Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can somebody help with B the answer is incorrect on the second post. Here are simplified financial statements for Watervan Corporation TREETATE Net anles .00

Can somebody help with B the answer is incorrect on the second post.

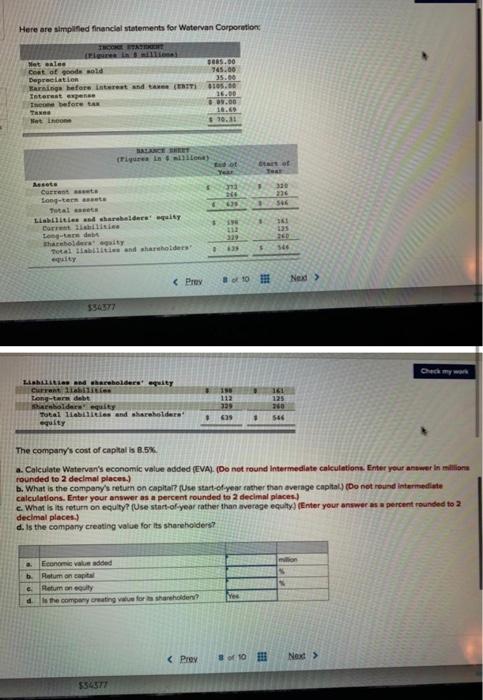

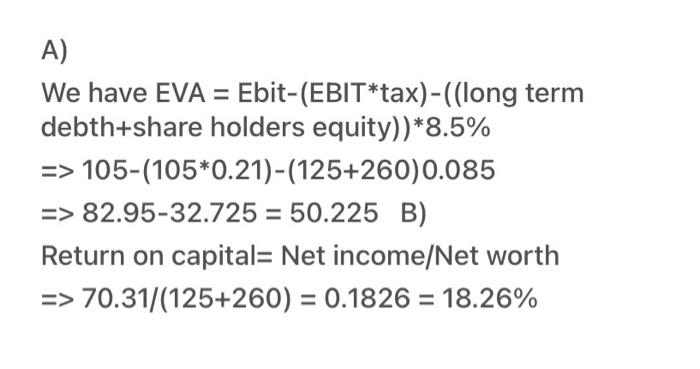

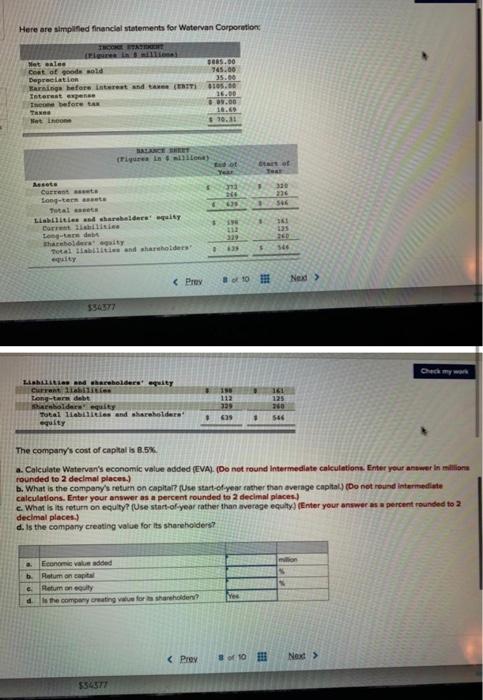

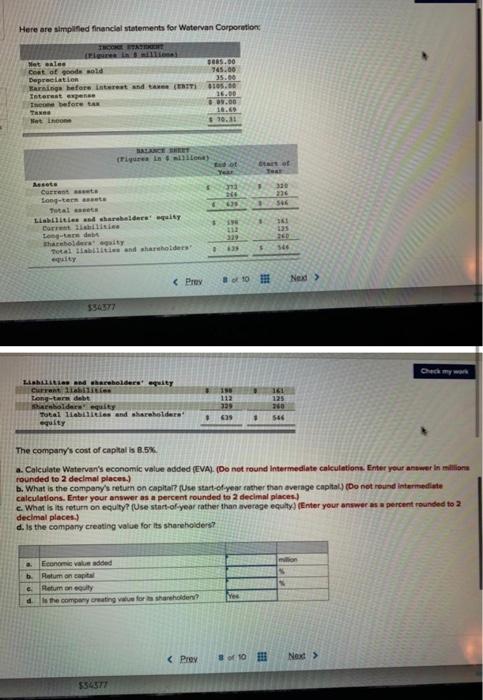

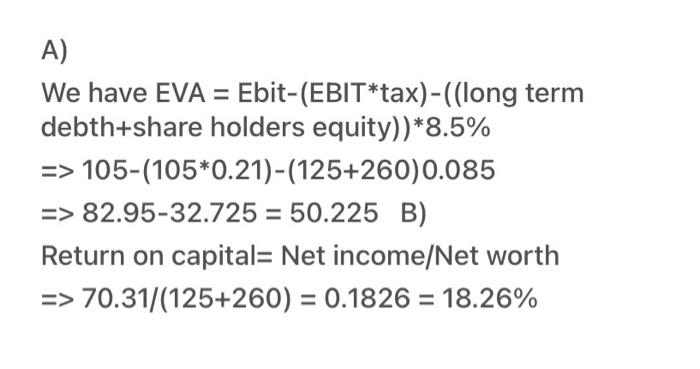

Here are simplified financial statements for Watervan Corporation TREETATE Net anles .00 Dext of good old 145.00 Depreciation 35.00 BARN hefore interest and IT 6105.00 Interest expense 16.00 The before tas DON.00 TANG 18.69 Net Income 10.30 BENCE BET fiya Lowon of art of 30 24 630 546 Assets Current Long-term se Totalt Liabilities shared wity Dort Halities habolat Total lite and shareholders 361 112 60 43 $94377 Oy 193 161 112 La shareholders quity Current les zonytar debt Darbolders equity Total Ries and shareholders quity 739 + 546 The company's cost of capital is 8.5% a. Calculate Watervan's economic value added (EVA). (Do not round Intermediate calculations. Enter your answer in million rounded to 2 decimal places.) b. What is the company's return on capital? (Use start of year rather than average capital)(Do not reund intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start of year rather than average equity) (Enter your answer as percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? . Economie waludded Rauman capital Return on equity Is the company rating for shareholder Yes $34377 A) We have EVA = Ebit-(EBIT*tax)-((long term debth+share holders equity))*8.5% => 105-(105*0.21)-(125+260)0.085 => 82.95-32.725 = 50.225 B) Return on capital= Net income/Net worth => 70.31/(125+260) = 0.1826 = 18.26%

Here are simplified financial statements for Watervan Corporation TREETATE Net anles .00 Dext of good old 145.00 Depreciation 35.00 BARN hefore interest and IT 6105.00 Interest expense 16.00 The before tas DON.00 TANG 18.69 Net Income 10.30 BENCE BET fiya Lowon of art of 30 24 630 546 Assets Current Long-term se Totalt Liabilities shared wity Dort Halities habolat Total lite and shareholders 361 112 60 43 $94377 Oy 193 161 112 La shareholders quity Current les zonytar debt Darbolders equity Total Ries and shareholders quity 739 + 546 The company's cost of capital is 8.5% a. Calculate Watervan's economic value added (EVA). (Do not round Intermediate calculations. Enter your answer in million rounded to 2 decimal places.) b. What is the company's return on capital? (Use start of year rather than average capital)(Do not reund intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start of year rather than average equity) (Enter your answer as percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? . Economie waludded Rauman capital Return on equity Is the company rating for shareholder Yes $34377 A) We have EVA = Ebit-(EBIT*tax)-((long term debth+share holders equity))*8.5% => 105-(105*0.21)-(125+260)0.085 => 82.95-32.725 = 50.225 B) Return on capital= Net income/Net worth => 70.31/(125+260) = 0.1826 = 18.26%

Can somebody help with B the answer is incorrect on the second post.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started