Answered step by step

Verified Expert Solution

Question

1 Approved Answer

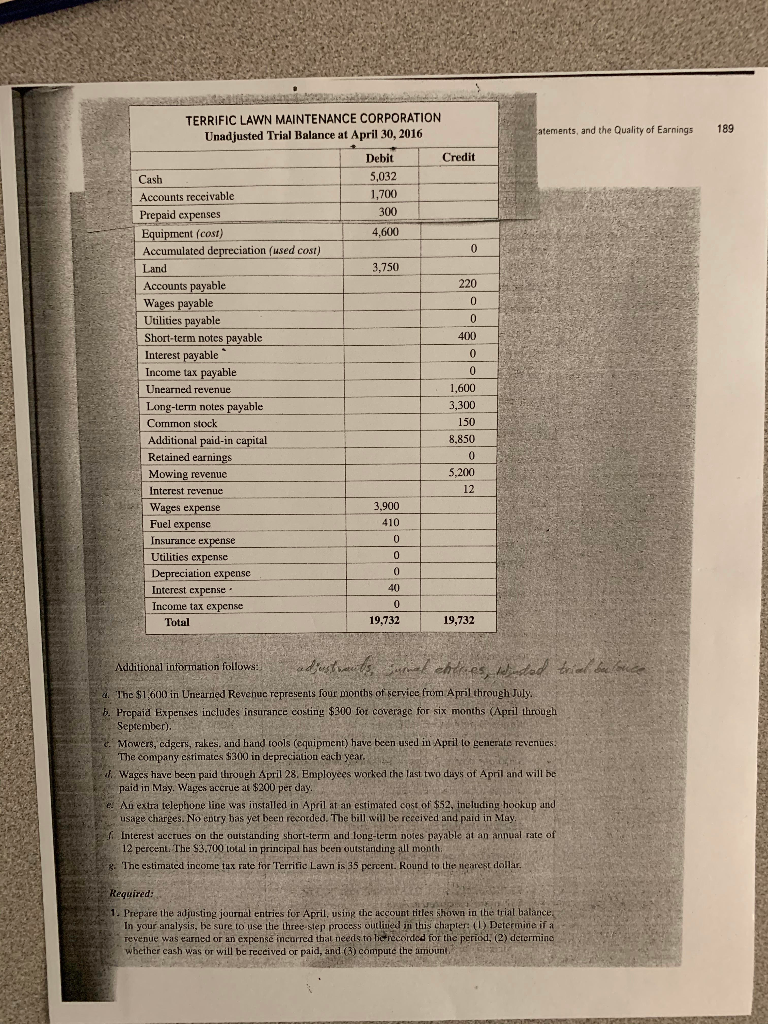

Can i please get a reply in the exel format? Thank you. atements, and the Quality of Earnings 189 400 TERRIFIC LAWN MAINTENANCE CORPORATION Unadjusted

Can i please get a reply in the exel format?

Thank you.

atements, and the Quality of Earnings 189 400 TERRIFIC LAWN MAINTENANCE CORPORATION Unadjusted Trial Balance at April 30, 2016 Debit Credit Cash 5,032 Accounts receivable 1,700 Prepaid expenses 300 Equipment (cost) 4.600 Accumulated depreciation (used cost) Land 3,750 Accounts payable 220 Wages payable Utilities payable Short-term notes payable Interest payable Income tax payable 0 Unearned revenue 1,600 Long-term notes payable 3,300 Common stock 150 Additional paid-in capital 8,850 Retained earnings Mowing revenue Interest revenue Wages expense Fuel expense 410 Insurance expense Utilities expense Depreciation expense Interest expense Income tax expense Total 19,732 19,732 5.200 12 3,900 Additional information follows: adjustments Surat chilies, diedad 4. The $1.600 in Unearded Revenue represents four months of service from April through Joly b. Prepaid Expenses includes insurance costing $300 for coverage for six months (April through September). . Mowers, edgers, kes, and hand tools (equipment) have been used in April to generate revenues: The company estimates $300 in depreciation each year. Wages have been paid through April 28. Employees worked the last two days of April and will be paid in May. Wages accrue at $200 per day. el An extra telephone line was installed in April at an estimated cost of $52, including hookup and usage charges. No cry bas yet been recorded. The bill will be received and paid in May Interest accrues on the outstanding short-term and long-term potes payable at an annual rate of 12 percent. The $3.700 total in principal has been outstanding all month 8. The estimated income tax rate for Territo Lawn Is 35 percent. Round to the nearest dollar Required: 1. Prepare the adjusting journal entries for April, using the account titles shown in the trial balance In your analysis, be sure to use the three-step process outlined in this chapter: (1) Determine if a revenue was earned or an expense incurred that needs to be recorded for the periode determina whether cash was or will be received or paid, and (3) compute the amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started