Can I have help with these so I can use it as an example for other problems?

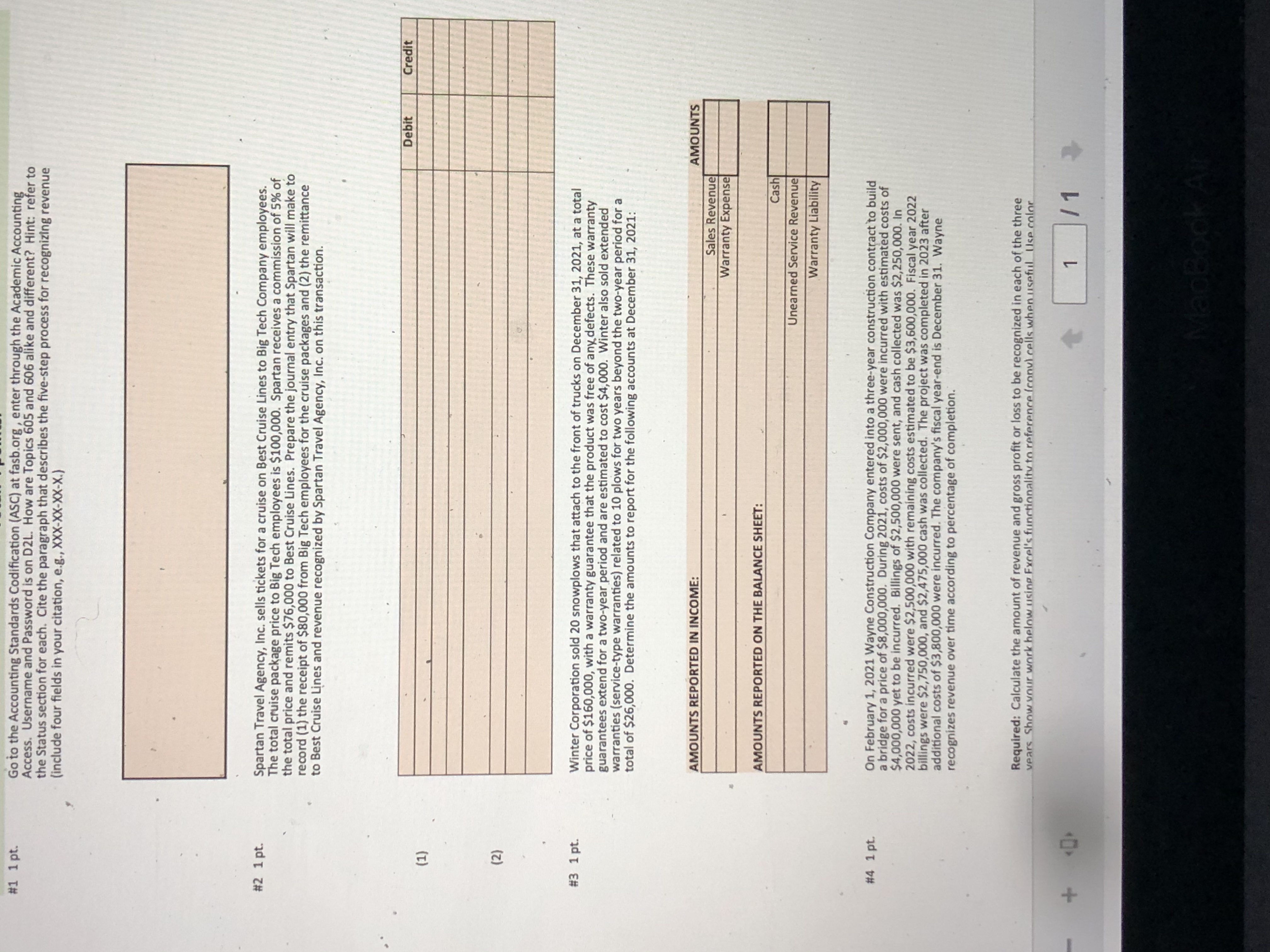

Required: Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years. Show your work below using Excel's functionality to reference (copy) cells when useful. Use color, borders and label data. 1 /1 MacBook Air 20 F3 F4 F 5 F6 $ % V & # 3 5 E R T Y#1 1 pt. Go to the Accounting Standards Codification (ASC) at fasb.org , enter through the Academic Accounting Access. Username and Password is on D2L. How are Topics 605 and 606 alike and different? Hint: refer to the Status section for each. Cite the paragraph that describes the five-step process for recognizing revenue (include four fields in your citation, e.g., XXX-XX-XX-X.) #2 1 pt. Spartan Travel Agency, Inc. sells tickets for a cruise on Best Cruise Lines to Big Tech Company employees. The total cruise package price to Big Tech employees is $100,000. Spartan receives a commission of 5% of the total price and remits $76,000 to Best Cruise Lines. Prepare the journal entry that Spartan will make to record (1) the receipt of $80,000 from Big Tech employees for the cruise packages and (2) the remittance to Best Cruise Lines and revenue recognized by Spartan Travel Agency, Inc. on this transaction. Debit Credit (1) (2) #3 1 pt. Winter Corporation sold 20 snowplows that attach to the front of trucks on December 31, 2021, at a total price of $160,000, with a warranty guarantee that the product was free of any, defects. These warranty guarantees extend for a two-year period and are estimated to cost $4,000. Winter also sold extended warranties (service-type warranties) related to 10 plows for two years beyond the two-year period for a total of $26,000. Determine the amounts to report for the following accounts at December 31, 2021: AMOUNTS REPORTED IN INCOME: AMOUNTS Sales Revenue Warranty Expense AMOUNTS REPORTED ON THE BALANCE SHEET: Cash Unearned Service Revenue Warranty Liability #4 1 pt. On February 1, 2021 Wayne Construction Company entered into a three-year construction contract to build a bridge for a price of $8,000,000. During 2021, costs of $2,000,000 were incurred with estimated costs of $4,000,000 yet to be incurred. Billings of $2,500,000 were sent, and cash collected was $2,250,000. In 2022, costs incurred were $2,500,000 with remaining costs estimated to be $3,600,000. Fiscal year 2022 billings were $2,750,000, and $2,475,000 cash was collected. The project was completed in 2023 after additional costs of $3,800,000 were incurred. The company's fiscal year-end is December 31. Wayne recognizes revenue over time according to percentage of completion. Required: Calculate the amount of revenue and gross profit or loss to be recognized in each of the three vears Show your work below using Excel's functionality to reference (conv) cells when useful_Use color 1 1 1 MacBook Air