Can I please get some help with the following steps.

Stock Valuation Using Multiples:

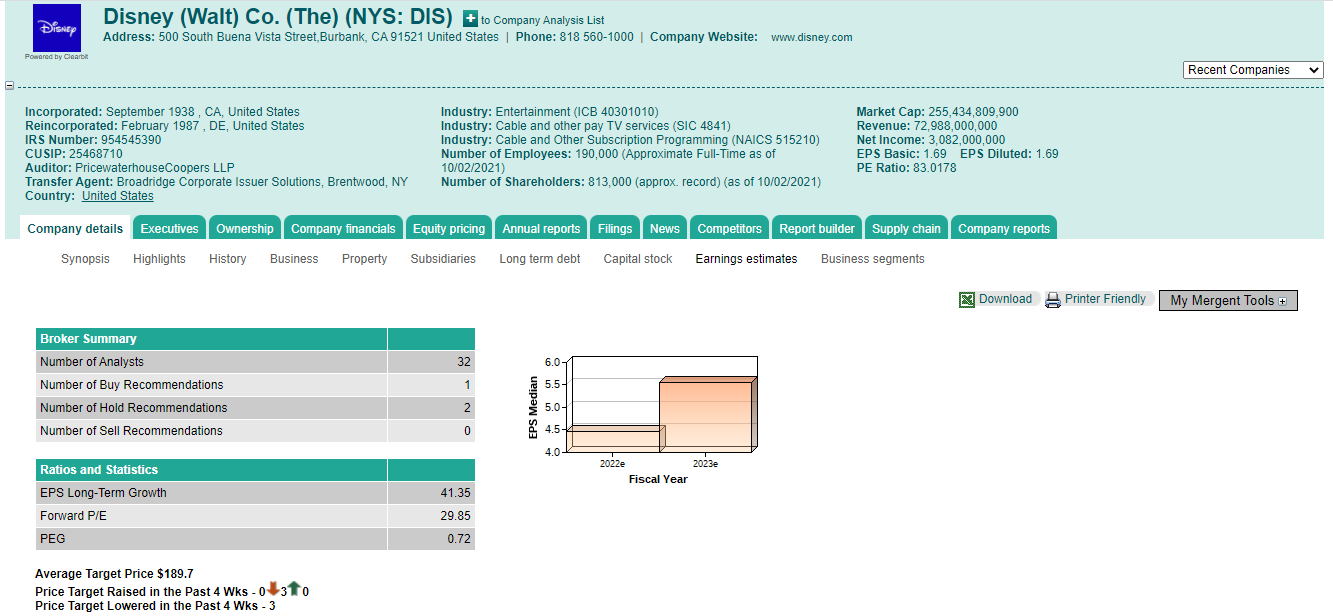

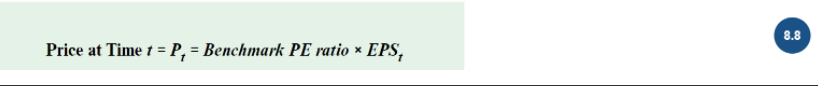

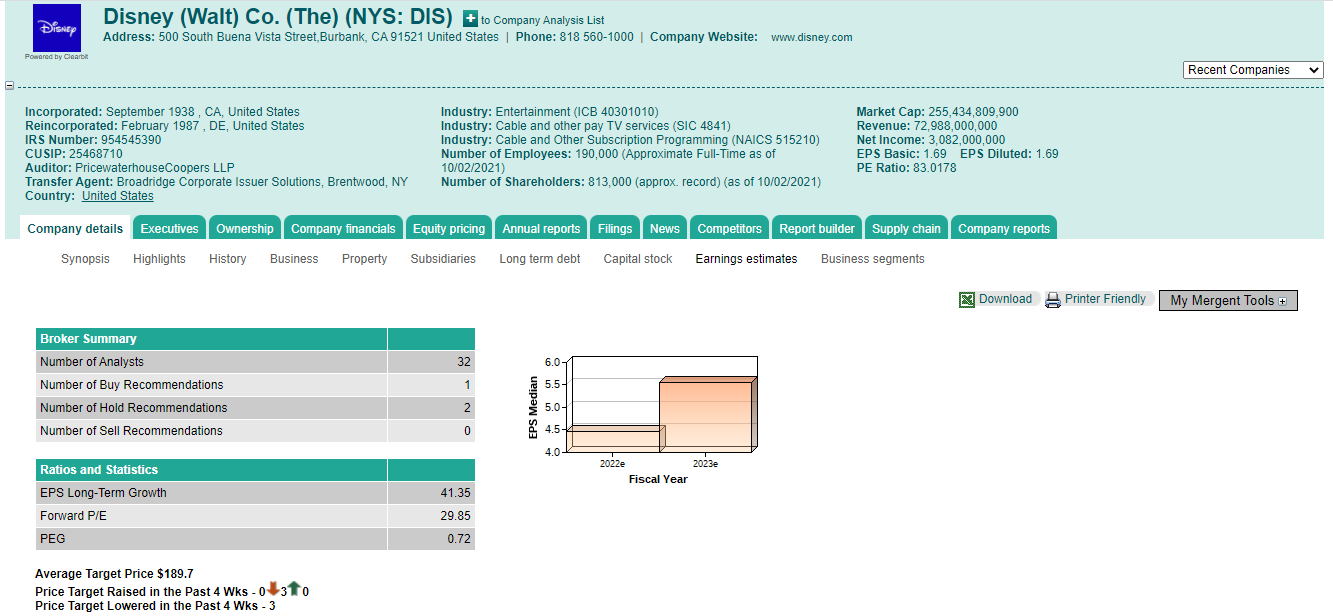

- From the selected companys main page, select the Company details tab and then choose Earnings estimates.

- On the left-hand side of the screen, note the number of analysts and the number of Buy, Hold, and Sell Recommendations in the Broker Summary.

- In the Ratios and Statistics section, retrieve the Forward P/E as an input for your Stock Valuation Using Multiples.

- Record the Average Target Price and the direction it has taken during the last four weeks (raised or lowered, indicated by orange/green arrows).

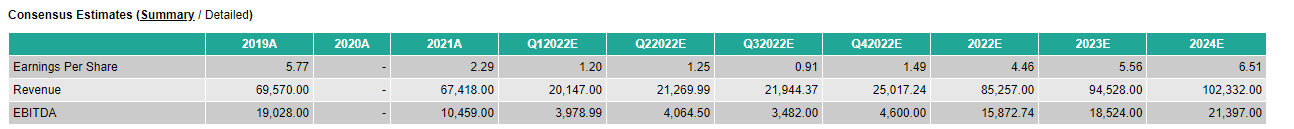

- In the Consensus Summary the companys annual Earning Per Share appear, both Actual (A) and as Estimated by analysts (E). Historical results (A) by year should be evaluated versus full year estimates for future periods (E). This data appears in the Consensus Estimates Summary by period.

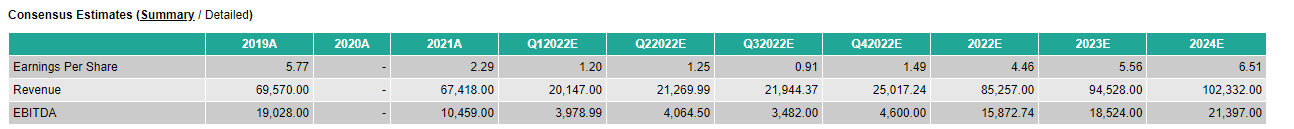

- Calculate an estimated value of a share of the stock using multiples as determined by Eq. 8-8 in the e-book. Use the Forward P/E as the Benchmark PE in the model. Calculate the estimated value for each year that a Consensus Estimate of Earnings per Share appears in Mergent.

For example, suppose the Forward P/E is 27 and there are Consensus Estimates of $2.06 in 2021E and $2.25 in 2022E. According to the model, P1 would be $55.62 and P2 would be equal to $60.75. As described in the text, forecasted prices such as these are called Target Prices.

Disney Disney (Walt) Co. (The) (NYS: DIS) + to Company Analysis List Address: 500 South Buena Vista Street, Burbank, CA 91521 United States | Phone: 818 560-1000 Company Website: www.disney.com Powered by Clear Recent Companies Incorporated: September 1938, CA, United States Reincorporated: February 1987, DE, United States IRS Number: 954545390 CUSIP: 25468710 Auditor: PricewaterhouseCoopers LLP Transfer Agent: Broadridge Corporate Issuer Solutions, Brentwood, NY Country: United States Industry: Entertainment (ICB 40301010) Industry: Cable and other pay TV services (SIC 4841) Industry: Cable and Other Subscription Programming (NAICS 515210) Number of Employees: 190,000 (Approximate Full-Time as of 10/02/2021) Number of Shareholders: 813,000 (approx. record) (as of 10/02/2021) Market Cap: 255,434,809,900 Revenue: 72,988,000,000 Net Income: 3,082,000,000 EPS Basic: 1.69 EPS Diluted: 1.69 PE Ratio: 83.0178 Company details Executives Ownership Company financials Equity pricing Annual reports Filings News Competitors Report builder Supply chain Company reports Synopsis Highlights History Business Property Subsidiaries Long term debt Capital stock Earnings estimates Business segments Download A Printer Friendly My Mergent Tools + 32 6.0 Broker Summary Number of Analysts Number of Buy Recommendations Number of Hold Recommendations Number of Sell Recommendations 1 5.5 2 EPS Median 5.0- 0 4.5 4.0 2022e 2023e Fiscal Year Ratios and Statistics EPS Long-Term Growth Forward P/E PEG 41.35 29.85 0.72 Average Target Price $189.7 Price Target Raised in the Past 4 Wks-0310 Price Target Lowered in the Past 4 Wks - 3 Consensus Estimates (Summary/Detailed) 2019A 2020A 2021A Q42022E 2022E 2023E 2024E Q22022E 1.25 2.29 4.46 5.56 Earnings Per Share Revenue EBITDA 5.77 69,570.00 19,028.00 Q12022E 1.20 20,147.00 3,978.99 Q32022E 0.91 21,944.37 3,482.00 67,418.00 10,459.00 94,528.00 1.49 25,017.24 4,600.00 21,269.99 4,064.50 85,257.00 15,872.74 6.51 102,332.00 21,397.00 18,524.00 8.8 Price at Time t = P, = Benchmark PE ratio * EPS, Disney Disney (Walt) Co. (The) (NYS: DIS) + to Company Analysis List Address: 500 South Buena Vista Street, Burbank, CA 91521 United States | Phone: 818 560-1000 Company Website: www.disney.com Powered by Clear Recent Companies Incorporated: September 1938, CA, United States Reincorporated: February 1987, DE, United States IRS Number: 954545390 CUSIP: 25468710 Auditor: PricewaterhouseCoopers LLP Transfer Agent: Broadridge Corporate Issuer Solutions, Brentwood, NY Country: United States Industry: Entertainment (ICB 40301010) Industry: Cable and other pay TV services (SIC 4841) Industry: Cable and Other Subscription Programming (NAICS 515210) Number of Employees: 190,000 (Approximate Full-Time as of 10/02/2021) Number of Shareholders: 813,000 (approx. record) (as of 10/02/2021) Market Cap: 255,434,809,900 Revenue: 72,988,000,000 Net Income: 3,082,000,000 EPS Basic: 1.69 EPS Diluted: 1.69 PE Ratio: 83.0178 Company details Executives Ownership Company financials Equity pricing Annual reports Filings News Competitors Report builder Supply chain Company reports Synopsis Highlights History Business Property Subsidiaries Long term debt Capital stock Earnings estimates Business segments Download A Printer Friendly My Mergent Tools + 32 6.0 Broker Summary Number of Analysts Number of Buy Recommendations Number of Hold Recommendations Number of Sell Recommendations 1 5.5 2 EPS Median 5.0- 0 4.5 4.0 2022e 2023e Fiscal Year Ratios and Statistics EPS Long-Term Growth Forward P/E PEG 41.35 29.85 0.72 Average Target Price $189.7 Price Target Raised in the Past 4 Wks-0310 Price Target Lowered in the Past 4 Wks - 3 Consensus Estimates (Summary/Detailed) 2019A 2020A 2021A Q42022E 2022E 2023E 2024E Q22022E 1.25 2.29 4.46 5.56 Earnings Per Share Revenue EBITDA 5.77 69,570.00 19,028.00 Q12022E 1.20 20,147.00 3,978.99 Q32022E 0.91 21,944.37 3,482.00 67,418.00 10,459.00 94,528.00 1.49 25,017.24 4,600.00 21,269.99 4,064.50 85,257.00 15,872.74 6.51 102,332.00 21,397.00 18,524.00 8.8 Price at Time t = P, = Benchmark PE ratio * EPS