Answered step by step

Verified Expert Solution

Question

1 Approved Answer

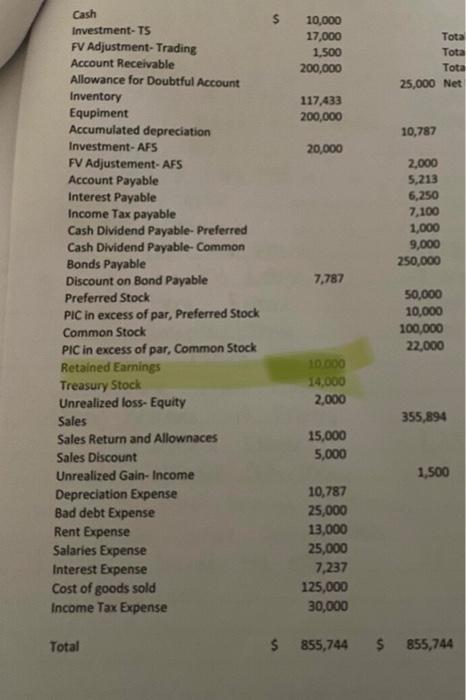

can I have the the post-closing trial, and what was the balance in the income summary immediately before closing the income summary into retained earnings.

can I have the the post-closing trial, and what was the balance in the income summary immediately before closing the income summary into retained earnings. show your work please, on the post-closing also try to show me the income summary. thanks

Cash 2$ 10,000 Investment-TS FV Adjustment- Trading Account Receivable Allowance for Doubtful Account 17,000 Tota 1,500 Tota 200,000 Tota 25,000 Net Inventory 117,433 Equpiment Accumulated depreciation 200,000 10,787 Investment- AFS 20,000 2,000 5,213 6,250 FV Adjustement- AFS Account Payable Interest Payable Income Tax payable Cash Dividend Payable- Preferred Cash Dividend Payable- Common Bonds Payable Discount on Bond Payable 7,100 1,000 9,000 250,000 7,787 50,000 10,000 Preferred Stock PIC in excess of par, Preferred Stock Common Stock 100,000 22,000 PIC in excess of par, Common Stock Retained Earnings 10.000 14,000 Treasury Stock Unrealized loss- Equity 2,000 Sales 355,894 Sales Return and Allownaces 15,000 Sales Discount 5,000 Unrealized Gain- Income 1,500 10,787 Depreciation Expense Bad debt Expense 25,000 13,000 Rent Expense Salaries Expense 25,000 7,237 125,000 Interest Expense Cost of goods sold Income Tax Expense 30,000 Total $ 855,744 $ 855,744

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Balance in income statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started