Answered step by step

Verified Expert Solution

Question

1 Approved Answer

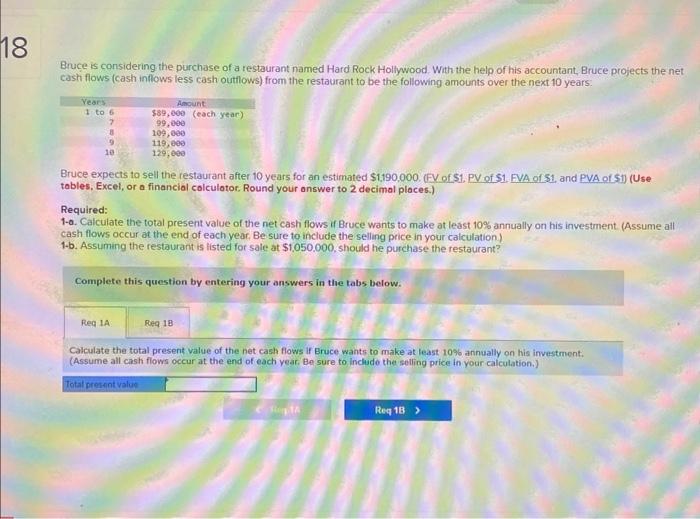

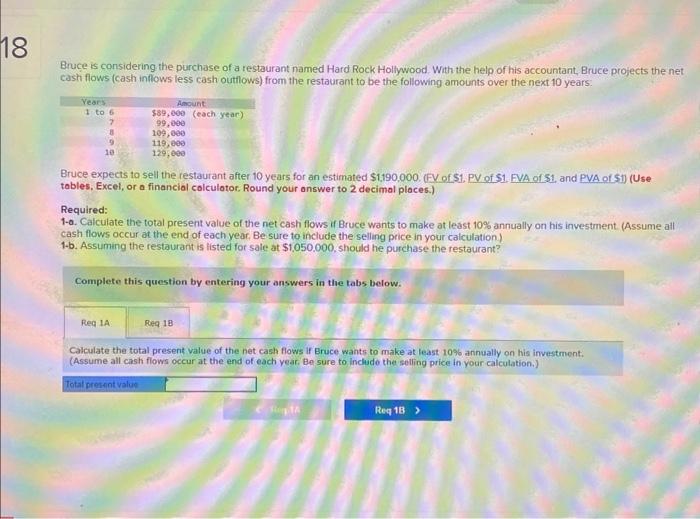

can some one help me solve this please! Bruce is considering the purchase of a restaurant named Hard Rock Hollywood With the help of his

can some one help me solve this please!

Bruce is considering the purchase of a restaurant named Hard Rock Hollywood With the help of his accountant, Bruce projects the net casti flows (cash inflows less cash outflows) from the restaurant to be the following amounts over the next 10 years. Bruce expects to sell the restaurant after 10 years for an estimated \$1,190,000. (FV of \$1. PV of S1. EVA of \$1, and PVA of \$1) (Use tables. Excel, or a financial calculator, Round your answer to 2 decimal places.) Required: 1-a. Calculate the total present value of the net cash flows if Bruce wants to make at least 10% annually on his investment. (Assume all cash flows occur at the end of each year, Be sure to include the selling price in your calculation) 1.b. Assuming the restaurant is listed for sale at $1,050.000, should he purchase the restaurant? Complete this question by entering your answers in the tabs below. Calculate the total present value of the net cash flows if Bruce wants to make at least 10% annually on his investment: (Assume all cash flows occur at the end of each year. Be sure to include the selling price in your calculation.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started