Can I have help with question 1

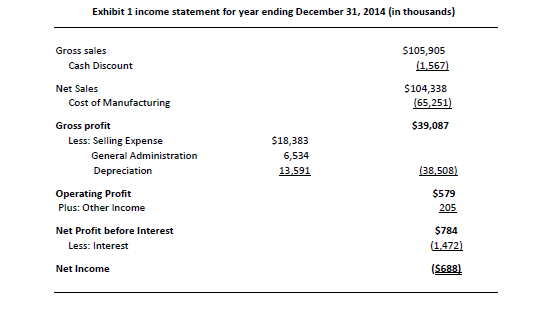

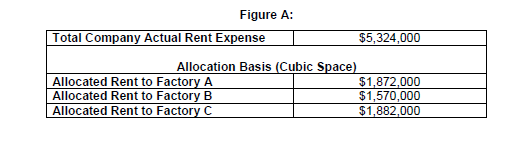

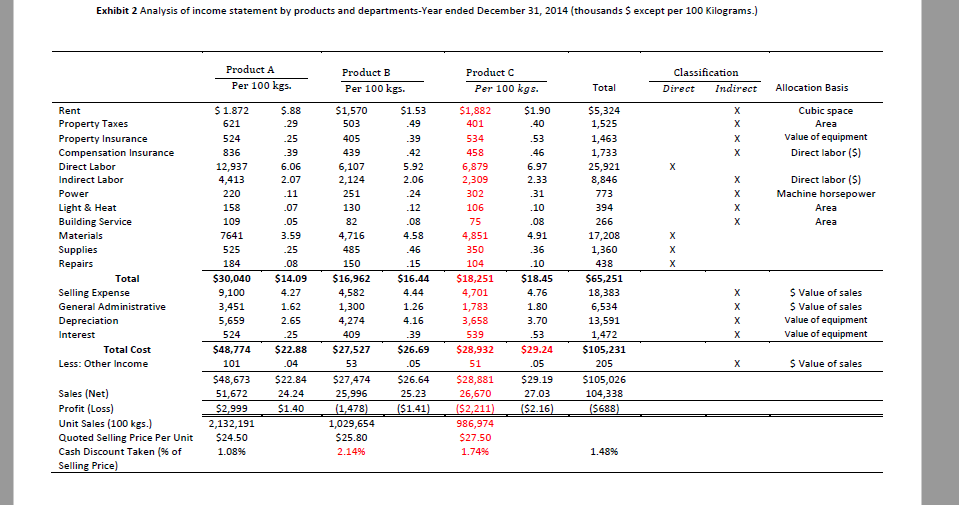

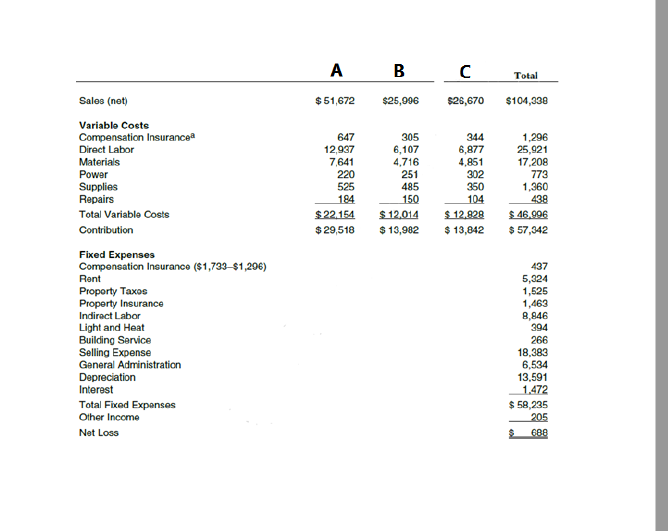

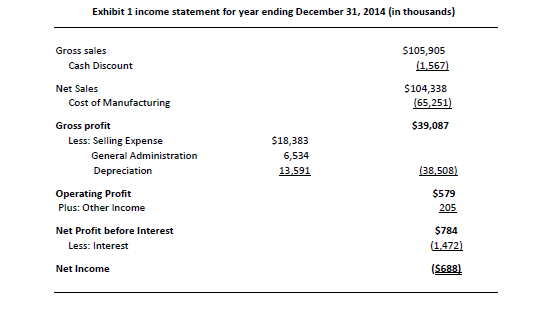

Question 1 ) Based on the 2014 income statement (Exhibits 1 & 2), do you agree with Majdy's decision to keep product C? Why?

After reading the case and relevant notes, students should go directly to Exhibit 2 where you can find sales and cost information related to three products. Where CM can be determined for A, B, C. Then you need to identify profit margin per unit then check if dropping will save fixed costs and check the CM. Then check, what consequences on the long-term can affect the company if you decide to drop or keep and recommend what to do.

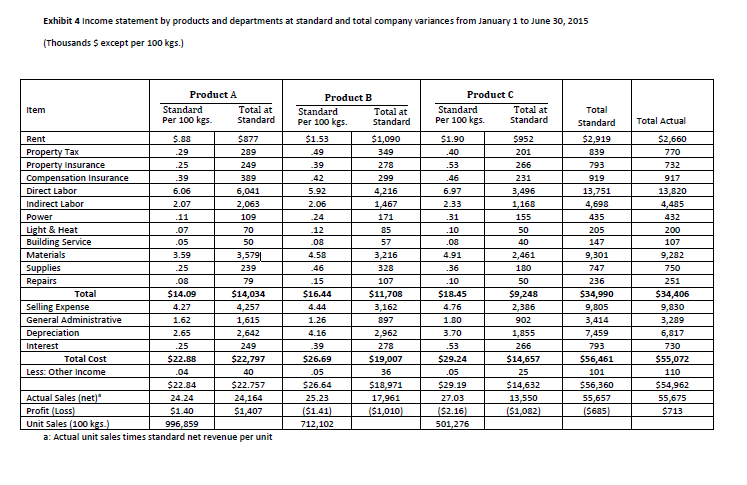

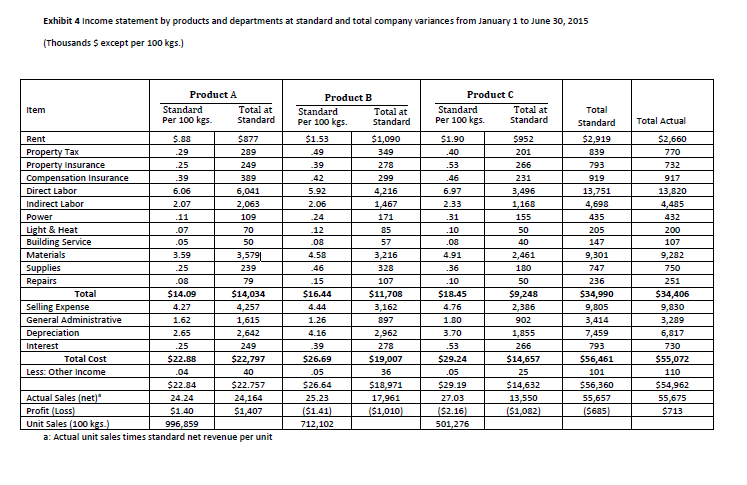

2. Should Mamoun Company lower as of January 1, 2016 its price of product A? To what price and why? 3. Why did Mamoun company improve profitability during the period January 1 to June 30, 2015? How useful was the data in Exhibit 4 for the purpose of this analysis? 4. Why is it important that Mamoun company has an effective cost system? What is your overall appraisal of the companys cost system and its use in reports to management? List the strengths and weaknesses of this system and its related reports for the purposes management uses the systems output. What recommendations, if any, would you make to Majdy regarding the companys cost accounting system and its related reports?

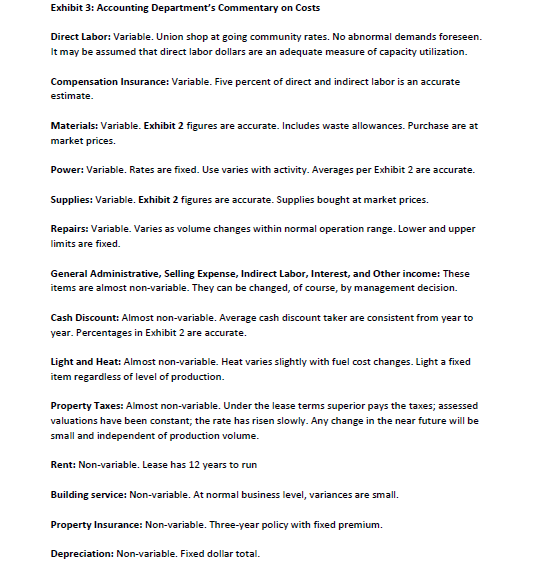

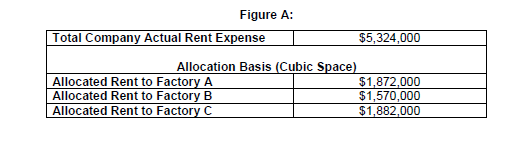

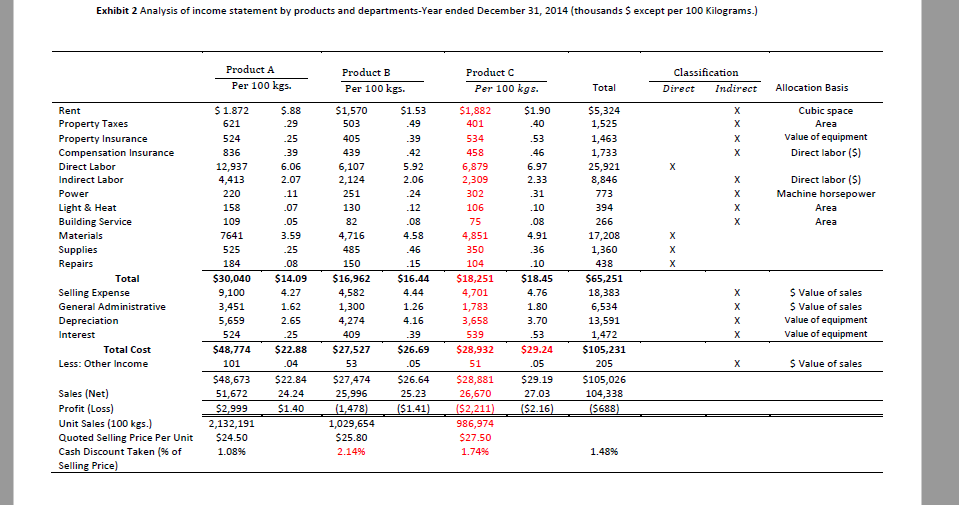

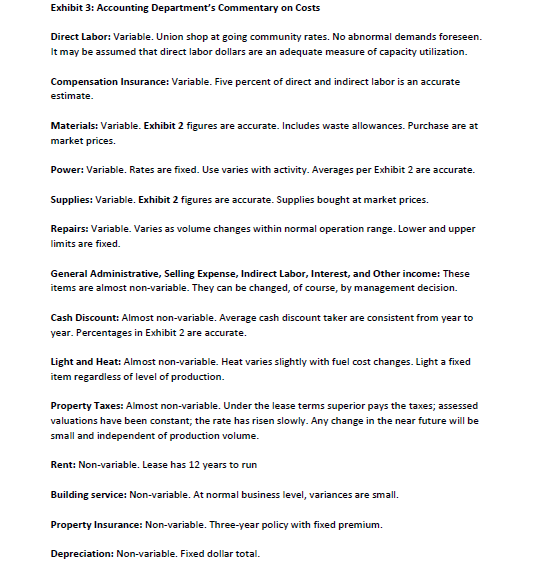

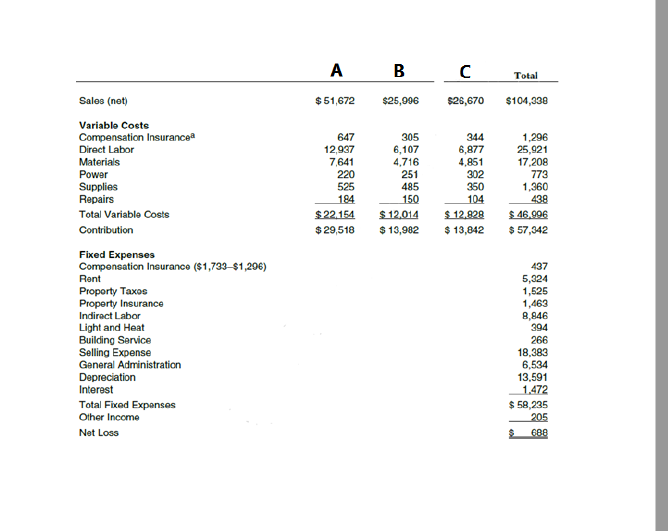

Exhibit 1 income statement for year ending December 31, 2014 (in thousands) $105,905 (1.567 $104,338 (65,251) $39,087 Gross sales Cash Discount Net Sales Cost of Manufacturing Gross profit Less: Selling Expense General Administration Depreciation Operating Profit Plus: Other Income Net Profit before Interest Less: Interest $18,383 6,534 13.591 (38,508) $579 205 $784 (1.472) Net Income (6688) Figure A: Total Company Actual Rent Expense $5,324,000 Allocation Basis (Cubic Space) Allocated Rent to Factory A $1,872.000 Allocated Rent to Factory B $1,570,000 Allocated Rent to Factory C $1,882,000 Exhibit 2 Analysis of income statement by products and departments-Year ended December 31, 2014 thousands $ except per 100 kilograms.) Product A Per 100 kgs. Product B Per 100 kgs. Product C Per 100 kgs. Classification Direct Indirect Total Allocation Basis Cubic space Area value of equipment Direct labor (5) Direct labor (5) Machine horsepower Area Area Rent Property Taxes Property Insurance Compensation Insurance Direct Labor Indirect Labor Power Light & Heat Building Service Materials Supplies Repairs Total Selling Expense General Administrative Depreciation Interest Total Cost Less: Other Income $ 1.872 621 524 836 12,937 4,413 220 158 109 7641 525 184 $30,040 9,100 3,451 5,659 524 $48,774 101 $48,673 51,672 $2.999 2,132,191 $24.50 1.0896 $.88 .29 .25 .39 6.06 2.07 .11 .07 .05 3.59 .25 .08 $14.09 4.27 1.62 2.65 -25 $22.88 .04 $1,570 503 405 439 6,107 2,124 251 130 82 4,716 485 150 $16,962 4,582 1,300 4,274 409 $27,527 53 $27,474 25,996 (1,478) 1,029,654 $25.80 2.1496 $1.53 .49 39 .42 5.92 2.06 .24 .12 .08 4.58 .46 . 15 $16.44 4.44 1.26 4.16 39 $26.69 .05 $26.64 25.23 ($1.41) $1,882 401 534 458 6,879 2,309 302 106 75 4,851 350 104 $18,251 4,701 1,783 3,658 539 $28,932 51 $28,881 26,670 ($2,211) 986,974 $27.50 1.7496 $1.90 .40 .53 .46 6.97 2.33 .31 . 10 .08 4.91 .36 .10 $18.45 4.76 1.80 3.70 .53 $29.24 .05 $29.19 27.03 ($2.16) $5,324 1,525 1,463 1,733 25,921 8,846 773 394 266 17,208 1,360 438 $65,251 18,383 6,534 13,591 1,472 $105,231 205 $105,026 104,338 ($688) $ Value of sales $ Value of sales Value of equipment value of equipment $ Value of sales $22.84 24.24 $1.40 Sales (Net) Profit (Loss) Unit Sales (100 kgs.) Quoted Selling Price Per Unit Cash Discount Taken (% of Selling Price) 1.48% Exhibit 3: Accounting Department's Commentary on Costs Direct Labor: Variable. Union shop at going community rates. No abnormal demands foreseen. It may be assumed that direct labor dollars are an adequate measure of capacity utilization. Compensation Insurance: Variable. Five percent of direct and indirect labor is an accurate estimate Materials: Variable. Exhibit 2 figures are accurate. Includes waste allowances. Purchase are at market prices Power: Variable. Rates are fixed. Use varies with activity. Averages per Exhibit 2 are accurate. Supplies: Variable. Exhibit 2 figures are accurate. Supplies bought at market prices. Repairs: Variable. Varies as volume changes within normal operation range. Lower and upper limits are fixed. General Administrative, Selling Expense, Indirect Labor, Interest, and Other income: These items are almost non-variable. They can be changed, of course, by management decision. Cash Discount: Almost non-variable. Average cash discount taker are consistent from year to year. Percentages in Exhibit 2 are accurate. Light and Heat: Almost non-variable. Heat varies slightly with fuel cost changes. Light a fixed item regardless of level of production. Property Taxes: Almost non-variable. Under the lease terms superior pays the taxes; assessed valuations have been constant; the rate has risen slowly. Any change in the near future will be small and independent of production volume. Rent: Non-variable. Lease has 12 years to run Building service: Non-variable. At normal business level, variances are small. Property Insurance: Non-variable. Three-year policy with fixed premium. Depreciation: Non-variable. Fixed dollar total. Exhibit 4 Income statement by products and departments at standard and total company variances from January 1 to June 30, 2015 (Thousands $ except per 100 kgs.) Item Product A Standard Total at Per 100 kgs. Standard Total Standard $2,919 Total Actual $2,660 349 201 839 770 793 919 2.33 13,751 4,698 435 205 .05 147 Rent $.88 $877 Property Tax .29 299 Property Insurance .25 249 Compensation Insurance .39 389 Direct Labor 6.06 6,041 Indirect Labor 2.07 2,063 Power .11 109 Light & Heat .07 70 Building Service 50 Materials 3.59 3,579 Supplies .25 239 Repairs .08 79 Total $14.09 $14,034 Selling Expense 4.27 4,257 General Administrative 1.62 1,615 Depreciation 2.65 2,642 Interest .25 249 Total Cost $22.88 $22,797 Less: Other Income .04 40 $22.84 $22.757 Actual Sales (net) 24.24 24,164 Profit Loss $1.40 $1,407 Unit Sales (100 kgs.) 996,859 a: Actual unit sales times standard net revenue per unit Product B Standard Total at Per 100 kgs. Standard $1.53 $1,090 .49 -39 278 .42 299 5.92 4,216 2.06 1,467 .24 171 .12 85 .08 57 4.58 3,216 .46 328 .15 107 $16.44 $11,708 4.44 3,162 1.26 897 4.16 2,962 .39 278 $26.69 $19,007 .05 36 $26.64 $18,971 25.23 17,961 ($1.41) ($1,010) 712,102 Product C Standard Total at Per 100 kgs. Standard $1.90 $952 .40 .53 266 .46 231 6.97 3,496 1,168 .31 155 .10 50 .08 40 4.91 2,461 .36 180 .10 50 $18.45 $9,248 4.76 2,336 1.80 902 3.70 1,855 .53 266 $29.24 $14,657 .05 25 $29.19 $14,632 27.03 13,550 ($2.16) ($1,082) 501,276 9,301 747 236 $34,990 9,805 3,414 7,459 793 $56,461 101 $56,360 55,657 ($685) 732 917 13,820 4,485 432 200 107 9,232 750 251 $34,406 9,830 3,289 6,817 730 $55,072 110 $54,962 55,675 $713 AB Total $ 51,672 $25,996 $26,670 $104,338 647 12.937 7641 220 525 194 $ 22.154 $ 29,518 305 6,107 4,716 251 485 150 $ 12,014 $ 13,982 344 6,877 4,851 302 350 104 $ 12.828 $ 13,842 1,296 25,921 17,208 773 1,360 438 $ 46.996 $57,342 Sales (not) Variable costs Compensation Insurancea Direct Labor Materials Power Supplies Repairs Total Variable costs Contribution Fixed Expenses Compensation Insuranco ($1,733-$1,296) Rent Property Taxos Property Insurance Indirect Labor Light and Heat Building Service Selling Expense General Administration Depreciation Interest Total Fixed Expenses Other Income Net Loss 437 5,324 1,525 1,463 8,846 394 266 18.383 6,534 13,591 1.472 $ 58,235 205 688 Exhibit 1 income statement for year ending December 31, 2014 (in thousands) $105,905 (1.567 $104,338 (65,251) $39,087 Gross sales Cash Discount Net Sales Cost of Manufacturing Gross profit Less: Selling Expense General Administration Depreciation Operating Profit Plus: Other Income Net Profit before Interest Less: Interest $18,383 6,534 13.591 (38,508) $579 205 $784 (1.472) Net Income (6688) Figure A: Total Company Actual Rent Expense $5,324,000 Allocation Basis (Cubic Space) Allocated Rent to Factory A $1,872.000 Allocated Rent to Factory B $1,570,000 Allocated Rent to Factory C $1,882,000 Exhibit 2 Analysis of income statement by products and departments-Year ended December 31, 2014 thousands $ except per 100 kilograms.) Product A Per 100 kgs. Product B Per 100 kgs. Product C Per 100 kgs. Classification Direct Indirect Total Allocation Basis Cubic space Area value of equipment Direct labor (5) Direct labor (5) Machine horsepower Area Area Rent Property Taxes Property Insurance Compensation Insurance Direct Labor Indirect Labor Power Light & Heat Building Service Materials Supplies Repairs Total Selling Expense General Administrative Depreciation Interest Total Cost Less: Other Income $ 1.872 621 524 836 12,937 4,413 220 158 109 7641 525 184 $30,040 9,100 3,451 5,659 524 $48,774 101 $48,673 51,672 $2.999 2,132,191 $24.50 1.0896 $.88 .29 .25 .39 6.06 2.07 .11 .07 .05 3.59 .25 .08 $14.09 4.27 1.62 2.65 -25 $22.88 .04 $1,570 503 405 439 6,107 2,124 251 130 82 4,716 485 150 $16,962 4,582 1,300 4,274 409 $27,527 53 $27,474 25,996 (1,478) 1,029,654 $25.80 2.1496 $1.53 .49 39 .42 5.92 2.06 .24 .12 .08 4.58 .46 . 15 $16.44 4.44 1.26 4.16 39 $26.69 .05 $26.64 25.23 ($1.41) $1,882 401 534 458 6,879 2,309 302 106 75 4,851 350 104 $18,251 4,701 1,783 3,658 539 $28,932 51 $28,881 26,670 ($2,211) 986,974 $27.50 1.7496 $1.90 .40 .53 .46 6.97 2.33 .31 . 10 .08 4.91 .36 .10 $18.45 4.76 1.80 3.70 .53 $29.24 .05 $29.19 27.03 ($2.16) $5,324 1,525 1,463 1,733 25,921 8,846 773 394 266 17,208 1,360 438 $65,251 18,383 6,534 13,591 1,472 $105,231 205 $105,026 104,338 ($688) $ Value of sales $ Value of sales Value of equipment value of equipment $ Value of sales $22.84 24.24 $1.40 Sales (Net) Profit (Loss) Unit Sales (100 kgs.) Quoted Selling Price Per Unit Cash Discount Taken (% of Selling Price) 1.48% Exhibit 3: Accounting Department's Commentary on Costs Direct Labor: Variable. Union shop at going community rates. No abnormal demands foreseen. It may be assumed that direct labor dollars are an adequate measure of capacity utilization. Compensation Insurance: Variable. Five percent of direct and indirect labor is an accurate estimate Materials: Variable. Exhibit 2 figures are accurate. Includes waste allowances. Purchase are at market prices Power: Variable. Rates are fixed. Use varies with activity. Averages per Exhibit 2 are accurate. Supplies: Variable. Exhibit 2 figures are accurate. Supplies bought at market prices. Repairs: Variable. Varies as volume changes within normal operation range. Lower and upper limits are fixed. General Administrative, Selling Expense, Indirect Labor, Interest, and Other income: These items are almost non-variable. They can be changed, of course, by management decision. Cash Discount: Almost non-variable. Average cash discount taker are consistent from year to year. Percentages in Exhibit 2 are accurate. Light and Heat: Almost non-variable. Heat varies slightly with fuel cost changes. Light a fixed item regardless of level of production. Property Taxes: Almost non-variable. Under the lease terms superior pays the taxes; assessed valuations have been constant; the rate has risen slowly. Any change in the near future will be small and independent of production volume. Rent: Non-variable. Lease has 12 years to run Building service: Non-variable. At normal business level, variances are small. Property Insurance: Non-variable. Three-year policy with fixed premium. Depreciation: Non-variable. Fixed dollar total. Exhibit 4 Income statement by products and departments at standard and total company variances from January 1 to June 30, 2015 (Thousands $ except per 100 kgs.) Item Product A Standard Total at Per 100 kgs. Standard Total Standard $2,919 Total Actual $2,660 349 201 839 770 793 919 2.33 13,751 4,698 435 205 .05 147 Rent $.88 $877 Property Tax .29 299 Property Insurance .25 249 Compensation Insurance .39 389 Direct Labor 6.06 6,041 Indirect Labor 2.07 2,063 Power .11 109 Light & Heat .07 70 Building Service 50 Materials 3.59 3,579 Supplies .25 239 Repairs .08 79 Total $14.09 $14,034 Selling Expense 4.27 4,257 General Administrative 1.62 1,615 Depreciation 2.65 2,642 Interest .25 249 Total Cost $22.88 $22,797 Less: Other Income .04 40 $22.84 $22.757 Actual Sales (net) 24.24 24,164 Profit Loss $1.40 $1,407 Unit Sales (100 kgs.) 996,859 a: Actual unit sales times standard net revenue per unit Product B Standard Total at Per 100 kgs. Standard $1.53 $1,090 .49 -39 278 .42 299 5.92 4,216 2.06 1,467 .24 171 .12 85 .08 57 4.58 3,216 .46 328 .15 107 $16.44 $11,708 4.44 3,162 1.26 897 4.16 2,962 .39 278 $26.69 $19,007 .05 36 $26.64 $18,971 25.23 17,961 ($1.41) ($1,010) 712,102 Product C Standard Total at Per 100 kgs. Standard $1.90 $952 .40 .53 266 .46 231 6.97 3,496 1,168 .31 155 .10 50 .08 40 4.91 2,461 .36 180 .10 50 $18.45 $9,248 4.76 2,336 1.80 902 3.70 1,855 .53 266 $29.24 $14,657 .05 25 $29.19 $14,632 27.03 13,550 ($2.16) ($1,082) 501,276 9,301 747 236 $34,990 9,805 3,414 7,459 793 $56,461 101 $56,360 55,657 ($685) 732 917 13,820 4,485 432 200 107 9,232 750 251 $34,406 9,830 3,289 6,817 730 $55,072 110 $54,962 55,675 $713 AB Total $ 51,672 $25,996 $26,670 $104,338 647 12.937 7641 220 525 194 $ 22.154 $ 29,518 305 6,107 4,716 251 485 150 $ 12,014 $ 13,982 344 6,877 4,851 302 350 104 $ 12.828 $ 13,842 1,296 25,921 17,208 773 1,360 438 $ 46.996 $57,342 Sales (not) Variable costs Compensation Insurancea Direct Labor Materials Power Supplies Repairs Total Variable costs Contribution Fixed Expenses Compensation Insuranco ($1,733-$1,296) Rent Property Taxos Property Insurance Indirect Labor Light and Heat Building Service Selling Expense General Administration Depreciation Interest Total Fixed Expenses Other Income Net Loss 437 5,324 1,525 1,463 8,846 394 266 18.383 6,534 13,591 1.472 $ 58,235 205 688