Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I have help finding the solutions to questions 11,12 and 13 on my practice guide. thank you 11) An analyst has the following information

Can I have help finding the solutions to questions 11,12 and 13 on my practice guide. thank you

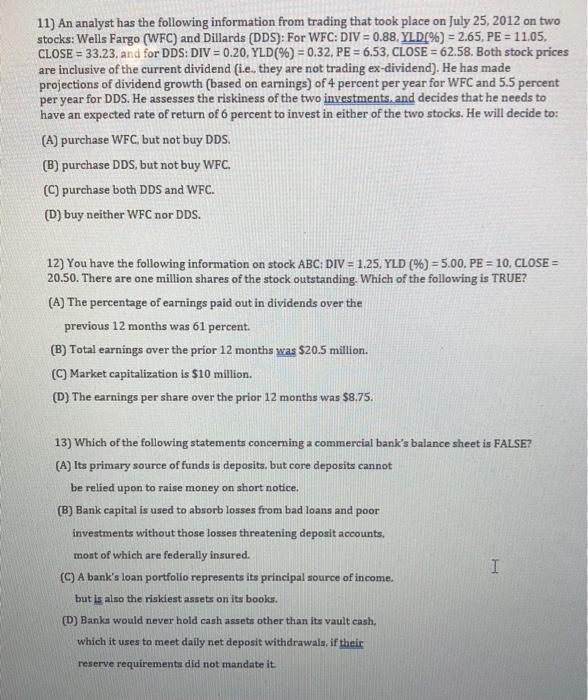

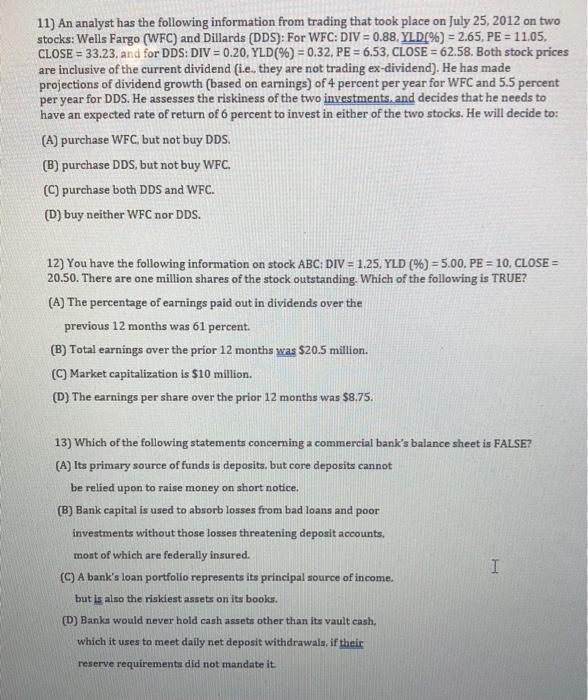

11) An analyst has the following information from trading that took place on July 25, 2012 on two stocks: Wells Fargo (WFC) and Dillards (DDS): For WFC: DIV = 0.88. YLD[%) = 2.65, PE = 11.05. CLOSE = 33.23, and for DDS: DIV = 0.20, YLD(%) = 0.32, PE = 6.53, CLOSE = 62.58. Both stock prices are inclusive of the current dividend (i.e., they are not trading ex-dividend). He has made projections of dividend growth (based on earnings) of 4 percent per year for WFC and 5.5 percent per year for DDS. He assesses the riskiness of the two investments, and decides that he needs to have an expected rate of return of 6 percent to invest in either of the two stocks. He will decide to: (A) purchase WFC, but not buy DDS. (B) purchase DDS, but not buy WFC. (C) purchase both DDS and WFC. (D) buy neither WFC nor DDS. ) 12) You have the following information on stock ABC DIV = 1.25. YLD (%) = 5.00. PE = 10. CLOSE = 20.50. There are one million shares of the stock outstanding. Which of the following is TRUE? (A) The percentage of earnings paid out in dividends over the previous 12 months was 61 percent. (B) Total earnings over the prior 12 months was $20.5 million. (0) Market capitalization is $10 million. (D) The earnings per share over the prior 12 months was $8.75. 13) Which of the following statements concerning a commercial bank's balance sheet is FALSE? (A) Its primary source of funds is deposits, but core deposits cannot be relied upon to raise money on short notice. (B) Bank capital is used to absorb losses from bad loans and poor investments without those losses threatening deposit accounts, most of which are federally insured. I (1) A bank's loan portfolio represents its principal source of income. but is also the riskiest assets on its books. (D) Banks would never hold cash assets other than its vault cash, which it uses to meet daily net deposit withdrawals, if their reserve requirements did not mandate it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started