Can I have the answer in excel format?

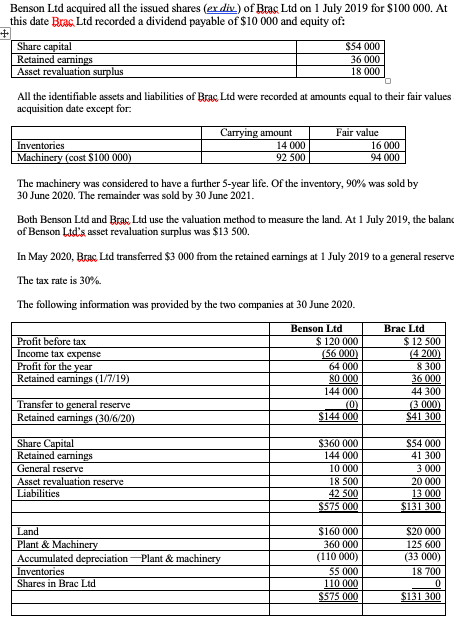

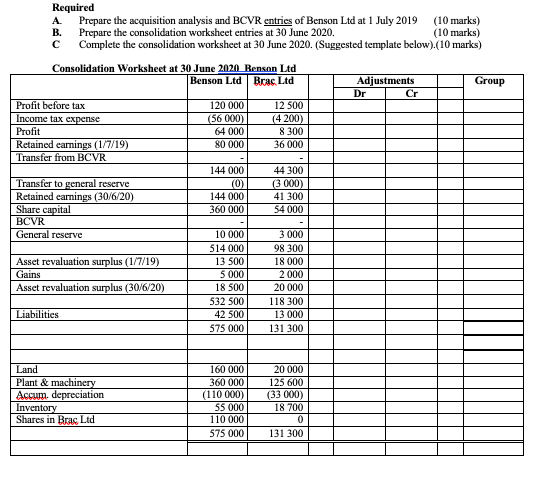

Benson Lid acquired all the issued shares (er div) of Brac Lid on 1 July 2019 for $100 000. At this date Brac Ltd recorded a dividend payable of $10 000 and equity of: Share capital $54 000 Retained earnings 36 000 Asset revaluation surplus 18 000 All the identifiable assets and liabilities of Brac Led were recorded at amounts equal to their fair values acquisition date except for: Carrying amount Fair value Inventories 14 000 16 000 Machinery (cost $100 000) 92 500 94 000 The machinery was considered to have a further 5-year life. Of the inventory, 90% was sold by 30 June 2020. The remainder was sold by 30 June 2021. Both Benson Lid and Brac Led use the valuation method to measure the land. At 1 July 2019, the balan of Benson Lid's asset revaluation surplus was $13 500. In May 2020, Brac Lid transferred $3 000 from the retained earnings at 1 July 2019 to a general reserve The tax rate is 30%. The following information was provided by the two companies at 30 June 2020. Benson Ltd Brac Ltd Profit before tax $ 120 000 $ 12 500 Income tax expense (56 000) (4 200) Profit for the year 64 000 8 300 Retained earnings (1/7/19) 80 000 36 000 144 000 44 300 Transfer to general reserve (3 000) Retained earnings (30/6/20) $144 000 $41 300 Share Capital $360 000 $54 000 Retained earnings 144 000 41 300 General reserve 10 000 3 000 Asset revaluation reserve 18 500 20 000 Liabilities 42 500 13 000 $575 000 $131 300 Land $160 000 $20 000 Plant & Machinery 360 000 125 600 Accumulated depreciation - Plant & machinery (110 000) (33 000) Inventories 55 000 18 700 Shares in Brac Led 110 000 $575 000 $131 300Required A. B. Prepare the acquisition analysis and BCVR entries of Benson Lid at 1 July 2019 (10 marks) C Prepare the consolidation worksheet entries at 30 June 2020. Complete the consolidation worksheet at 30 June 2020. (Suggested template below).(10 marks) (10 marks) Consolidation Worksheet at 30 June 2020 Benson Led Benson Ltd Brac. Ltd Adjustments Group Dr Cr Profit before tax 120 000 12 500 Income tax expense (56 000) (4 200) Profit 64 000 8 300 Retained earnings (1/7/19) 80 000 36 000 Transfer from BCVR 144 000 44 300 Transfer to general reserve (0) (3 000) Retained earnings (30/6/20) 144 000 41 300 Share capital 360 000 54 000 BCVR General reserve 10 000 3 000 514 000 98 300 Asset revaluation surplus (1/7/19) 13 500 18 000 Gains 5 000 2 000 Asset revaluation surplus (30/6/20) 18 500 20 000 532 500 118 300 Liabilities 42 500 13 000 575 000 131 300 Land 160 000 20 000 Plant & machinery 360 000 25 600 Accum. depreciation (110 000) (33 000) Inventory 55 000 18 700 Shares in Brac, Ltd 1 10 000 0 575 000 131 300