Can solve it quick please

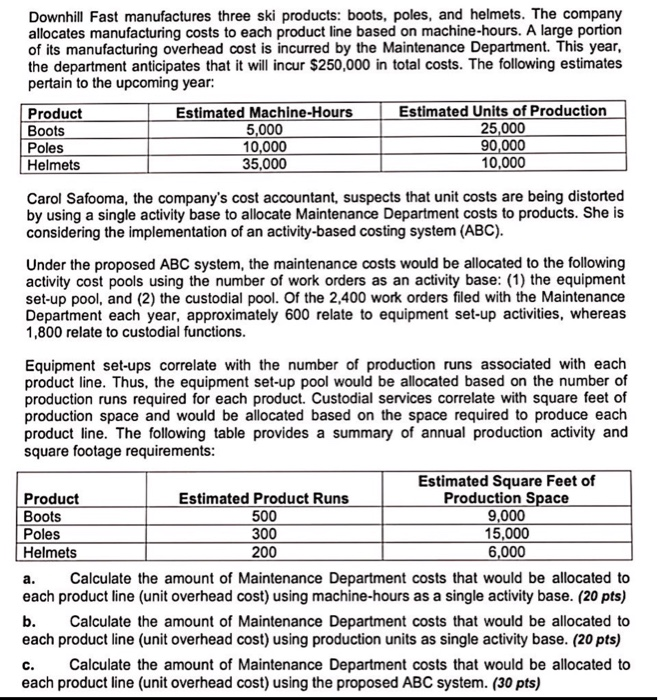

Downhill Fast manufactures three ski products: boots, poles, and helmets. The company allocates manufacturing costs to each product line based on machine-hours. A large portion of its manufacturing overhead cost is incurred by the Maintenance Department. This year, the department anticipates that it will incur $250,000 in total costs. The following estimates pertain to the upcoming year: Product Estimated Machine-Hours Estimated Units of Production Boots 5,000 25,000 Poles 10,000 90,000 Helmets 35,000 10,000 Carol Safooma, the company's cost accountant, suspects that unit costs are being distorted by using a single activity base to allocate Maintenance Department costs to products. She is considering the implementation of an activity-based costing system (ABC). Under the proposed ABC system, the maintenance costs would be allocated to the following activity cost pools using the number of work orders as an activity base: (1) the equipment set-up pool, and (2) the custodial pool. Of the 2,400 work orders filed with the Maintenance Department each year, approximately 600 relate to equipment set-up activities, whereas 1,800 relate to custodial functions. Equipment set-ups correlate with the number of production runs associated with each product line. Thus, the equipment set-up pool would be allocated based on the number of production runs required for each product. Custodial services correlate with square feet of production space and would be allocated based on the space required to produce each product line. The following table provides a summary of annual production activity and square footage requirements: Estimated Square Feet of Product Estimated Product Runs Production Space Boots 500 9,000 Poles 300 15,000 Helmets 200 6,000 a. Calculate the amount of Maintenance Department costs that would be allocated to each product line (unit overhead cost) using machine-hours as a single activity base. (20 pts) b. Calculate the amount of Maintenance Department costs that would be allocated to each product line (unit overhead cost) using production units as single activity base. (20 pts) c. Calculate the amount of Maintenance Department costs that would be allocated to each product line (unit overhead cost) using the proposed ABC system. (30 pts)