Answered step by step

Verified Expert Solution

Question

1 Approved Answer

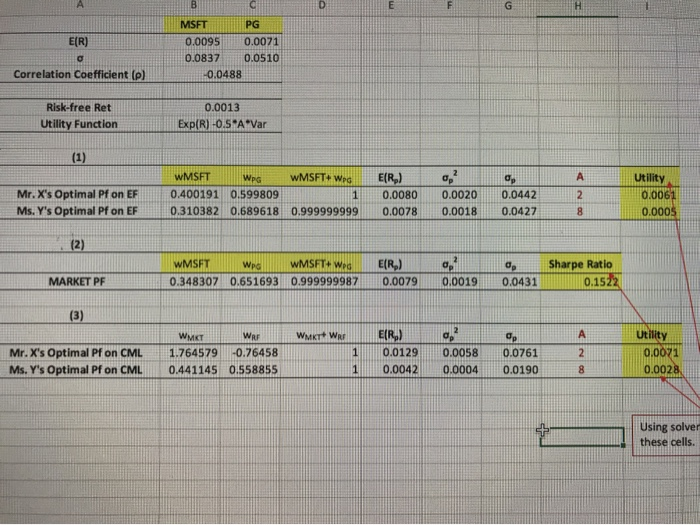

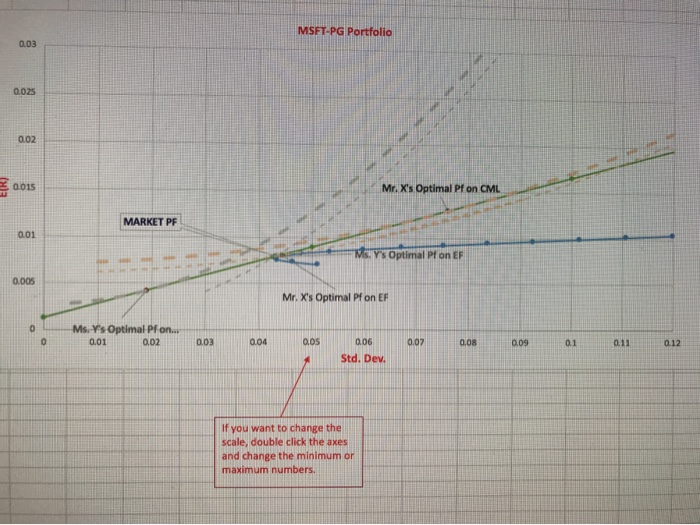

Can somebody please explain this graph to me? E(R) MSFT PG 0.0095 0.0071 0.0837 0.0510 -0.0488 Correlation coefficient (p) Risk-free Ret Utility Function 0.0013 Exp(R)-O.STAVar

Can somebody please explain this graph to me?

E(R) MSFT PG 0.0095 0.0071 0.0837 0.0510 -0.0488 Correlation coefficient (p) Risk-free Ret Utility Function 0.0013 Exp(R)-O.STA"Var WpG Utility Mr. X's Optimal Pf on EF Ms. Y's Optimal Pf on EF WMSFT WMSFT+WC 0.400191 0.599809 0.310382 0.689618 0.999999999 E(R) 0.0080 0.0078 0.0020 0.0018 0.0442 0.0427 0.0061 0.000$ MARKET PF WMSFT WMSFT+ Wed E(R) 0.348307 0.651693 0.999999987|0.0079 | 0.0019| Sharpe Ratio 0.1522 0.0431 WMKT W Mr. X's Optimal Pf on CML Ms. Y's Optimal Pf on CML WMKT WE 1.764579 -0.76458 0.441145 0.558855 E(R) 0.0129 0.0042 opp 0.0058 0.0761 0.0004 0.0190 Utility 0.0071 0.0028 Using solver these cells. MSFT-PG Portfolio 0.03 0.025 0.02 tr. X's Optimal Pf on CML 2015 MARKET PF 0.01 Ms. Y's Optimal Pron EF 0.005 Mr. X's Optimal Pf on EF OL 0 M s. Y's Optimal Pron... 0.01 0.02 0.04 0.03 0.0 0.07 0.08 0.09 01 011 0 12 0.06 Std. Dev. If you want to change the scale, double click the axes and change the minimum or maximum numbers. E(R) MSFT PG 0.0095 0.0071 0.0837 0.0510 -0.0488 Correlation coefficient (p) Risk-free Ret Utility Function 0.0013 Exp(R)-O.STA"Var WpG Utility Mr. X's Optimal Pf on EF Ms. Y's Optimal Pf on EF WMSFT WMSFT+WC 0.400191 0.599809 0.310382 0.689618 0.999999999 E(R) 0.0080 0.0078 0.0020 0.0018 0.0442 0.0427 0.0061 0.000$ MARKET PF WMSFT WMSFT+ Wed E(R) 0.348307 0.651693 0.999999987|0.0079 | 0.0019| Sharpe Ratio 0.1522 0.0431 WMKT W Mr. X's Optimal Pf on CML Ms. Y's Optimal Pf on CML WMKT WE 1.764579 -0.76458 0.441145 0.558855 E(R) 0.0129 0.0042 opp 0.0058 0.0761 0.0004 0.0190 Utility 0.0071 0.0028 Using solver these cells. MSFT-PG Portfolio 0.03 0.025 0.02 tr. X's Optimal Pf on CML 2015 MARKET PF 0.01 Ms. Y's Optimal Pron EF 0.005 Mr. X's Optimal Pf on EF OL 0 M s. Y's Optimal Pron... 0.01 0.02 0.04 0.03 0.0 0.07 0.08 0.09 01 011 0 12 0.06 Std. Dev. If you want to change the scale, double click the axes and change the minimum or maximum numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started