Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone do this for me please? Question 1 Answer all parts of the question Raina has provided the following information regarding her income for

Can someone do this for me please?

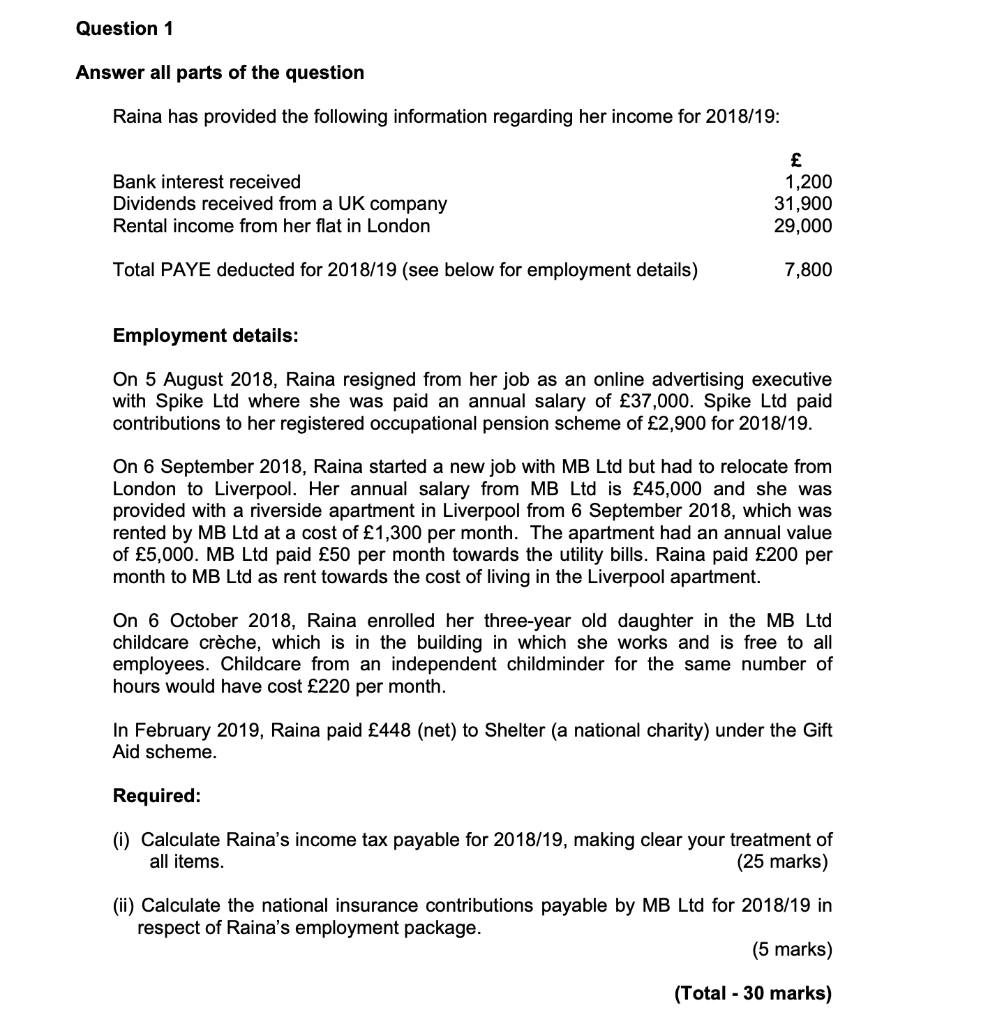

Question 1 Answer all parts of the question Raina has provided the following information regarding her income for 2018/19: Bank interest received Dividends received from a UK company Rental income from her flat in London 1,200 31,900 29,000 Total PAYE deducted for 2018/19 (see below for employment details) 7,800 Employment details: On 5 August 2018, Raina resigned from her job as an online advertising executive with Spike Ltd where she was paid an annual salary of 37,000. Spike Ltd paid contributions to her registered occupational pension scheme of 2,900 for 2018/19. On 6 September 2018, Raina started a new job with MB Ltd but had to relocate from London to Liverpool. Her annual salary from MB Ltd is 45,000 and she was provided with a riverside apartment in Liverpool from 6 September 2018, which was rented by MB Ltd at a cost of 1,300 per month. The apartment had an annual value of 5,000. MB Ltd paid 50 per month towards the utility bills. Raina paid 200 per month to MB Ltd as rent towards the cost of living in the Liverpool apartment. On 6 October 2018, Raina enrolled her three-year old daughter in the MB Ltd childcare crche, which is in the building in which she works and is free to all employees. Childcare from an independent childminder for the same number of hours would have cost 220 per month. In February 2019, Raina paid 448 (net) to Shelter (a national charity) under the Gift Aid scheme. Required: (i) Calculate Raina's income tax payable for 2018/19, making clear your treatment of all items. (25 marks) (ii) Calculate the national insurance contributions payable by MB Ltd for 2018/19 in respect of Raina's employment package. (5 marks) (Total - 30 marks) Question 1 Answer all parts of the question Raina has provided the following information regarding her income for 2018/19: Bank interest received Dividends received from a UK company Rental income from her flat in London 1,200 31,900 29,000 Total PAYE deducted for 2018/19 (see below for employment details) 7,800 Employment details: On 5 August 2018, Raina resigned from her job as an online advertising executive with Spike Ltd where she was paid an annual salary of 37,000. Spike Ltd paid contributions to her registered occupational pension scheme of 2,900 for 2018/19. On 6 September 2018, Raina started a new job with MB Ltd but had to relocate from London to Liverpool. Her annual salary from MB Ltd is 45,000 and she was provided with a riverside apartment in Liverpool from 6 September 2018, which was rented by MB Ltd at a cost of 1,300 per month. The apartment had an annual value of 5,000. MB Ltd paid 50 per month towards the utility bills. Raina paid 200 per month to MB Ltd as rent towards the cost of living in the Liverpool apartment. On 6 October 2018, Raina enrolled her three-year old daughter in the MB Ltd childcare crche, which is in the building in which she works and is free to all employees. Childcare from an independent childminder for the same number of hours would have cost 220 per month. In February 2019, Raina paid 448 (net) to Shelter (a national charity) under the Gift Aid scheme. Required: (i) Calculate Raina's income tax payable for 2018/19, making clear your treatment of all items. (25 marks) (ii) Calculate the national insurance contributions payable by MB Ltd for 2018/19 in respect of Raina's employment package. (5 marks) (Total - 30 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started