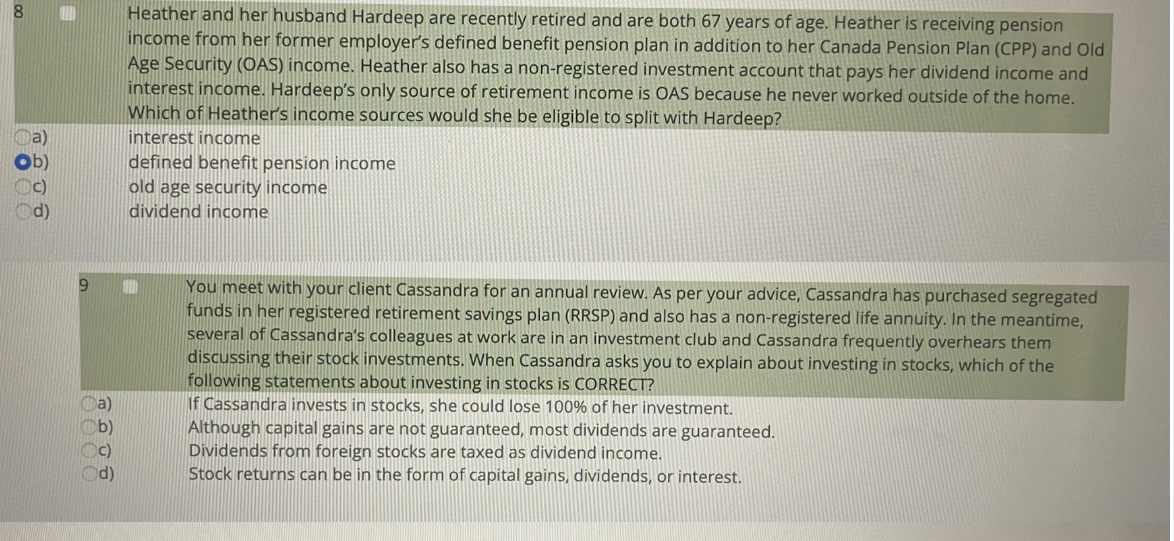

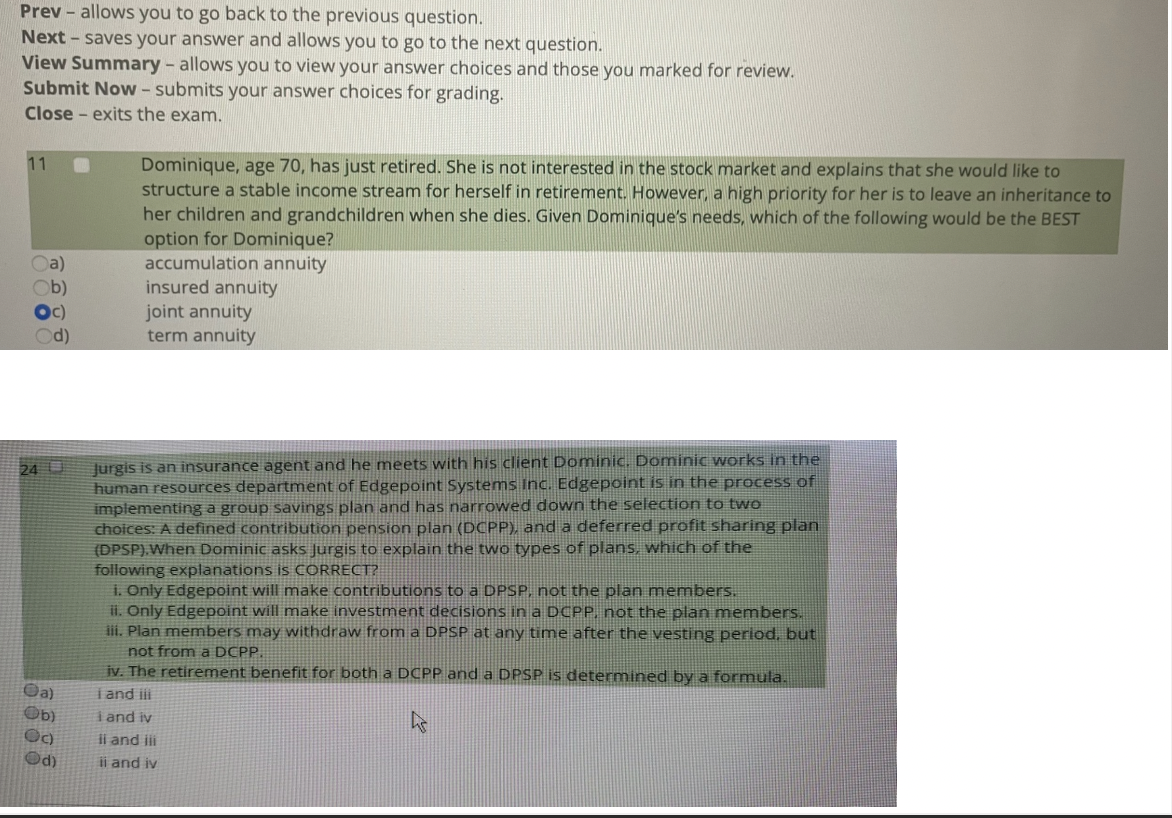

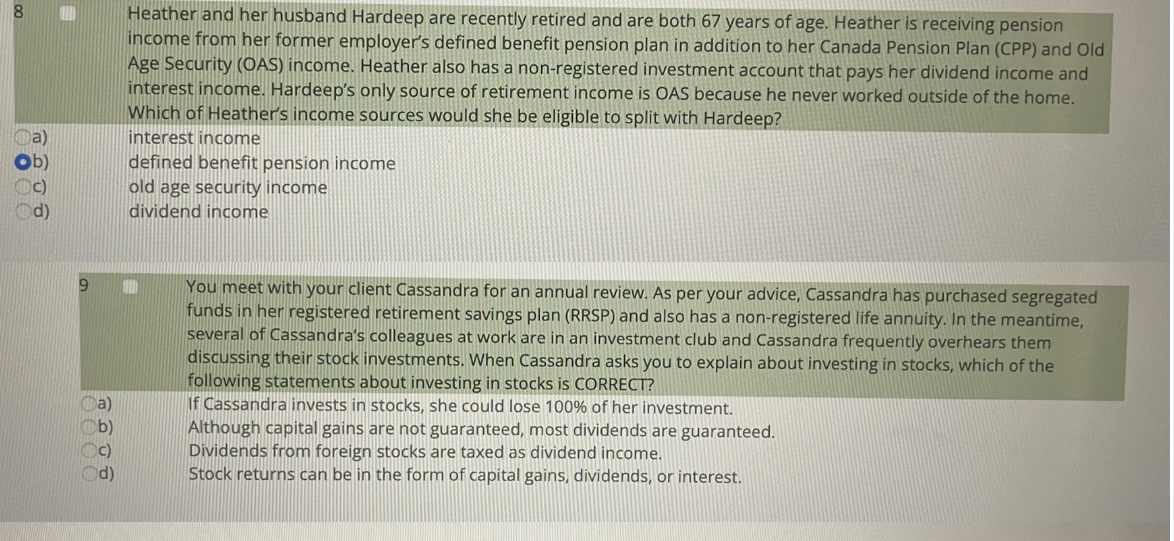

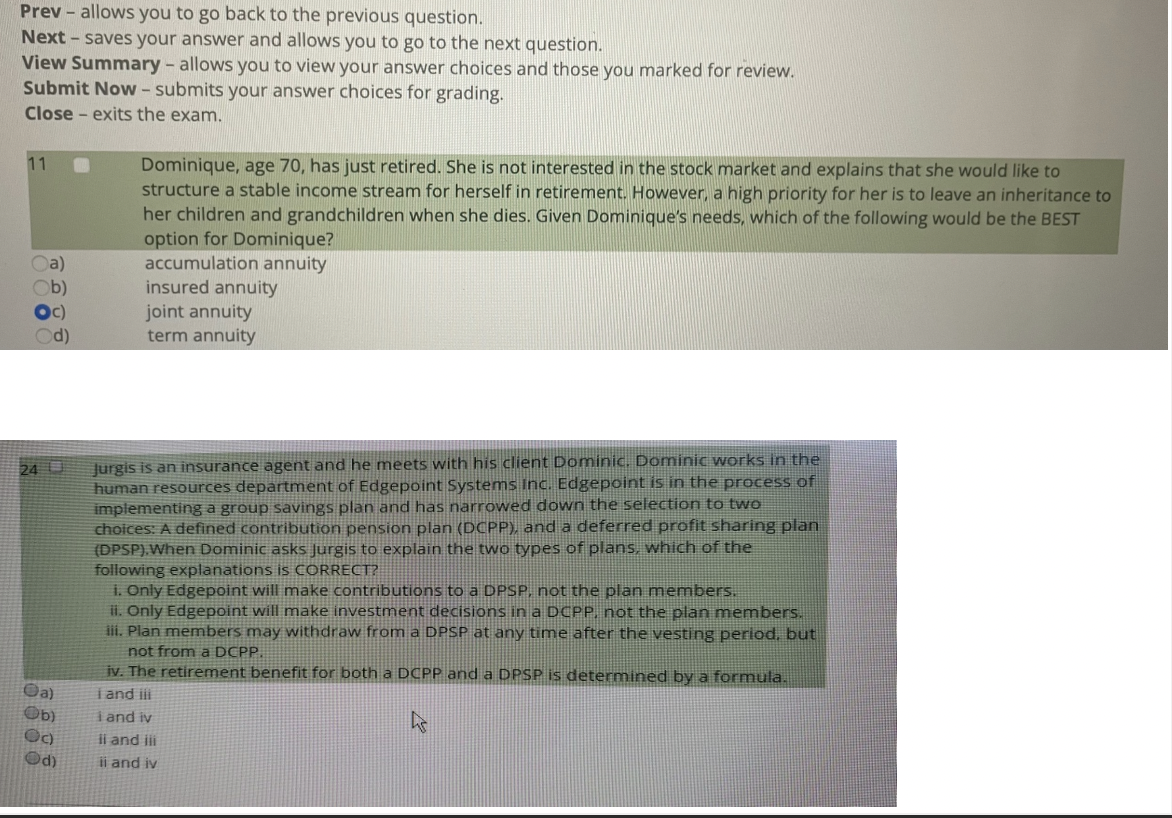

8 Heather and her husband Hardeep are recently retired and are both 67 years of age. Heather is receiving pension income from her former employer's defined benefit pension plan in addition to her Canada Pension Plan (CPP) and Old Age Security (OAS) income. Heather also has a non-registered investment account that pays her dividend income and interest income. Hardeep's only source of retirement income is OAS because he never worked outside of the home. Which of Heather's income sources would she be eligible to split with Hardeep? interest income defined benefit pension income old age security income dividend income a) Ob) c) d) 9 You meet with your client Cassandra for an annual review. As per your advice, Cassandra has purchased segregated funds in her registered retirement savings plan (RRSP) and also has a non-registered life annuity. In the meantime, several of Cassandra's colleagues at work are in an investment club and Cassandra frequently overhears them discussing their stock investments. When Cassandra asks you to explain about investing in stocks, which of the following statements about investing in stocks is CORRECT? If Cassandra invests in stocks, she could lose 100% of her investment. Although capital gains are not guaranteed, most dividends are guaranteed. Dividends from foreign stocks are taxed as dividend income. Stock returns can be in the form of capital gains, dividends, or interest. ) d) Prev - allows you to go back to the previous question. Next - saves your answer and allows you to go to the next question. View Summary - allows you to view your answer choices and those you marked for review. Submit Now - submits your answer choices for grading. Close - exits the exam. 11 Dominique, age 70, has just retired. She is not interested in the stock market and explains that she would like to structure a stable income stream for herself in retirement. However, a high priority for her is to leave an inheritance to her children and grandchildren when she dies. Given Dominique's needs, which of the following would be the BEST option for Dominique? accumulation annuity insured annuity joint annuity term annuity a) b) Oc) d) 24 Jurgis is an insurance agent and he meets with his client Dominic. Dominic works in the human resources department of Edgepoint Systems Inc. Edgepoint is in the process of implementing a group savings plan and has narrowed down the selection to two choices: A defined contribution pension plan (DCPP), and a deferred profit sharing plan (DPSP).When Dominic asks Jurgis to explain the two types of plans, which of the following explanations is CORRECT? i. Only Edgepoint will make contributions to a DPSP, not the plan members. ii. Only Edgepoint will make investment decisions in a DCPP, not the plan members. iii. Plan members may withdraw from a DPSP at any time after the vesting period, but not from a DCPP. iv. The retirement benefit for both a DCPP and a DPSP is determined by a formula. i and ili land iv he il and ili ii and iv a) Ob) Oc) d)

can i have answer with reason

can i have answer with reason