Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can some one help please ! 2. You plan to invest in DivMod Inc. and expect the following dividend payments per share over the following

can some one help please !

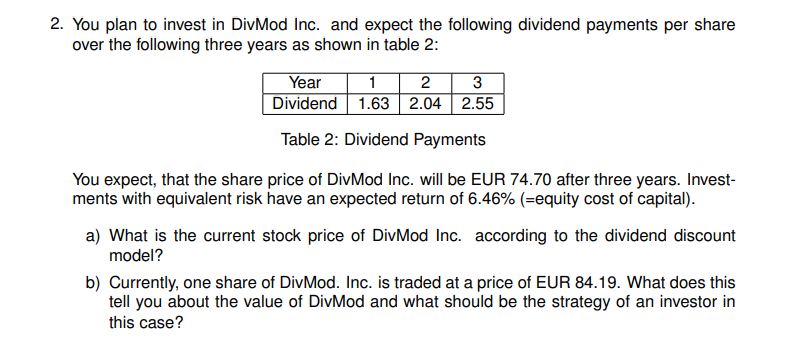

2. You plan to invest in DivMod Inc. and expect the following dividend payments per share over the following three years as shown in table 2: Year 3 12 Dividend 1.63 2.04 2.55 Table 2: Dividend Payments You expect, that the share price of DivMod Inc. will be EUR 74.70 after three years. Invest- ments with equivalent risk have an expected return of 6.46% (=equity cost of capital). a) What is the current stock price of DivMod Inc. according to the dividend discount model? b) Currently, one share of DivMod. Inc. is traded at a price of EUR 84.19. What does this tell you about the value of DivMod and what should be the strategy of an investor in this caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started