Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can i please get some help on this homework? they are all the same home work problem Directions: On April 1, a petty cash fund

can i please get some help on this homework? they are all the same home work problem

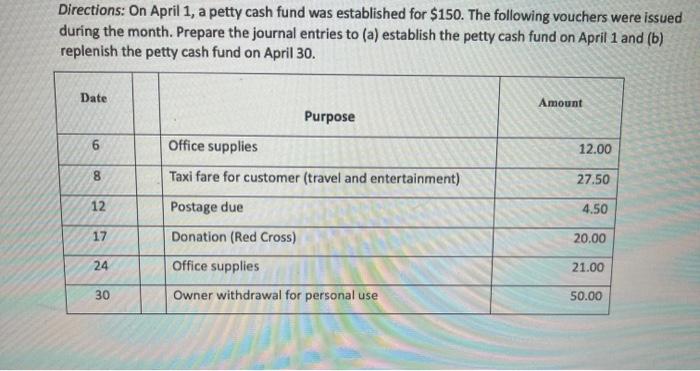

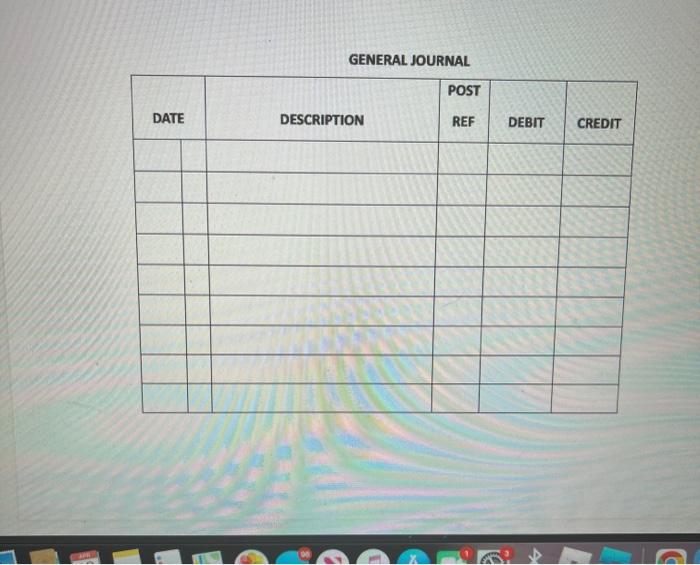

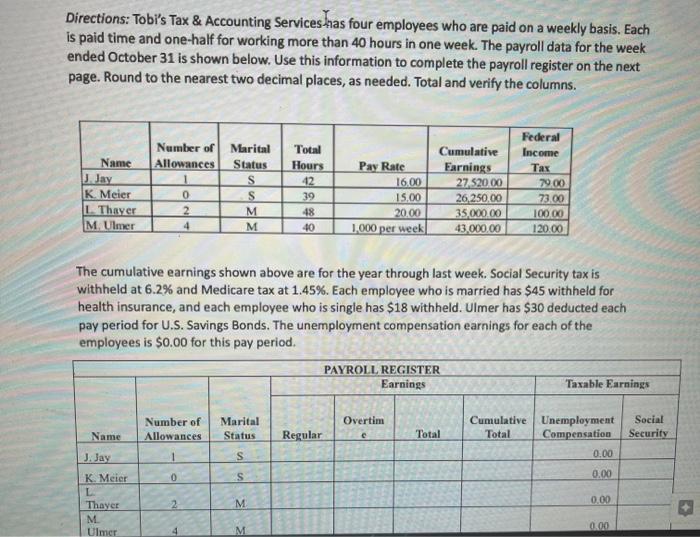

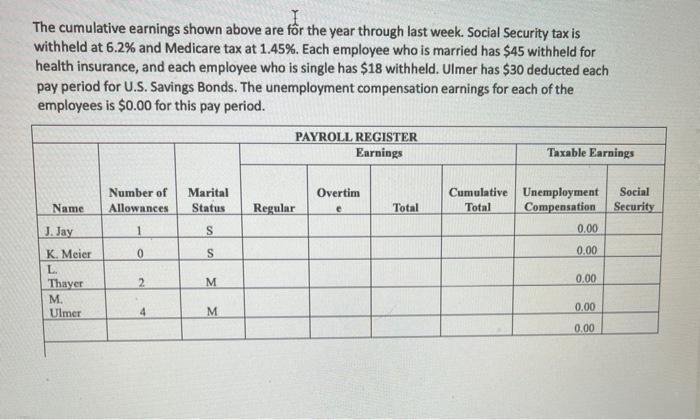

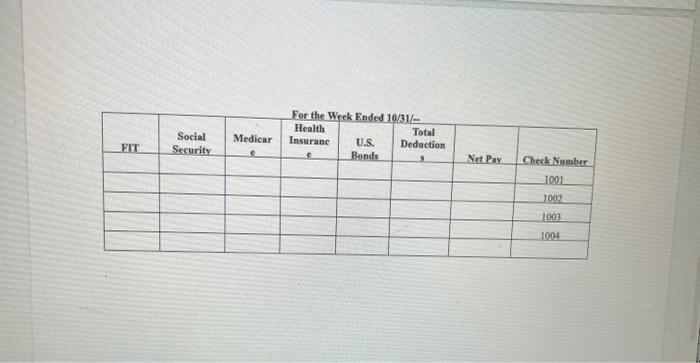

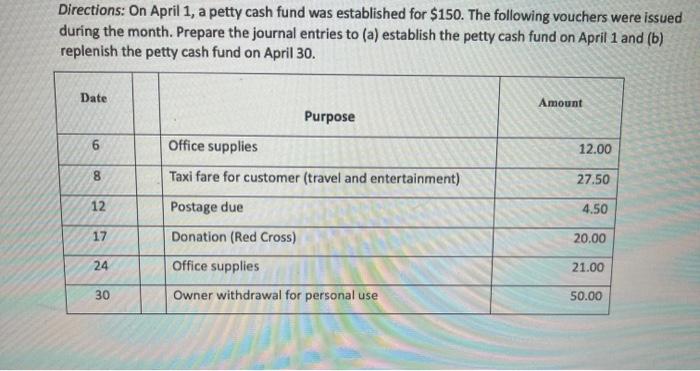

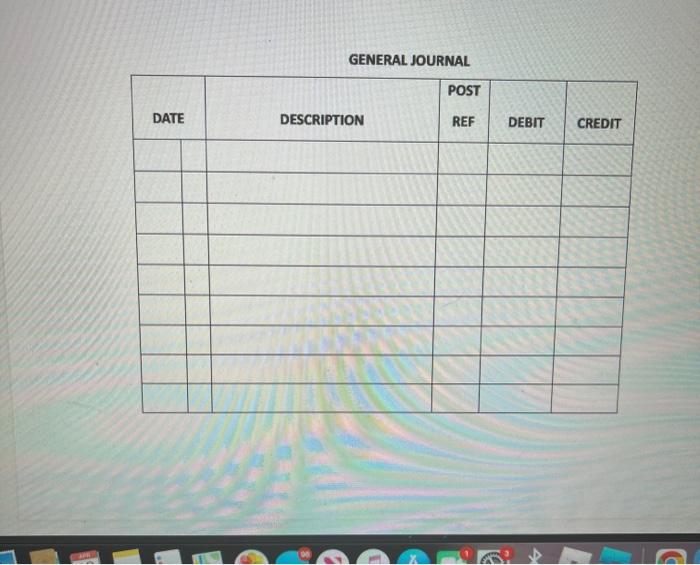

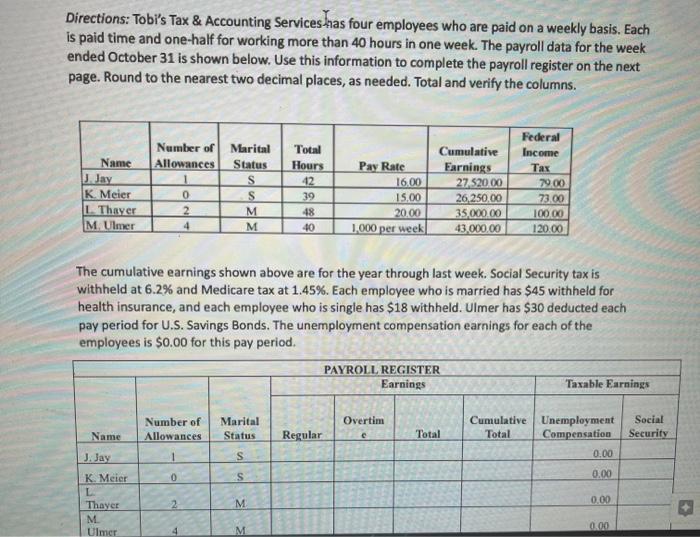

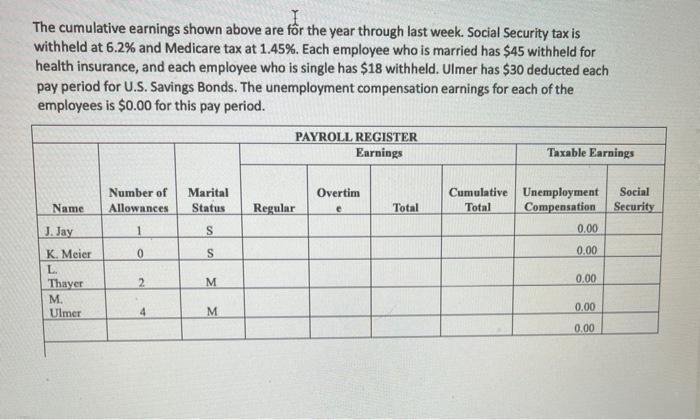

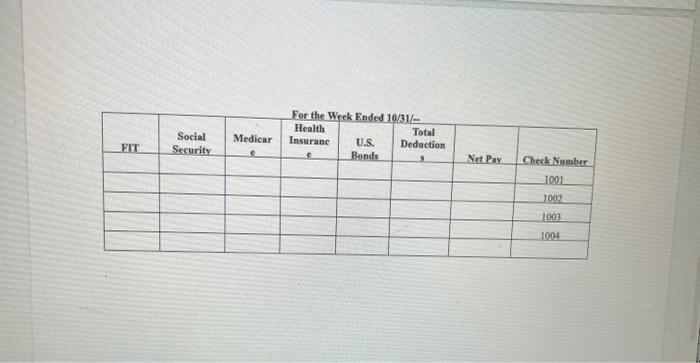

Directions: On April 1, a petty cash fund was established for $150. The following vouchers were issued during the month. Prepare the journal entries to (a) establish the petty cash fund on April 1 and (b) replenish the petty cash fund on April 30. Date Amount Purpose 6 Office supplies 12.00 8 Taxi fare for customer (travel and entertainment) 27.50 12 Postage due 4.50 17 20.00 24 Donation (Red Cross) Office supplies Owner withdrawal for personal use 21.00 30 50.00 GENERAL JOURNAL POST DATE DESCRIPTION REF DEBIT CREDIT Directions: Tobi's Tax & Accounting Services has four employees who are paid on a weekly basis. Each is paid time and one-half for working more than 40 hours in one week. The payroll data for the week ended October 31 is shown below. Use this information to complete the payroll register on the next page. Round to the nearest two decimal places, as needed. Total and verify the columns. Number of Allowances Name J.Jay K Meier 1. Thayer M. Ulmer Marital Status S S M M Total Hours 12 39 48 40 Pay Rate 16.00 15.00 20.00 1,000 per week 0 Federal Income Tax 79.00 73.00 10000 120.00 Cumulative Earnings 27 520.00 26.250.00 35,000.00 43,000.00 2 4 The cumulative earnings shown above are for the year through last week. Social Security tax is withheld at 6.2% and Medicare tax at 1.45%. Each employee who is married has $45 withheld for health insurance, and each employee who is single has $18 withheld. Ulmer has $30 deducted each pay period for U.S. Savings Bonds. The unemployment compensation earnings for each of the employees is $0.00 for this pay period. PAYROLL REGISTER Earnings Taxable Earnings Overtim Number of Allowances Marital Status Social Security Name Regular Cumulative Unemployment Total Compensation 0.00 Total J.Jay S K. Meier 0 s 0.00 M 0.00 Thayer M Ulmer 0.00 4 M The cumulative earnings shown above are for the year through last week. Social Security tax is withheld at 6.2% and Medicare tax at 1.45%. Each employee who is married has $45 withheld for health insurance, and each employee who is single has $18 withheld. Ulmer has $30 deducted each pay period for U.S. Savings Bonds. The unemployment compensation earnings for each of the employees is $0.00 for this pay period. PAYROLL REGISTER Earnings Taxable Earnings Overtim Number of Allowances Marital Status Name Regular Social Security e Cumulative Unemployment Total Compensation 0.00 Total 1 S 0 S 0.00 J.Jay K. Meier L. Thayer M Ulmer 2 M 0.00 0.00 4 M 0.00 Social Security Medicar For the Week Ended 10/31 Health Total Insuranc U.S. Deduction Bonds FIT Net Pay Check Number 1001 1002 1003 1004

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started