Question

Can please explain it step by step how to do this and process so I can understand. Also, where does calculation will go in the

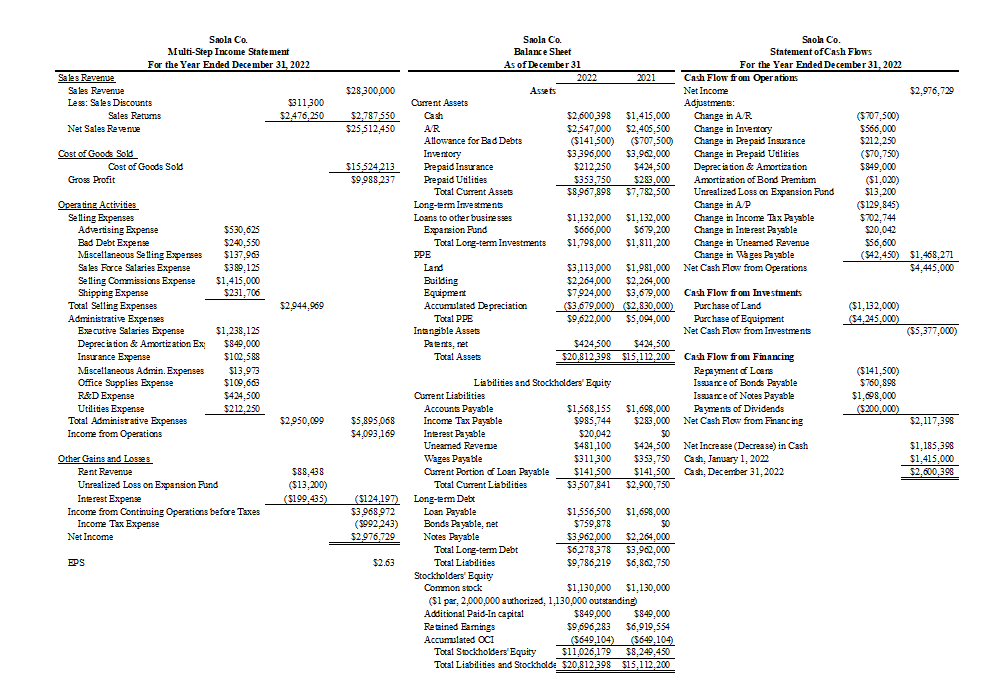

Can please explain it step by step how to do this and process so I can understand. Also, where does calculation will go in the financial statements. And appropriate journal entries of those changes. The Below I listed the financial statements I was provided.

Information:

1. The total contract price for the machines and the maintenance contract is $920,000.

2. By the end of 2022, Saola had installed the first and third machines for which the university had paid $506,000. According to Saola's management team, the final machine will be installed in January of 2023, and the maintenance contract will begin immediately following the installation. As soon as the last one is installed, the university will pay the balance of the contract.

3. To ensure accuracy, Saola decides to round all revenue allocation percentages to the nearest percentage point. Which means that 12.33% (or 0.1233) would be rounded to 12% (or .12). If the sum of the rounded percentages exceeds (or falls short) of 100% (or 1), Saola will adjust the percentage for the last obligation (or the one that will be completed last).

4. After rounding, if the sum of your percentages doesn't equal 100% (if it gives you 99% or 101%), then manually adjust the last obligation's percentage up or down so that you have a total of 100%. (confused about this part as well, do explain and show me how?)

Calculation Instructions:

1. Saola's management would like to know the impact of your adjustment on the following ratios:

* Profit Margin (Net Income / Net Sales)

* Current Ratio

* ROA

2. Make the appropriate journal entries, if any, to reflect the installation of the machines (including any necessary adjustments to income tax expense) and the university's first payment. Assume Saola spent $184,000 on the first machine, $331,000 on the second, and $193,000 on the third. The average cost of the maintenance contract is $41,000. Saola's work building these machines has already been appropriately recorded in inventory.

3. Make any necessary modifications to the financial statements.

4. Include only the amount the client has paid.

Financial Statements Listed Below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started