Answered step by step

Verified Expert Solution

Question

1 Approved Answer

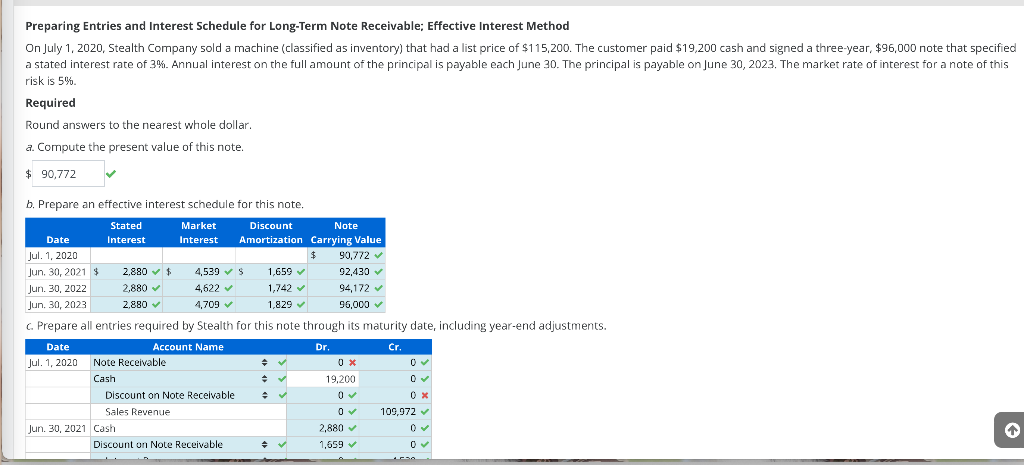

CAN I PLEASE GET SOME HELP ON THE NOTE RECEIVABLE PART FOR JULY AND THE DISCOUNT ON NOTE RECEIVABLE FOR JULY Preparing Entries and Interest

CAN I PLEASE GET SOME HELP ON THE NOTE RECEIVABLE PART FOR JULY AND THE DISCOUNT ON NOTE RECEIVABLE FOR JULY

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On July 1, 2020, Stealth Company sold a machine (classified as inventory) that had a list price of $115,200. The customer paid $19,200 cash and signed a three-year, $96,000 note that specified a stated interest rate of 3%. Annual interest on the full amount of the principal is payable each June 30. The principal is payable on June 30, 2023. The market rate of interest for a note of this risk is 5%. Required Round answers to the nearest whole dollar. a. a. Compute the present value of this note. $ 90,772 b. Prepare an effective interest schedule for this note. Stated Market Discount Note Date Interest Interest Amortization Carrying Value Jul. 1. 2020 $ 90,772 Jun 30, 2021 $ 2.880 $ 4,539S 1,659 92,430 Jun 30, 2022 2,880 4,622 1,742 94,172 Jun 30, 2023 2.880 4,709 1,829 96,000 c. Prepare all entries required by Stealth for this note through its maturity date, including year-end adjustments. Date Account Name Dr. Cr. Jul 1, 2020 Note Receivable 0X 0 Cash 19,200 0 0 Discount on Note Receivable 0 OX Sales Revenue 0 109,972 Jun 30, 2021 Cash 2,880 0 Discount on Note Receivable 1,659 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started