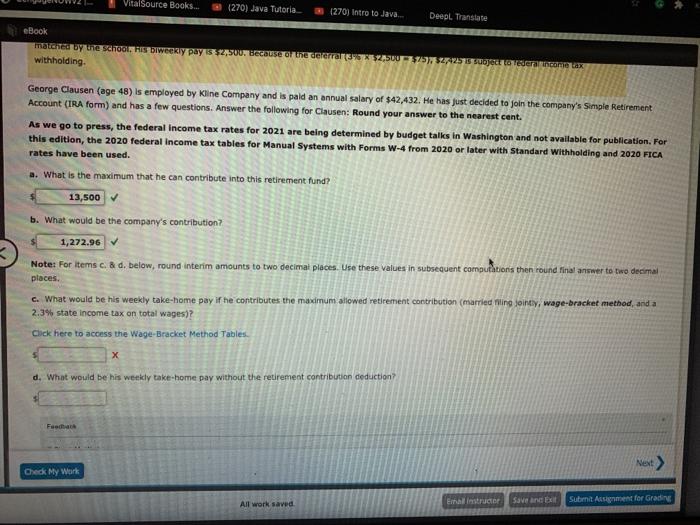

can somebody help me with part C and D

VitalSource Books... (270) Java Tutoria (270) Intro to Java Deepl Translate eBook matched by the school FIS biweekly pay 5 2.500. Because of the cerere AS9521234TESCO vax withholding George Clausen (age 48) is employed by Kline Company and is paid an annual salary of $42,432. He has just decided to join the company's Simple Retirement Account (IRA form) and has a few questions. Answer the following for Clausen: Round your answer to the nearest cant. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal Income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. a. What is the maximum that he can contribute into this retirement fund? 13,500 b. What would be the company's contribution? 1,272.96 Note: For items c. & d. below, round interim amounts to two decimal places. Use these values in subsequent computations then round final answer to two decimal places. c. What would be his weekly take-home pay if he contributes the maximum allowed retirement contribution (married Wing jointy, wage-bracket method, and a 2.3% state income tax on total wages)? Click here to access the Wage-Bracket Method Tables. X d. What would be his weekly take-home pay without the retirement contribution deduction? Fecha Next > Check My Work All work saved Email Instructor Save and Est Submit Assignment for Grading VitalSource Books... (270) Java Tutoria (270) Intro to Java Deepl Translate eBook matched by the school FIS biweekly pay 5 2.500. Because of the cerere AS9521234TESCO vax withholding George Clausen (age 48) is employed by Kline Company and is paid an annual salary of $42,432. He has just decided to join the company's Simple Retirement Account (IRA form) and has a few questions. Answer the following for Clausen: Round your answer to the nearest cant. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal Income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. a. What is the maximum that he can contribute into this retirement fund? 13,500 b. What would be the company's contribution? 1,272.96 Note: For items c. & d. below, round interim amounts to two decimal places. Use these values in subsequent computations then round final answer to two decimal places. c. What would be his weekly take-home pay if he contributes the maximum allowed retirement contribution (married Wing jointy, wage-bracket method, and a 2.3% state income tax on total wages)? Click here to access the Wage-Bracket Method Tables. X d. What would be his weekly take-home pay without the retirement contribution deduction? Fecha Next > Check My Work All work saved Email Instructor Save and Est Submit Assignment for Grading