Answered step by step

Verified Expert Solution

Question

1 Approved Answer

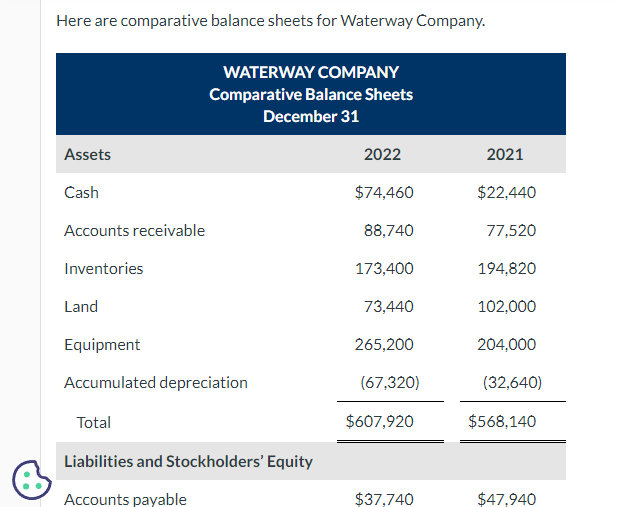

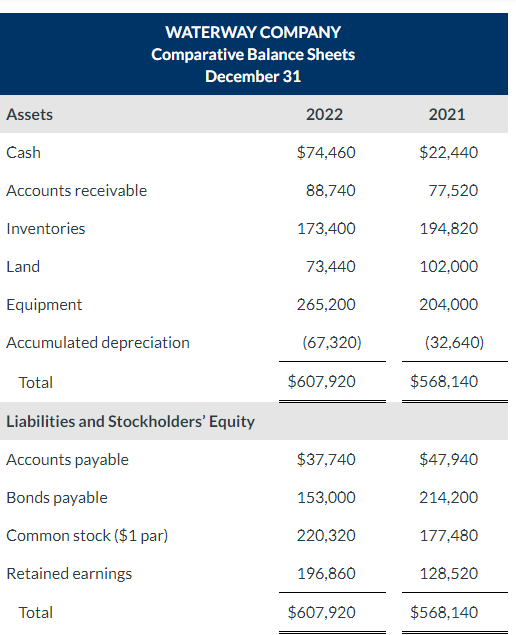

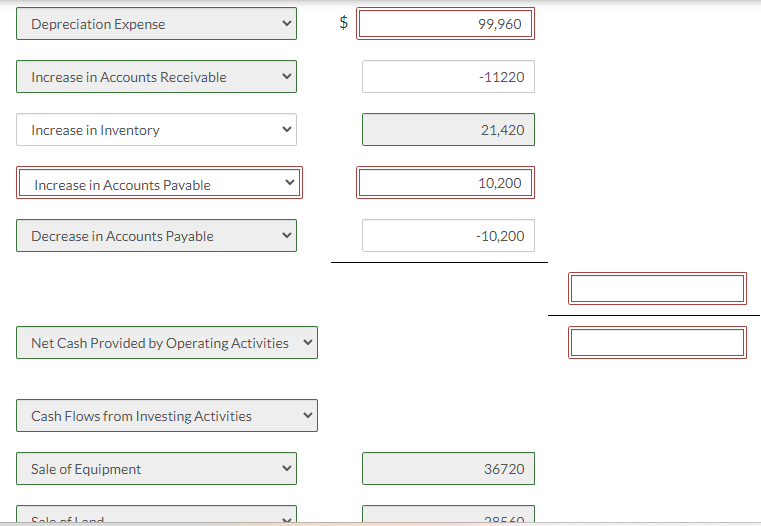

Can not figure out what I am doing wrong in the red boxs. Here are comparative balance sheets for Waterway Company. WATERWAY COMPANY Comparative Balance

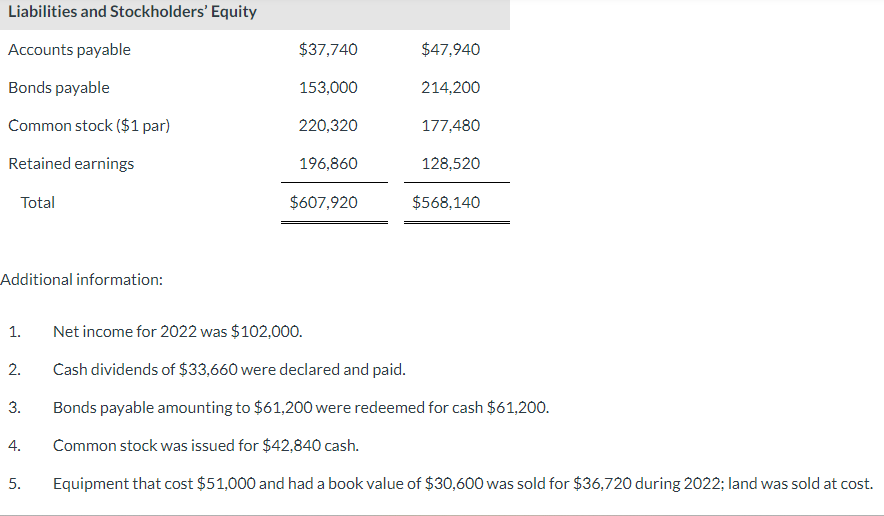

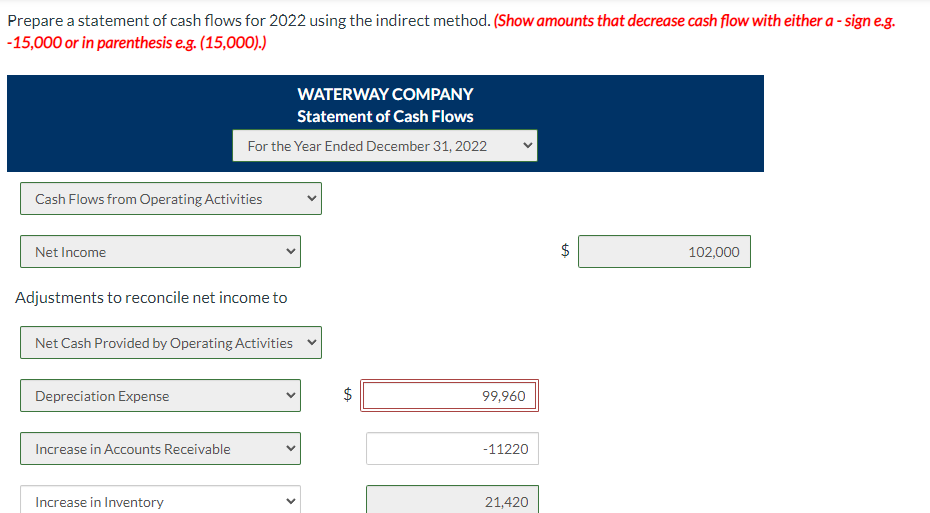

Can not figure out what I am doing wrong in the red boxs.

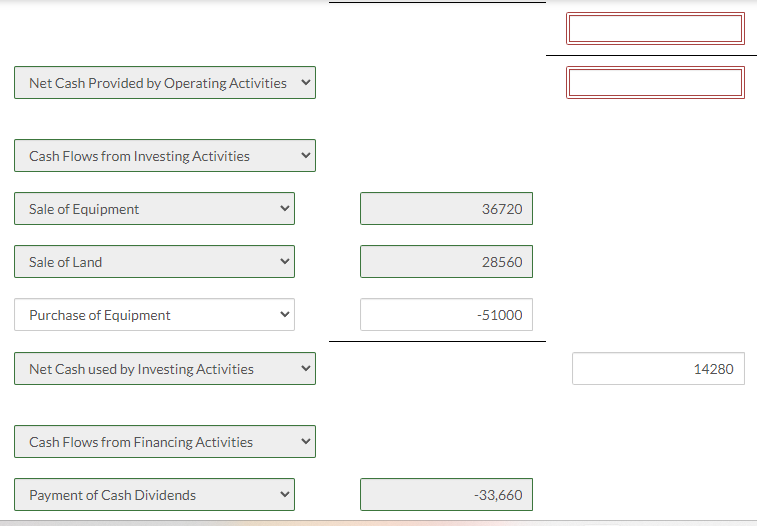

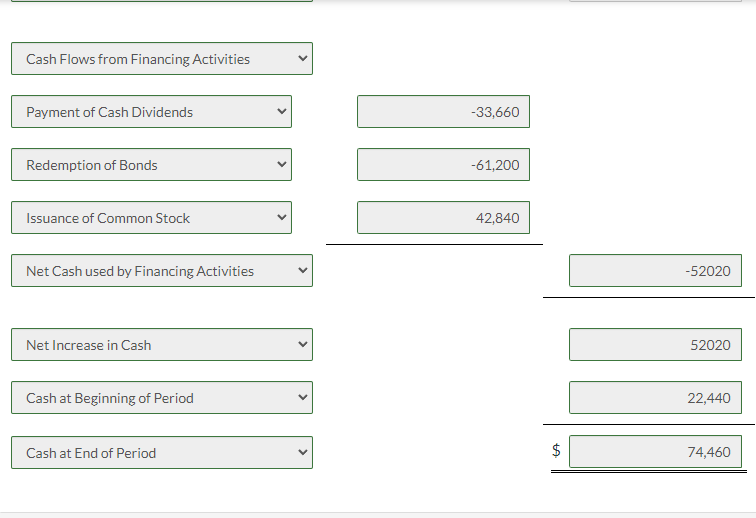

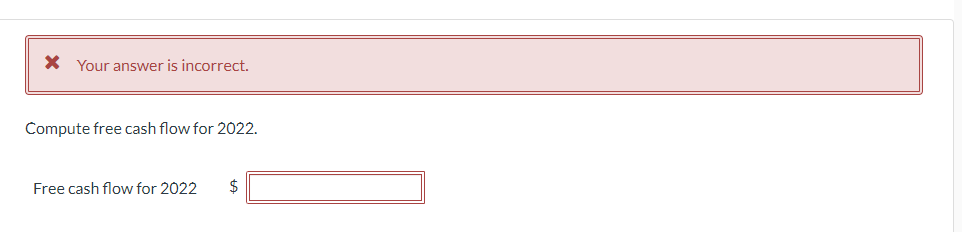

Here are comparative balance sheets for Waterway Company. WATERWAY COMPANY Comparative Balance Sheets December 31 1. Net income for 2022 was $102,000. 2. Cash dividends of $33,660 were declared and paid. 3. Bonds payable amounting to $61,200 were redeemed for cash $61,200. 4. Common stock was issued for $42,840 cash. 5. Equipment that cost $51,000 and had a book value of $30,600 was sold for $36,720 during 2022 ; land was sold at cost. Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or in parenthesis e.g. (15,000). Depreciation Expense $99,960 Increase in Accounts Receivable 11220 Increase in Inventory 21,420 \begin{tabular}{|l|l|} \hline Increase in Accounts Pavable \\ \hline \end{tabular} \begin{tabular}{|l|} \hline 10,200 \\ \hline \hline \end{tabular} Decrease in Accounts Payable 10,200 Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Equipment 36720 Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Land 28560 Purchase of Equipment Net Cash used by Investing Activities 14280 Cash Flows from Financing Activities Payment of Cash Dividends 33,660 Cash Flows from Financing Activities Payment of Cash Dividends 33,660 Redemption of Bonds 61,200 \begin{tabular}{|ll|} \hline Issuance of Common Stock & \\ \hline \end{tabular} 42,840 \begin{tabular}{|ll|} \hline Net Cash used by Financing Activities & \\ \hline \end{tabular} Net Increase in Cash 52020 Cash at Beginning of Period \begin{tabular}{r|} \hline 22,440 \\ $74,460 \\ \hline \hline \end{tabular} Your answer is incorrect. Compute free cash flow for 2022. Free cash flow for 2022 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started