Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone explain how i can do this ? im not understanding the process Casper used the following assets in his Schedule Ctrade or business

can someone explain how i can do this ? im not understanding the process

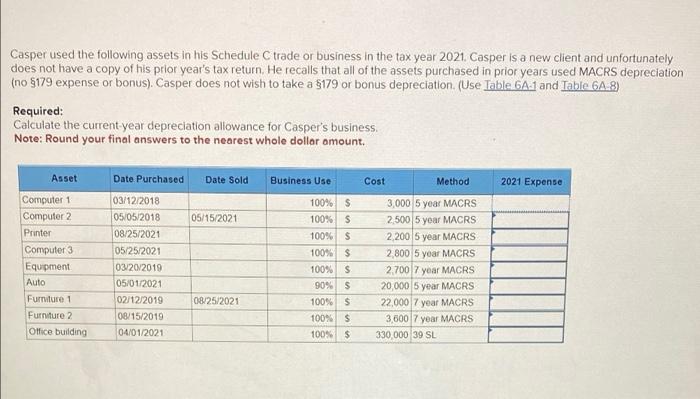

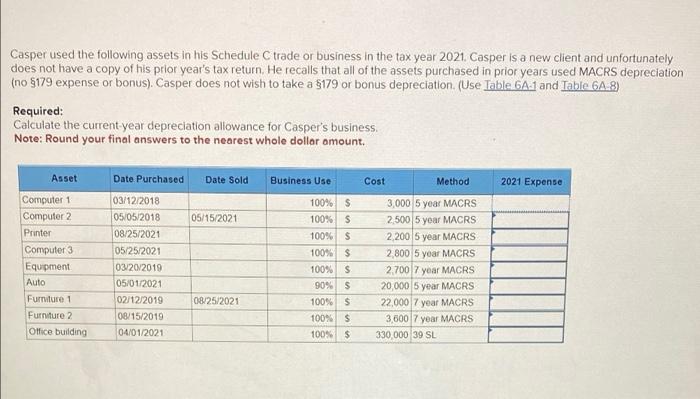

Casper used the following assets in his Schedule Ctrade or business in the tax year 2021. Casper is a new client and unfortunately does not have a copy of his prior year's tax return. He recalls that all of the assets purchased in prior years used MACRS depreciation (no $179 expense or bonus). Casper does not wish to take a $179 or bonus depreciation (Use Table 6A1 and Table 6A 8) Required: Calculate the current-year depreciation allowance for Casper's business Note: Round your final answers to the nearest whole dollar amount. Asset Cost Method 2021 Expense Computer 1 Computer 2 Printer Computer 3 Equipment Auto Furniture 1 Furniture 2 Office building Date Purchased Date Sold 03/12/2018 05/05/2018 05/15/2021 08/25/2021 05/25/2021 03/20/2019 05/01/2021 02/12/2019 08/25/2021 08/15/2019 04/01/2021 Business Use 100% S 100% S 100% $ 100% $ 100% s 90% S 100% $ 3,000 5 year MACRS 2500 5 year MACRS 2,200 5 year MACRS 2,800 5 year MACRS 2,700 7 year MACRS 20,000 5 year MACRS 22,000 7 year MACRS 3,600 7 year MACRS 330,000 39 SL 100% $ 100% $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started