Answered step by step

Verified Expert Solution

Question

1 Approved Answer

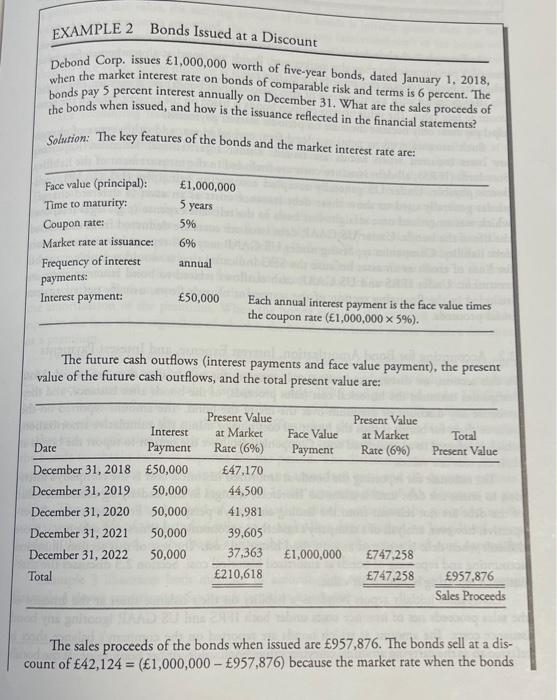

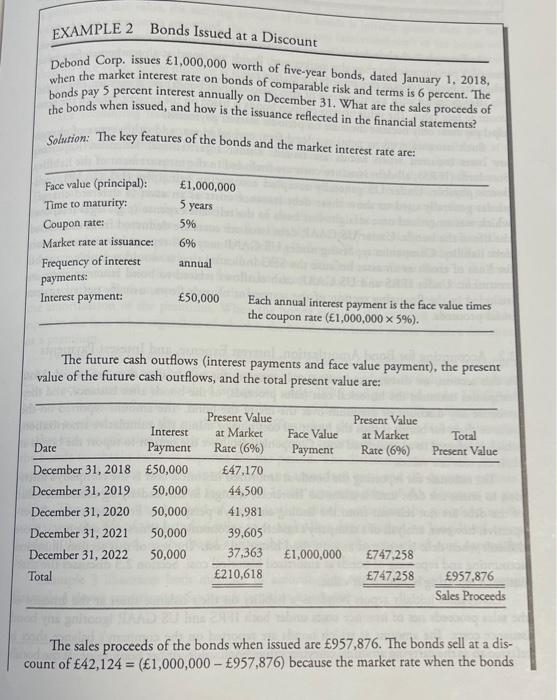

can somebody PLEASE explain how they are getting the numbers at the bottom that say present value at market rate in both columns! idk how

can somebody PLEASE explain how they are getting the numbers at the bottom that say "present value at market rate" in both columns! idk how they got the 210,618 and the 747,258

EXAMPLE 2 Bonds Issued at a Discount Debond Corp, issues 1,000,000 worth of five-year bonds, dated January 1, 2018, when the market interest rate on bonds of comparable risk and terms is 6 percent. The bonds pay 5 percent interest annually on December 31 . What are the sales proceeds of the bonds when issued, and how is the issuance reflected in the financial statements? Solution: The key features of the bonds and the market interest rate are: The future cash outflows (interest payments and face value payment), the present value of the future cash outflows, and the total present value are: The sales proceeds of the bonds when issued are 957,876. The bonds sell at a discount of 42,124=(1,000,000957,876) because the market rate when the bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started